1. Forex Market Insight

EUR/USD

EUR/USD rose to its highest level since 17th August 2022.

It touched a 20-year-low of $0.9862 last week. EUR ended up 0.7% at $1.0117.

Sources told Reuters that European Central Bank (ECB) policymakers believe there is a growing risk that the central bank will need to raise its key interest rate to 2% or higher to curb record inflation in the euro zone.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0190-line today. If EUR runs steadily below the 1.0190-line, then pay attention to the support strength of the two positions of 1.0116 and 0.9999. If the strength of EUR breaks above the 1.0190-line, then pay attention to the suppression strength of the two positions of 1.0277 and 1.0357.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD ended the day at $1.1681, up 0.8% on the day and above the 37-year low touched last week.

According to data released by the UK Statistics Authority, the UK’s inflation rate reached 10.1% in July this year, a record high since February 1982, and is the first country in the G7 where the inflation rate exceeded 10%. In addition, the UK is also facing economic growth pressures.

The Organization for Economic Cooperation and Development (OECD) predicted in June that UK economic growth would stagnate next year.

The Bank of England will have a difficult choice to make between “fighting inflation” and “stabilizing growth”. Two days before the Queen’s death, Britain welcomed a new Prime Minister, Alex Truss, who pursues monetarism and is committed to helping people ease the pressure of the cost of living through tax cuts.

While promising tax cuts, Truss stressed that he would not cut public spending, which means that there is a possibility that the government deficit will widen again.

In the short term, investors are expected to take a more cautious view of UK government bonds and the British pound.

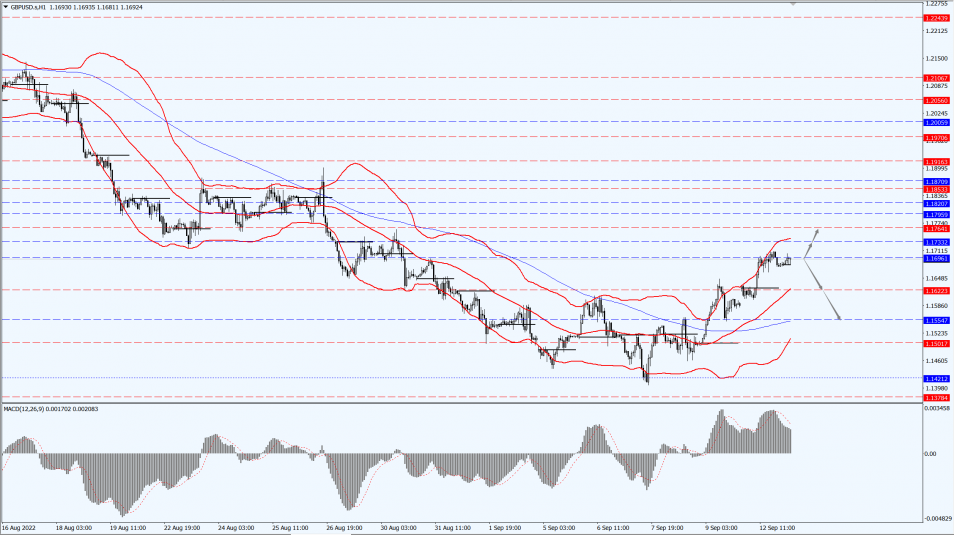

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1696-line today. If GBP runs below the 1.1696-line, it will pay attention to the suppression strength of the two positions of 1.1622 and 1.1554. If GBP runs above the 1.1696-line, then pay attention to the suppression strength of the two positions of 1.1733 and 1.1764.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Supported by a weaker dollar, gold jumped about 1% on Monday, 12th September 2022, while investors awaited key inflation data for clues on the pace of Federal Reserve rate hikes.

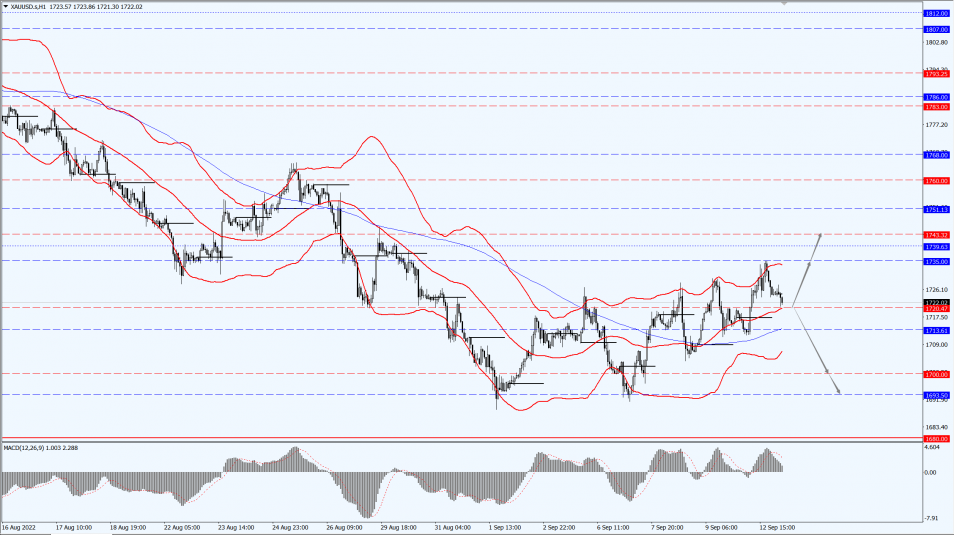

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1720-line today. If the gold price runs steadily below the 1720-line, then it will pay attention to the support strength of the 1700 and 1693 positions. If the gold price breaks above the 1720-line, then pay attention to the suppression strength of the two positions of the 1735 and 1743.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed higher on Monday, 12th September 2022, shrugging off weaker demand expectations as supply concerns intensify as winter approaches.

U.S. Strategic Petroleum Reserve stocks fell 8.4 million barrels to 434.1 million barrels in the week ended 9th September 2022, the lowest level since October 1984, according to data released Monday, 12th September 2022, by the U.S. Department of Energy.

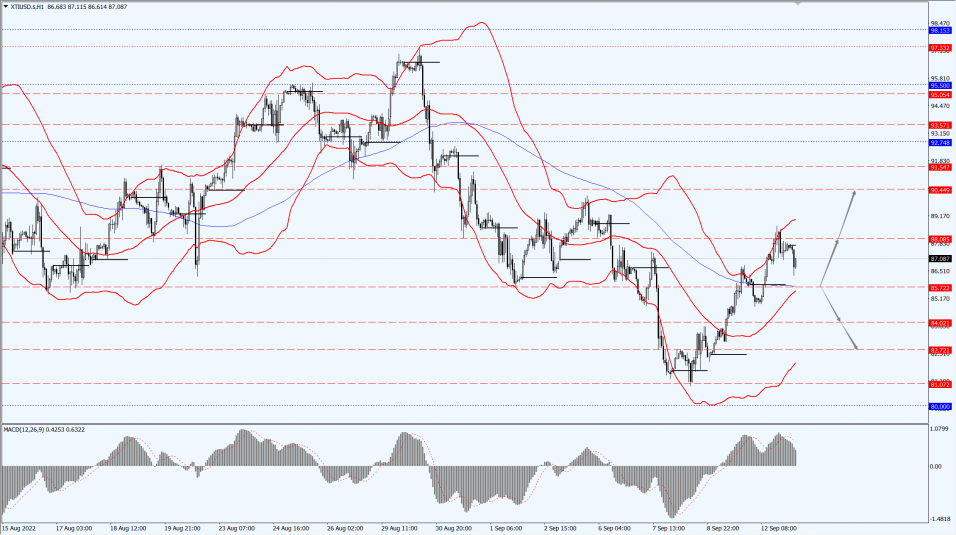

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 85.72-line today. If the oil price runs above the 85.72-line, then focus on the suppression strength of the two positions of 88.08 and 90.44. If the oil price runs below the 85.72-line, then pay attention to the support strength of the two positions of 84.02 and 82.72.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.