1. Forex Market Insight

EUR/USD

EUR/USD rose 1.52% in the late trading at $0.9739 after hitting a low of 0.9535 on Wednesday, 28th September 2022.

When news of the Nord Stream-1 and Nord Stream-2 leaks broke earlier, EUR/USD had moved as low as 0.9535, setting a new 20-year low.

Since the Russia-Ukraine conflict in February this year, high energy prices in the euro hit the local economy hard, and S&P Global recently released a survey showing that the eurozone recession intensified in September and business conditions worsened for the third consecutive month.

Weak economic fundamentals superimposed on the pace of interest rate hikes less than the Federal Reserve’s European Central Bank, the euro is also still on its way down against the dollar.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9701-line today. If EUR runs steadily below the 0.9701-line, then pay attention to the support strength of the two positions of 0.9597 and 0.9559. If the strength of EUR breaks above the 0.9701-line, then pay attention to the suppression strength of the two positions of 0.9770 and 0.9810

GBP Intraday Trend Analysis

Fundamental Analysis:

British assets have plummeted in recent days and the pound has fallen more than 20% this year after new Chancellor of the Exchequer Kwarteng announced Friday, 23rd September 2022, that he would finance the wide-ranging tax cuts by issuing debt.

The Bank of England decided on Wednesday, 28th September 2022, that it had to step in, saying it had seen “dysfunction” in the long-term British bond market and would buy 65 billion pounds worth of assets to correct the situation.

The Bank of England’s intervention has somewhat soothed investors’ extremely weakened sentiment, and GBP/USD has rebounded more sharply as a result.

Technical Analysis:

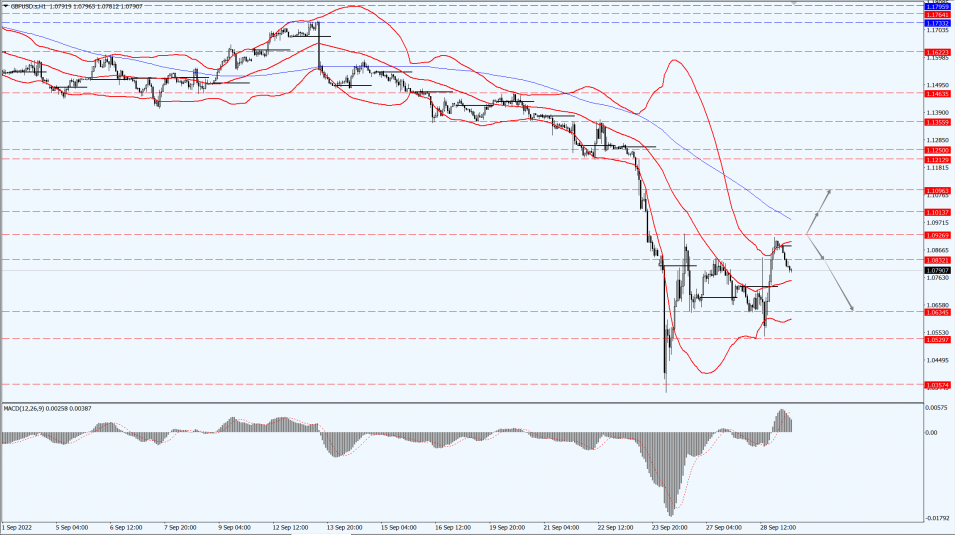

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.0926-line today. If GBP runs below the 1.0926-line, it will pay attention to the suppression strength of the two positions of 1.0832 and 1.0634. If GBP runs above the 1.0926-line, then pay attention to the suppression strength of the two positions of 1.1013 and 1.1096.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose about 2% on Wednesday, 28th September 2022, as the dollar retreated to make gold more attractive as a safe-haven, but the prospect of a sharp interest rate hike kept the price of non-yielding gold near a two-and-a-half-year low.

The dollar retreated after hitting a 20-year high, making gold less expensive for overseas buyers, and U.S. Treasury yields retreated.

Moscow is set to annex parts of Ukraine on Wednesday, 28th September 2022.

Russian officials stationed in the four occupied regions of Ukraine reported an overwhelming vote in favor of joining Russia in the referendum.

The U.S. plans to pass a resolution at the United Nations condemning the referendum as fraudulent.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1660-line today. If the gold price runs steadily below the 1660-line, then it will pay attention to the support strength of the 1648 and 1627 positions. If the gold price breaks above the 1660-line, then pay attention to the suppression strength of the two positions of the 1680 and 1686.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose for a second straight day on Wednesday, 28th September 2022, rebounding from recent losses as the dollar softened from recent gains and consumer demand rebounded after U.S. fuel inventory data showed a larger-than-expected drop.

Inventory data from the U.S. showed a rebound in consumer demand, although supplies of refined oil products over the past four weeks remained 3% lower than a year ago.

U.S. crude oil inventories fell by 215,000 barrels in the latest week, while gasoline stocks fell by 2.4 million barrels and distillate stocks fell by 2.9 million barrels as refining activity declined after several production outages.

The dollar hit a new 20-year high against a basket of currencies before retreating on Wednesday, 28th September 2022.

A strong dollar makes oil more expensive for buyers using other currencies, thus reducing demand for oil.

In the early afternoon in the U.S., the dollar index was down 0.9%.

On Tuesday, 27th September 2022, Goldman Sachs cut its oil price forecast for 2023 on expectations of weaker demand and a stronger dollar, but said a shortfall in global supply would only strengthen its long-term bullish outlook.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 82416-line today. If the oil price runs above the 82.41-line, then focus on the suppression strength of the two positions of 84.02 and 85.72. If the oil price runs below the 82.41-line, then pay attention to the support strength of the two positions of 80.00 and 79.12.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.