1. Forex Market Insight

EUR/USD

The opening of the European Central Bank’s (ECB) annual forum held in Portugal.

European Central Bank President Christine Lagarde and Federal Reserve Chair Jerome Powell are both set to attend, with the euro leading gains against the dollar.

Markets will be watching for any signs of future policy moves.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the two positions of 1.0357 and 1.0184. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

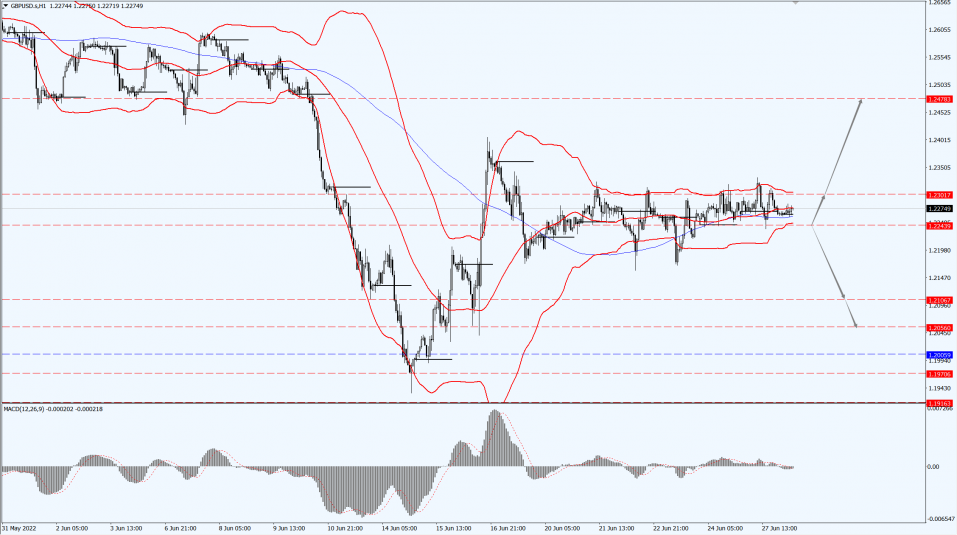

GBP Intraday Trend Analysis

Fundamental Analysis:

The market has lowered its growth forecast for the UK economy, but does not believe it will fall into recession.

Markets see war, soaring commodity prices and the outbreak in Asia as the main drivers of the sharp slowdown in the UK economy.

This could lead the UK into a “mild” recession in 2023.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2243-line today. If GBP runs below the 1.2243-line, it will pay attention to the suppression strength of the two positions of 1.2106 and 1.2056. If GBP runs above the 1.2243-line, then pay attention to the suppression strength of the two positions of 1.2301 and 1.2478.

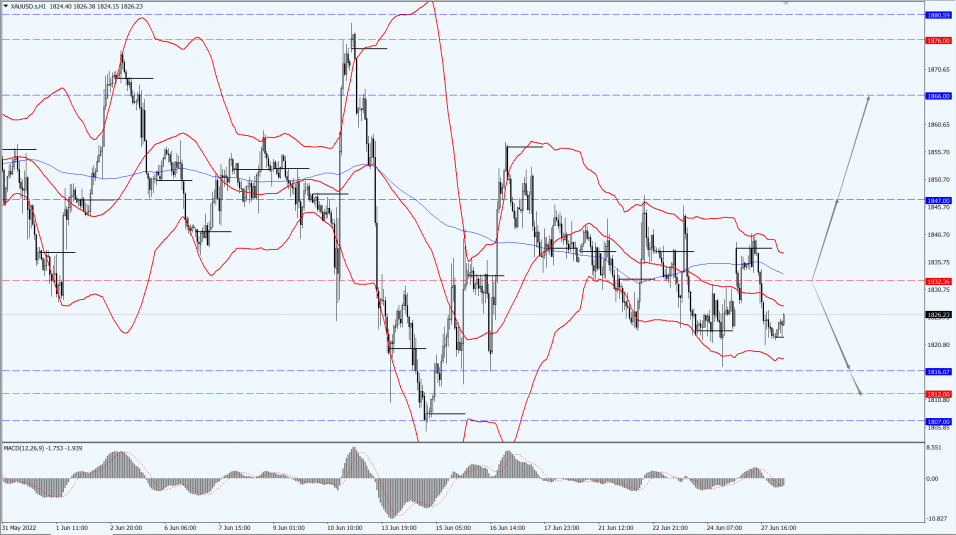

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell yesterday, 27th June 2022, under pressure on rising interest rates.

Markets watching for any clues about policy moves at the ECB’s annual forum to be held in Portugal.

Gold weakened as the bond market suffered another sell-off following yet another weak demand for U.S. bond markdowns.

In the short term, the outlook for gold is mixed, with a lot of uncertainty this summer.

On one side is the possibility of a more aggressive Fed, and on the other is the risk of recession.

On one side is the possibility of a more aggressive Fed, and on the other is the risk of recession.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1832-line today. If the gold price runs steadily below the 1832-line, then it will pay attention to the support strength of the 1816 and 1812 positions. If the gold price breaks above the 1832-line, then pay attention to the suppression strength of the two positions of the 1847 and 1866.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose nearly $2 yesterday, 27th June 2022.

Aided by the prospect of tighter supplies, after the Group of Seven (G7) pledged to further cut off Russian President Vladimir Putin’s sources of war funding.

It also pushed energy prices back down.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 109.62-line today. If the oil price runs above the 109.62-line, then focus on the suppression strength of the two positions of 111.95 and 116.30. If the oil price runs below the 109.62-line, then pay attention to the support strength of the two positions of 107.52 and 105.01.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.