EUR/USD was little changed at $0.9706, following four straight days of declines that sent the euro down toward a 20-year low of $0.9528 touched on 26th September 2022.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9701-line today. If EUR runs steadily below the 0.9701-line, then pay attention to the support strength of the two positions of 0.9641 and 0.9559. If the strength of EUR breaks above the 0.9701-line, then pay attention to the suppression strength of the two positions of 0.9770 and 0.9810.

GBP Intraday Trend Analysis

Fundamental Analysis:

UK markets remained jittery, with news that the Bank of England stepped up its bond purchases and Chancellor Quarten’s pledge to announce the budget ahead of schedule did not completely calm market doubts.

The pound fell to a two-week low of $1.0962 yesterday, 11th October 2022, down 0.9%.

Technical Analysis:

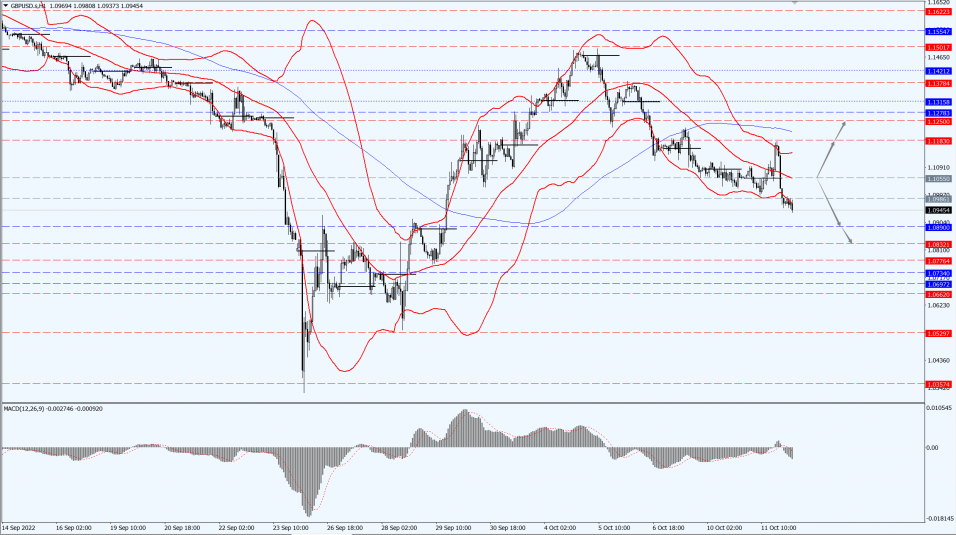

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1055-line today. If GBP runs below the 1.1055-line, it will pay attention to the suppression strength of the two positions of 1.0890 and 1.0832. If GBP runs above the 1.1055-line, then pay attention to the suppression strength of the two positions of 1.1183 and 1.1250.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rebounded from a one-week low on Tuesday, 11th October 2022, as markets prepared for a key U.S. inflation report that is expected to affect the Federal Reserve’s monetary policy stance.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1660-line today. If the gold price runs steadily below the 1660-line, then it will pay attention to the support strength of the 1642 and 1627 positions. If the gold price breaks above the 1660-line, then pay attention to the suppression strength of the two positions of the 1680 and 1693.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed 2% lower on Tuesday, 11th October 2022, extending a nearly 2% decline from the previous session, as recession fears and the spread of the epidemic sparked concerns about global demand.

Oil prices surged earlier this year as Russia’s invasion of Ukraine fueled supply concerns, bringing the Brent contract close to an all-time high of $147, but prices slumped due to economic concerns.

Oil is also under pressure from a strong dollar, which has reached multi-year highs due to concerns about interest rate hikes and escalating war in Ukraine.

A strong dollar makes oil more expensive for buyers using other currencies and tends to depress risk appetite.

However, the decline was limited by tight market supply and the decision last week by OPEC+, made up of the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, to reduce its production target by 2 million barrels per day.

Technical Analysis:

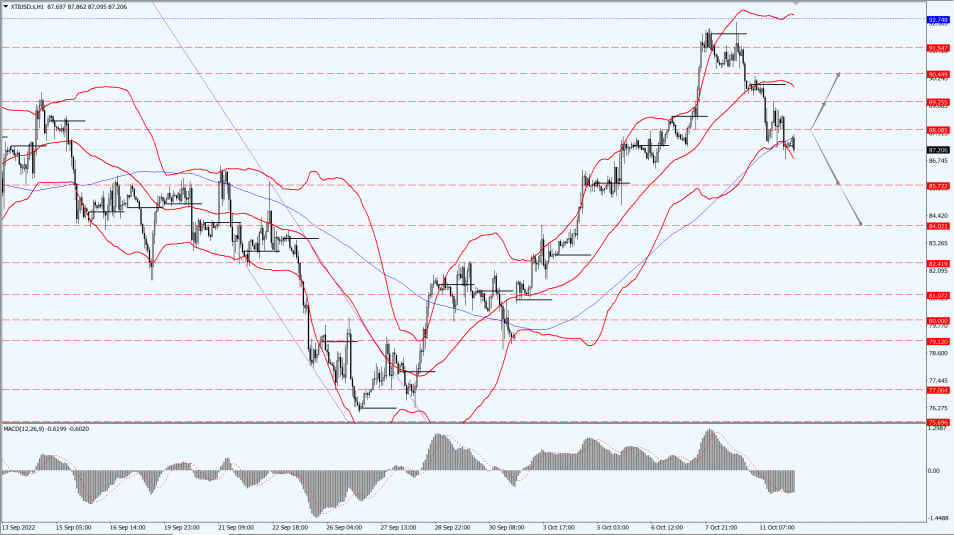

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 88.08-line today. If the oil price runs above the 88.08-line, then focus on the suppression strength of the two positions of 89.25 and 90.44. If the oil price runs below the 88.08-line, then pay attention to the support strength of the two positions of 85.72 and 84.02.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.