1. Forex Market Insight

EUR/USD

The euro was up by 0.16% against the dollar at 1.1343, after posting its biggest one-day loss in a month in the previous session.

On Wednesday, 19th January 2022, the German 10-year bond yield rose above 0% for the first time since 2019, signaling a possible inflection point in the eurozone debt market, which has been characterized by negative yields for years, news that provided support for the euro as a whole.

The German 10-year bond yield, considered an indicator for the eurozone as a whole, rose as high as 0.025% and ended the day at minus 0.007%, essentially unchanged for the day.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the suppression of the 1.1357-line. If the euro runs steadily below the 1.1357-line, we will pay attention to the support of 1.1338 and 1.1315 below. If the euro breaks above the 1.1357-line, we will pay attention to the suppression of 1.1378 and 1.1401.

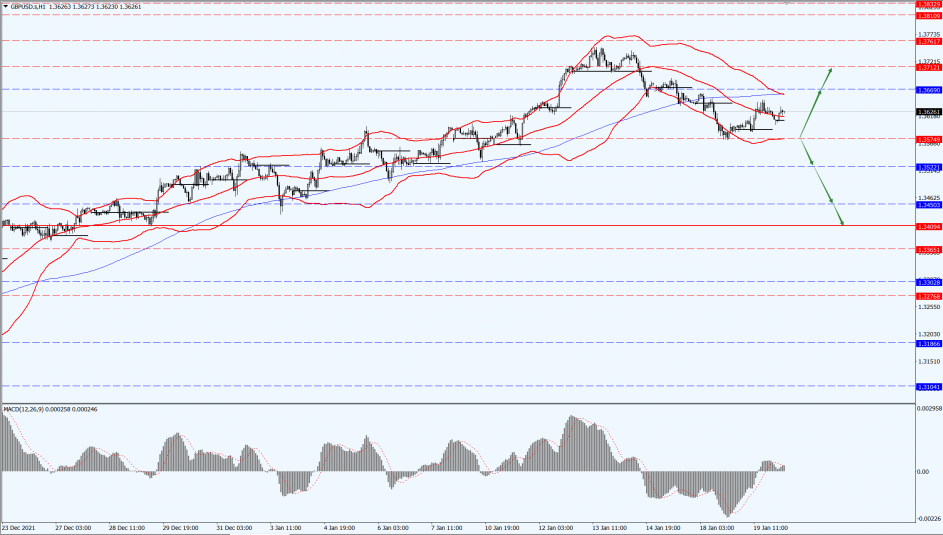

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound advanced after data showed that the U.K. Consumer Price Index (CPI) rose by 5.4% in December, the biggest gain in 30 years, raising expectations for a rate hike. However, rumors of a challenge to British Prime Minister Johnson’s leadership position limited gains.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3574-line today. If the pound runs above the 1.3574-line, it will focus on the suppression strength of the 1.3669 and 1.3712 positions. If the pound runs below the 1.3574-line, it will pay attention to the support strength of the 1.3522 and 1.3409 positions.

2. Precious Metals Market Insight

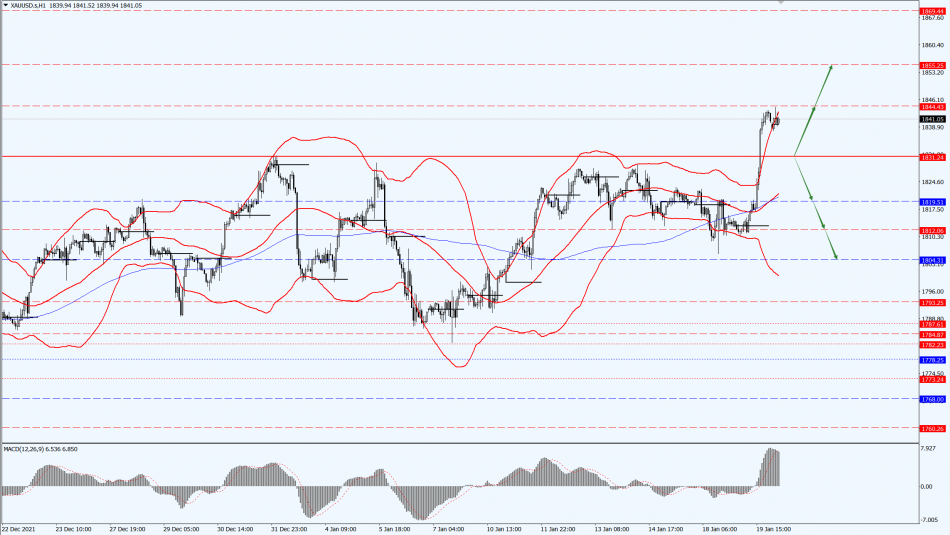

Gold

Fundamental Analysis:

Gold prices rose sharply to a two-month high yesterday as a weaker dollar and geopolitical tensions around Ukraine enhanced gold’s safe-haven appeal.

In addition, a sharp pullback in equities also supported gold prices, but expectations of a Fed rate hike still kept gold prices under pressure. The focus during the day will be on the U.S. initial jobless claims.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1831-line today. If the gold price runs steadily above the 1831-line, then pay attention to the suppression strength of the 1844 and 1855 positions. If the gold price falls below the 1831-line, it will open up further callback space. At that time, pay attention to the strength of 1819 and 1804.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, oil prices surged higher and fell back, once rising to a new seven-year high of $86.79/barrel during the day, as the International Energy Agency (IEA) said the market supply looks tighter than previously thought.

Adding to this, the Iraq-Turkey pipeline disruption exacerbated supply concerns, with bullish sentiment high among agencies, but continued weakness in U.S. stocks and an unexpected increase in API crude inventories caused oil prices to retreat their gains.

Intraday focus on the U.S. initial jobless claims for the week ending 15th January 2022, the World Economic Davos Forum, and the Friday 00:00 release of EIA data.

Also, pay special attention to the NYMEX New York crude oil February futures subject to shift for the month on 21st January, 3:30 to complete the last transaction on the floor, 6:00 am to complete the last transaction on the electronic market.

Plus, pay attention to the trading venue expiry for the month announcement control risk. The last trade will be completed on 21st January at 3:30 am, and the last trade will be completed at 6:00 am. This part of the trading platform U.S. oil contract expiration time is usually one day earlier than the official NYMEX.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 83.74-line today. If the oil price runs below the 83.74-line, then pay attention to the support strength of the 81.07 and 80 positions. If the oil price runs above the 83.74-line, then pay attention to the suppression of the 87-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home