1. Forex Market Insight

EUR/USD

The euro reached a seven-month high shortly against the dollar on Wednesday 11th January 2023 but stayed within a narrow range as markets avoided making big moves ahead of Thursday’s U.S. inflation data, which could provide clearer clues on the direction of interest rates.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0734 line today. If the EUR runs below the 1.0734 line, then pay attention to the support strength of the two positions of 1.0697 and 1.0642. If the strength of EUR rises over the 1.0734 line, then pay attention to the suppression strength of the two positions of 1.0776 and 1.0832.

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound continued to be in a narrow range against the dollar, closing the day basically remained the same position as the previous trading day, closing around 1.2148.

The Fed has not revealed that if this year will cut interest rates, while also promising to maintain high-interest rates, but the market has a strong feeling that the Fed will reduce the increase range of interest rates and the year ahead will also go down the interest rates. Thus, increasing the dollar short bets, resulting in the continued firmness of the pound.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2111-line today. If GBP runs below the 1.12111-line, it will pay attention to the suppression strength of the two positions of 1.2010 and 1.1902. If GBP runs above the 1.2111-line, then pay attention to the suppression strength of the two positions of 1.2222 and 1.2311.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices held steady after hitting an eight-month high on Wednesday 11th January 2023 as the market braced for U.S. inflation data that could influence the Fed’s policy path.

The U.S. consumer price report will be closely watched after the Federal Reserve slowed its pace of rate hikes to 50 basis points in December after four consecutive 75-basis-point increases.

The market expects the Fed to have a 77% chance of raising the indicator rate by 25 basis points to 4.50%-4.75% in February and believes rates will peak at 4.92% in June.

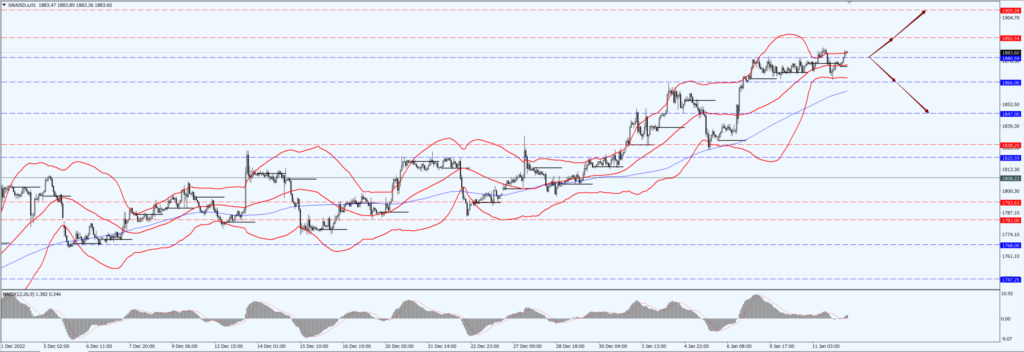

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1880-line today. If the gold price runs below the 1880-line, then it will pay attention to the support strength of the 1866 and 1847 positions. If the gold price breaks above the 1880-line, then pay attention to the suppression strength of the two positions of 1892 and 1909.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose 3% to a one-week high Wednesday 11th January 2023 as hopes for an improved global economic outlook and concerns about the impact of sanctions on Russian crude production outweighed the impact of an unexpected surge in U.S. crude inventories.

Both indicator contracts closed at their highest points since Dec. 30, with U.S. crude rising for a fifth straight day, the first since October, and Brent for a third straight day, the first since December.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 77.76- line today. If the oil price runs above the 77.76 -line, then focus on the suppression strength of the two positions of 76.07 and 80.13. If the oil price runs below the 77.76 -line, then pay attention to the support strength of the two positions of 76.94 and 76.07.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.