1. Forex Market Insight

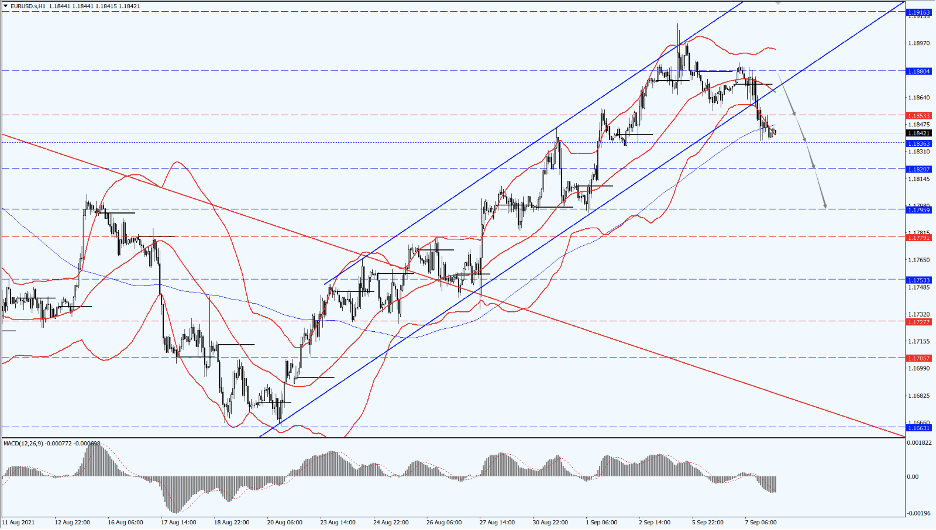

EUR/USD

The dollar rose yesterday, moving further off the nearly one-month low it touched last week. Rising U.S. Treasury yields prompted investors to cut their short positions in the dollar against the euro ahead of this week’s European Central Bank meeting.

On Friday,3rd September 2021, the dollar fell to its lowest since early August after an unexpectedly weak U.S. nonfarm payrolls report. As a result, it has prompted the market to increase bets that the Federal Reserve will not scale back its stimulus program in the coming months.

On top of that, outsiders believe the ECB will debate stimulus cuts at Thursday’s meeting, and analysts predict that the central bank’s rate of purchases under the pandemic emergency purchase program (PEPP) could slow down to 60 billion euros per month from the current 80 billion euros.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, the euro is on a bearish trend. The top focus is on the suppression of the two positions of 1.1880 and 1.1853, while the bottom is focused on the support of the two positions at 1.1820 and 1.1795.

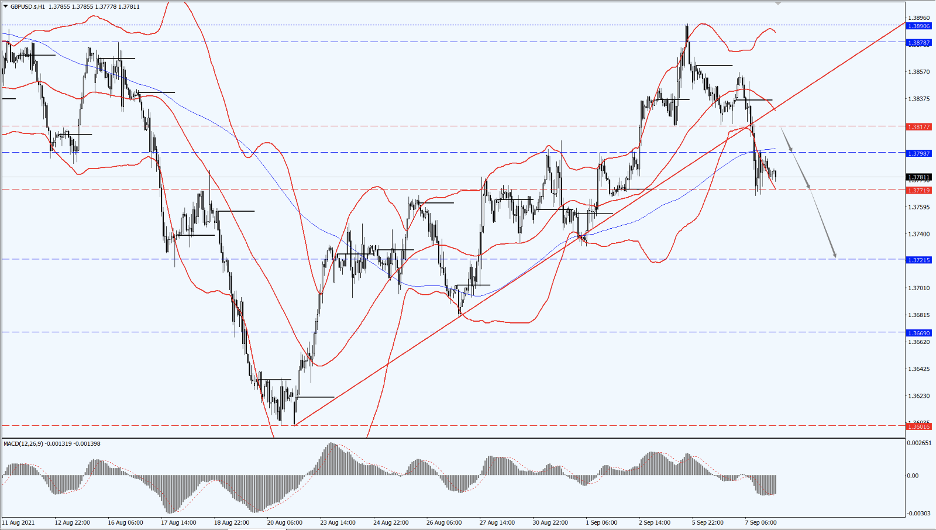

GBP Intraday Trend Analysis

Fundamental Analysis:

On the 7th, the World Health Organization (WHO) released the weekly epidemiological update of the Coronavirus disease (Covid-19). As of last week (August 30th to September 5th), more than 4.47 million new confirmed cases of the Covid-19 were reported worldwide. This number excludes the region of the Americas, where the number of new cases increased. Elsewhere, all other regions have seen a decline in new cases. The five countries with the highest number of reported cases last week were the United States, India, the United Kingdom, Iran and Brazil. In addition, there are now 174 countries and regions infected with Delta strain.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

Today, the pound is on a bearish trend. The top focus is on the suppression of 1.3817 and 1.3798, while the bottom is focused on the support of 1.3771 and 1.3721.

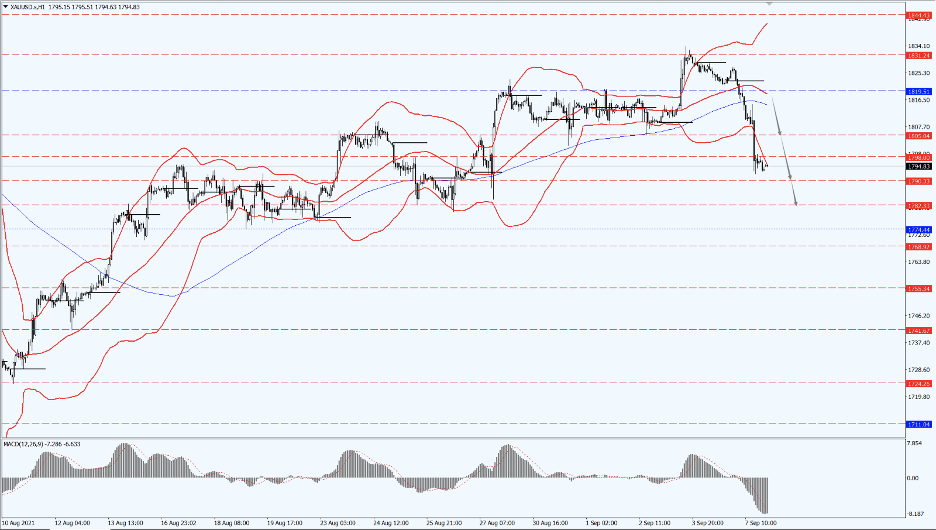

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell the most in more than a month yesterday as the dollar strengthened after the U.S. Labor Day holiday, while the inflation-adjusted yields rose.

The weaker-than-expected jobs report released on Friday, 3rd September 2021, and a subsequent spike in U.S. yields pushed up the actual interest rates, and limited the upside of interest-free gold.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is bearish on the trend today. The top focus is on the suppression of the two positions at 1805 and 1819, while the bottom focus is on the support of the two positions at 1790 and 1782.

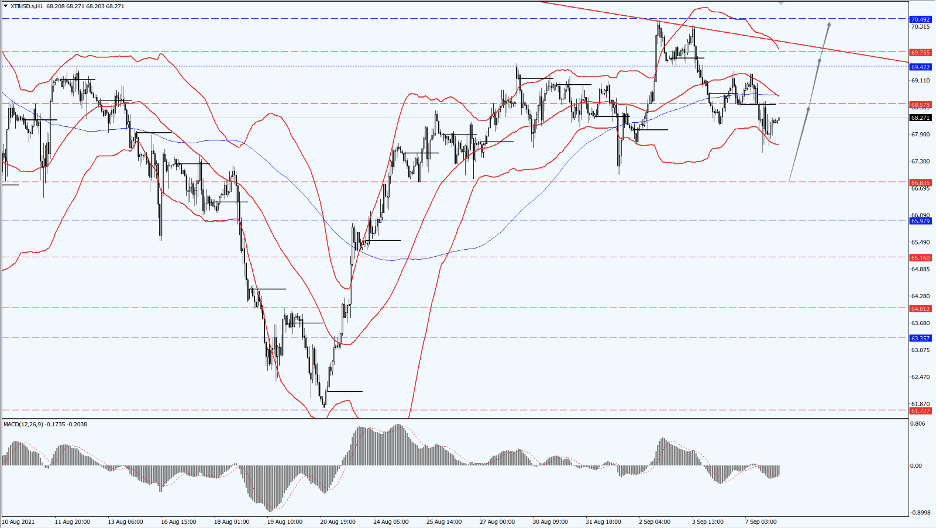

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices weakened for a second consecutive trading day, as the rise in dollar offset strong Chinese trade data and ongoing production disruptions in the U.S. Gulf of Mexico.

WTI crude futures fell by 1.4% as the stronger dollar made dollar-denominated commodities less attractive. Meanwhile, the crude industry is still assessing the impact of Hurricane Ida on oil production, with nearly 80% of U.S. crude production in the Gulf of Mexico yet to recover. Moreover, the rapidly spreading Delta strain has raised concerns about demand in recent weeks.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, the oil prices pay attention to the 66.83 first-line support, and the top pays attention to the suppression at 68.57 and 69.75 in turn.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.