Eurozone CPI rose a surprising 10% year-over-year in September, above expectations of 9.7% and up from 9.1% in August.

Eurostat said the increase was driven by a 1.2% increase from a year earlier, doubling the 0.6% increase in August.

Rising gas prices are the main culprit, with the Netherlands seeing an incredible 17.1% increase in gas prices in September.

However, price pressures in the eurozone are expected to rise across the board, and not just in the energy sector, leading markets to expect a stronger response from the ECB in October this year.

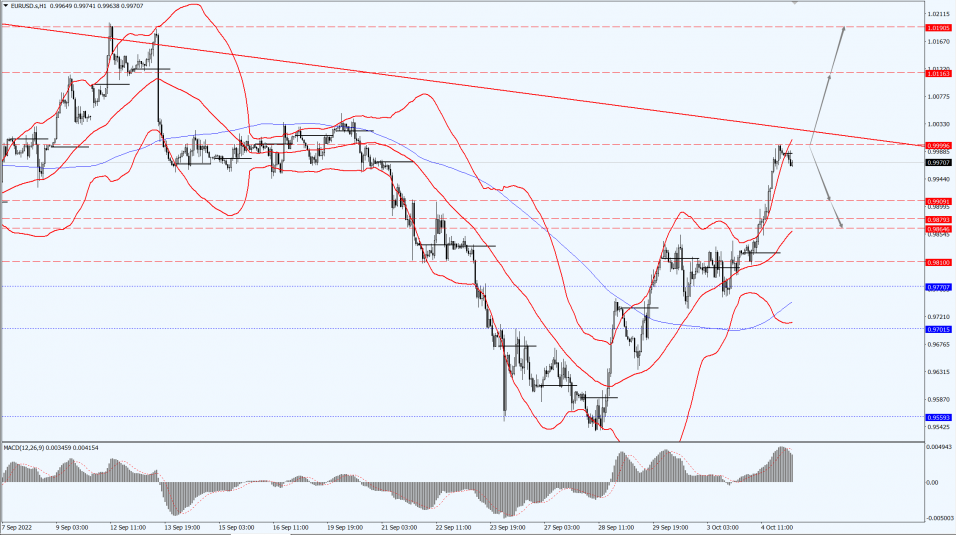

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9909 and 0.9864. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

As the market ruled out an emergency rate hike, the three-month forward rate for the pound has rebounded to levels near those seen prior to the mini-budget announcement.

Longer-term indicators still suggest that the pound’s spread over the dollar will be much higher than previously expected, and this trend in the market has been largely reversed.

The forward rate, or spread between the forward currency and the spot currency, is a measure of the relative exchange rate expectations for different currencies.

This indicator reflects the cost of holding pounds rather than dollars, and vice versa.

Another way to look at this issue is the implied rate of return, but the implied rate of return reflects the same information.

GBP 3-month implied yield is 17 basis points higher than the day before UK Chancellor of the Exchequer Kwarteng’s mini-budget announcement and was 98 basis points higher last week.

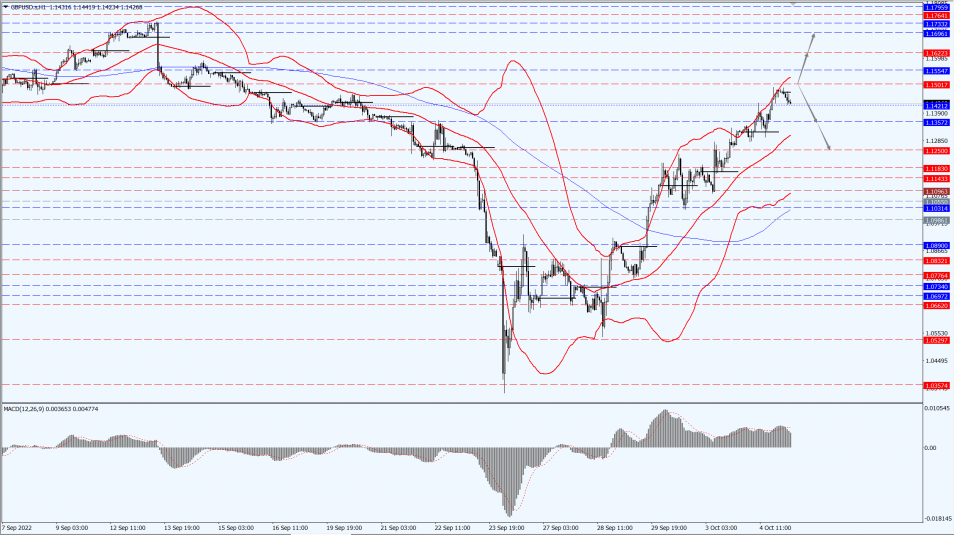

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1501-line today. If GBP runs below the 1.1501-line, it will pay attention to the suppression strength of the two positions of 1.1357 and 1.1250. If GBP runs above the 1.1501-line, then pay attention to the suppression strength of the two positions of 1.1622 and 1.1696.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose more than 1% on Tuesday, 4th October 2022, touching a three-week high, as the dollar and U.S. Treasury yields retreated and investors looked to the Federal Reserve to take a less aggressive approach to raising interest rates.

Spot gold rose 1.5% to $1,723.99 an ounce, the highest since 13th September 2022.

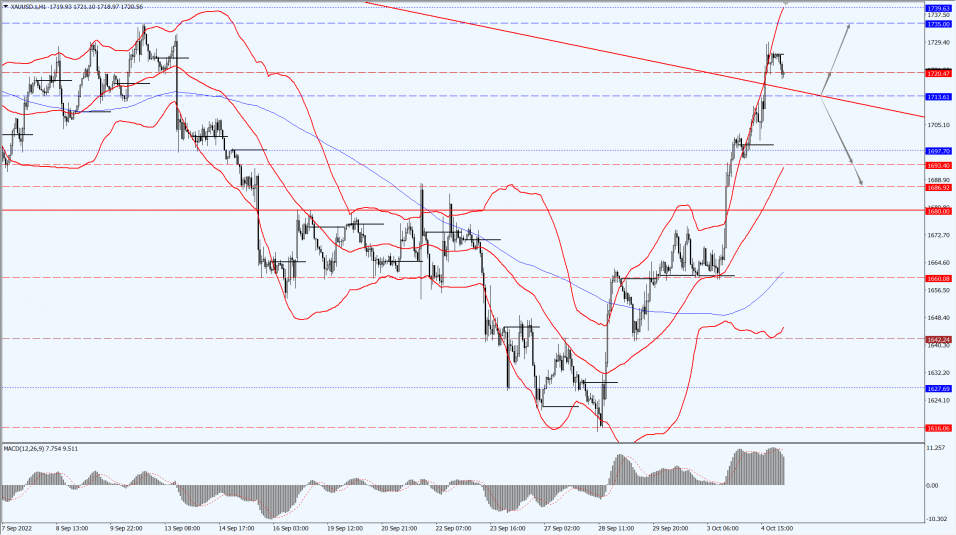

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1713-line today. If the gold price runs steadily below the 1713-line, then it will pay attention to the support strength of the 1693 and 1686 positions. If the gold price breaks above the 1713-line, then pay attention to the suppression strength of the two positions of the 1720 and 1735.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose nearly $3 on Tuesday on expectations that the OPEC+ coalition of oil producers will cut output sharply, while a weaker dollar made oil less expensive to buy.

OPEC+ looks set to cut production at Wednesday’s, 5th October 2022, meeting.

The move will squeeze supply in the oil market, which energy company executives and analysts say is already tight due to healthy demand, lack of investment and supply issues.

OPEC+ sources said the alliance is discussing production cuts greater than 1 million barrels per day.

Oil prices extended gains after Bloomberg News reported that OPEC+ is considering cutting production by 2 million barrels per day.

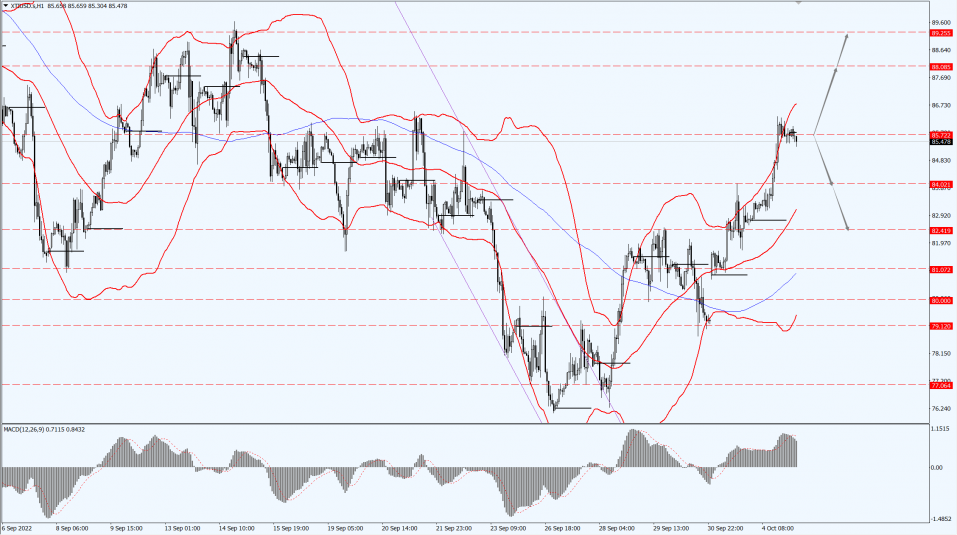

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 85.72-line today. If the oil price runs above the 85.72-line, then focus on the suppression strength of the two positions of 88.08 and 89.25. If the oil price runs below the 85.72-line, then pay attention to the support strength of the two positions of 84.02 and 82.41.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.