1. Forex Market Insight

EUR/USD

Currency markets have increased their bets on a more aggressive Fed rate hike in September, with the likelihood of a 75 basis point hike now expected to be around 70%.

U.S. Treasury yields surged, with the two-year Treasury yield touching a 15-year high of about 3.49%.

The market awaits the U.S. jobs report for August, due out on 2nd September 2022, which will be the last major look at the health of the economy in the face of rising interest rates and stubbornly high inflation before the Federal Reserve’s next policy meeting.

European Central Bank (ECB) Executive Committee member Schnabel pointed out that the ECB may raise interest rates by 75 basis points at its meeting on 8th September 2022, pushing the euro to climb.

Schnabel said Saturday, 27th August 2022, that the ECB needs to take strong action to fight inflation and maintain public trust.

That trust now seems to be waning.

Technical Analysis:

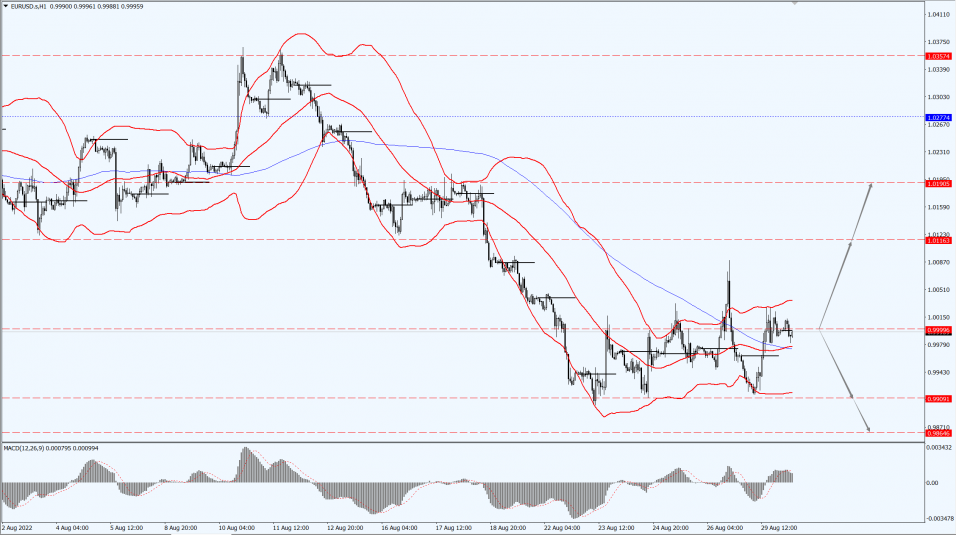

(EUR/USD 1-hour chart)

We focus on the 0.09999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9938 and 09864. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP hit an intraday low of $1.1649 against the dollar in two-and-a-half years and ended the session down 0.23% at $1.1703.

Markets traded quietly on Monday, 29th August 2022, a public holiday in the UK.

Technical Analysis:

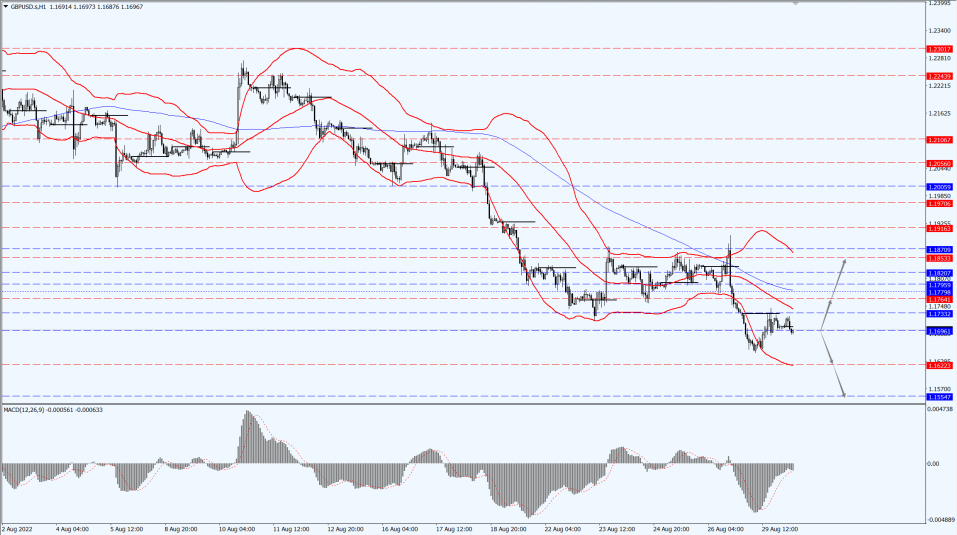

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1696-line today. If GBP runs below the 1.1696-line, it will pay attention to the suppression strength of the two positions of 1.1622 and 1.1554. If GBP runs above the 1.1764-line, then pay attention to the suppression strength of the two positions of 1.1764 and 1.1853.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices increased on Monday, 29th Monday 2022, as the dollar rally lost momentum, and earlier in the session, gold prices touched a one-month low, weighed down by the Federal Reserve’s hint on Friday, 26th August 2022, that it would continue to raise interest rates sharply.

Powell said that could mean slower growth, but did not hint at what measures the Fed might take at its September policy meeting.

Currently, market participants generally expect the Fed to raise rates by 75 basis points at its September meeting.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1735-line today. If the gold price runs steadily below the 1735-line, then it will pay attention to the support strength of the 1720 and 1713 positions. If the gold price breaks above the 1735-line, then pay attention to the suppression strength of the two positions of the 1743 and 1751.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices settled up more than 4% on Monday, 29th August 2022, extending last week’s rally as possible OPEC+ production cuts and the conflict in Libya helped offset the impact of a strong dollar and a gloomy outlook for U.S. economic growth.

Saudi Arabia, the largest producer in the Organization of the Petroleum Exporting Countries (OPEC), last week raised the possibility of cutting production.

Sources said the production cuts could coincide with an increase in supply from Iran if it reaches a nuclear deal with the West.

OPEC+, made up of OPEC and oil-producing allies such as Russia, will meet on 5th September 2022, to set policy.

Technical Analysis:

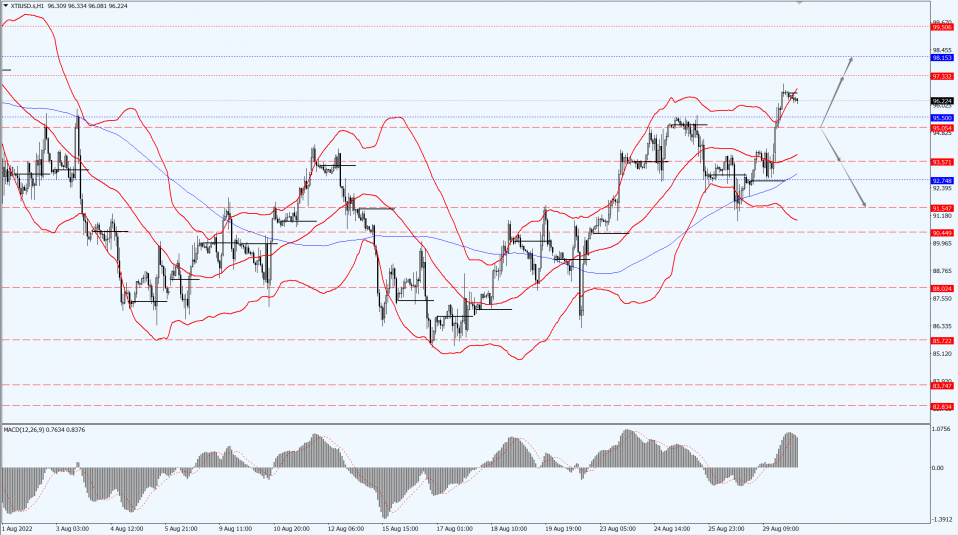

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 95.05-line today. If the oil price runs above the 95.05-line, then focus on the suppression strength of the two positions of 97.33 and 98.15. If the oil price runs below the 95.05-line, then pay attention to the support strength of the two positions of 93.57 and 91.54.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.