1. Forex Market Insight

EUR/USD

EUR/USD was flat at 0.9968 on the day, after briefly recovering above par overnight.

But in Germany Ifo Institute for Economic Research (Ifo) published a survey showing that German business confidence in August fell to its lowest since June 2020, as the war in Ukraine brought a high degree of uncertainty and fears of economic slippage in the third quarter after the euro softened.

Minutes from the European Central Bank meeting on 21st July show that policymakers appear increasingly concerned that high inflation is becoming entrenched, despite the risk of the eurozone falling into recession.

The euro’s strength against the dollar this week was largely driven by a spike in natural gas prices, which correlated with a weaker euro as the European region relies on natural gas for its energy needs.

This, coupled with concerns about the global economy, caused investors to flock to the dollar earlier in the week.

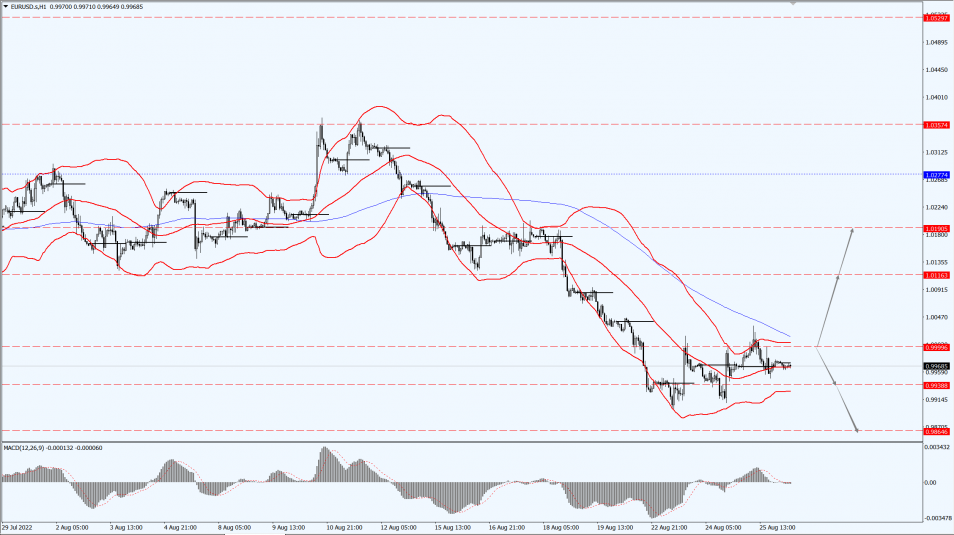

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.09999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9938 and 09864. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP recovered some of its lost ground against the dollar on Thursday, 25th August 2022, but is still hovering around the two-and-a-half-year low of 1.1819.

The decline of GBP has slowed in the last two sessions, mainly due to a profit-taking correction in the U.S. dollar index after it surged to a 20-year high earlier in the week.

The market is currently focused on the Jackson Hole meeting, where some analysts believe that BoE Governor Bailey may reiterate his commitment to raise interest rates in order to bring inflation down to the target level, even though the economy is forecast to enter recession at the end of this year and not come out of it until 2024.

According to Lufte data, interest rate futures market pricing has fully reflected the Bank of England in next month’s meeting to raise interest rates by 50 basis points is expected, and that a 75 basis point rate increase is not unlikely.

In fact, the key to this meeting still depends on what tendencies Fed Chairman Powell will deliver a speech, if it continues to make tougher statements in monetary policy, the pound’s headwinds are still afraid to be suppressed by the dollar and is weak.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1764-line today. If GBP runs below the 1.1764-line, it will pay attention to the suppression strength of the two positions of 1.1696 and 1.1622. If GBP runs above the 1.1764-line, then pay attention to the suppression strength of the two positions of 1.1820 and 1.1870.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose Thursday, 25th August 2022, as the dollar retreated from recent highs and investors awaited the Jackson Hole symposium, seeking to get a hint about the Federal Reserve’s monetary policy.

Markets will be watching Fed Chairman Jerome Powell’s speech at a central bank seminar in Wyoming on Friday for clues about the Fed’s strategy for raising interest rates.

The U.S. economy contracted less in the second quarter than initially estimated, with consumer spending offsetting some of the drag caused by the sharp slowdown in inventory accumulation, which eased concerns that the economy was about to fall into recession.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1751-line today. If the gold price runs steadily below the 1751-line, then it will pay attention to the support strength of the 1743 and 1735 positions. If the gold price breaks above the 1751-line, then pay attention to the suppression strength of the two positions of the 1760 and 1768.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices slipped about $2 in jittery trading Thursday, 25th August 2022, as investors braced for the possible return of sanctioned Iranian oil exports to global markets and worried that rising U.S. interest rates could weaken fuel demand.

Investors are also awaiting Federal Reserve Chairman Jerome Powell’s speech at the Kansas City Fed’s Economic Policy Symposium scheduled for Friday, 26th August 2022, in Jackson Hole, Wyoming.

Powell is expected to summarize the Fed’s stance on controlling inflation, including information on the long-term and short-term path of rate increases.

Weak U.S. gasoline demand has sparked concerns about slowing economic activity and pushed prices lower.

According to the latest data released by the U.S. Energy Information Administration (EIA), overall U.S. demand for gasoline dipped last week, leaving the four-week average daily supply of gasoline products 7% lower than a year earlier.

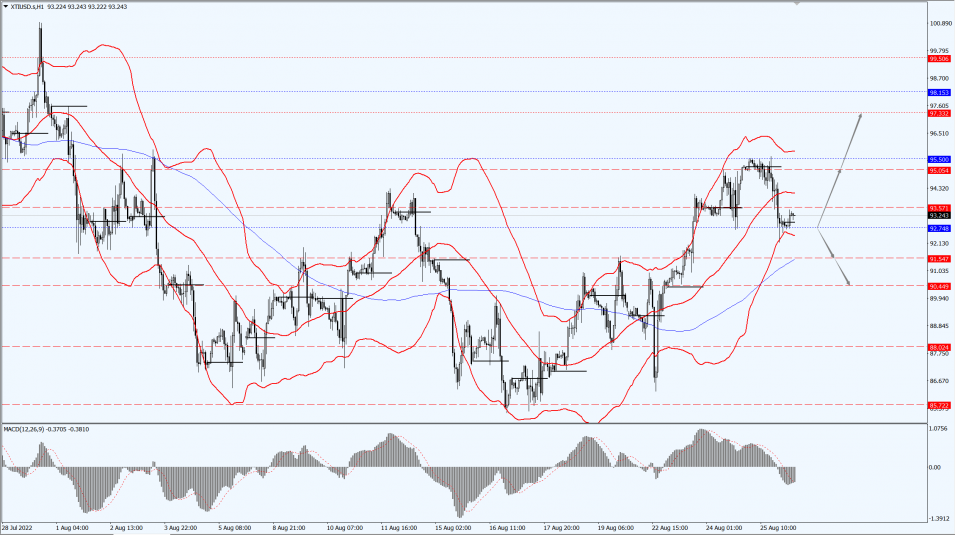

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 92.74-line today. If the oil price runs above the 92.74-line, then focus on the suppression strength of the two positions of 95.05 and 97.33. If the oil price runs below the 92.74-line, then pay attention to the support strength of the two positions of 91.54 and 90.44.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.