1. Forex Market Insight

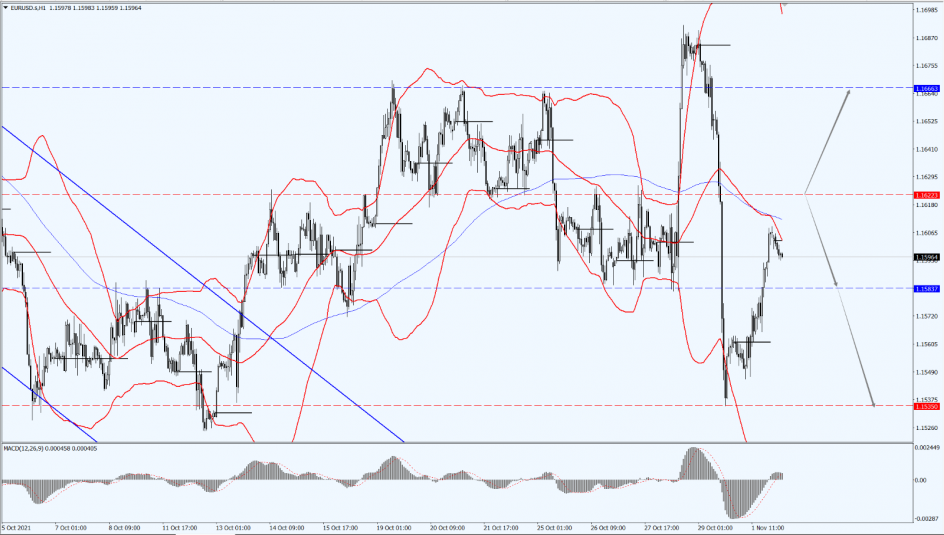

EUR/USD

The dollar weakened yesterday, having recorded its biggest one-day gain in more than four months in the previous session. During this interval, traders are preparing for this week’s highly anticipated Federal Reserve policy meeting. With this, the dollar’s decline led to a rebound in euro strength.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1622-line. If the euro runs steadily below the 1.1622-line, maintain the bearish trend. On the lower end, focus on the 1.1583 and 1.1535. If the euro breaks above the 1.1622-line, pay attention to the suppression of 1.1666 at that time.

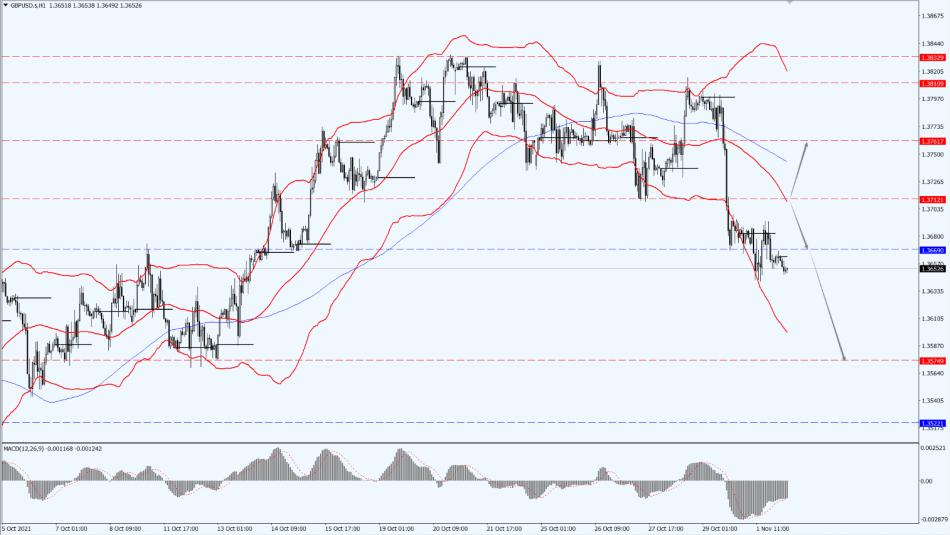

GBP Intraday Trend Analysis

Fundamental Analysis:

U.S. manufacturing companies continued to be under pressure in October because of supply chain issues, with suppliers taking longer to deliver and inventory indicators rising.

According to data released Monday, 1st November 2021, the Institute of Supply Management’s (ISM) manufacturing index fell to 60.8 from 61.1 in September. A reading above 50 indicates expansion.

The median estimate of economists surveyed by Bloomberg was 60.5. ISM’s supplier delivery indicator rose to a five-month high, indicating that manufacturers are facing longer delivery times for raw materials.

Additionally, the upcoming announcement of the U.K. monetary policy led the pound to consolidate weakly yesterday.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3712-line. If the pound runs below the 1.3721-line, then pay attention to the support at 1.3669 and 1.3574 in turn. If the pound breaks through the 1.3712-line, pay attention to the suppression of the 1.3761-line.

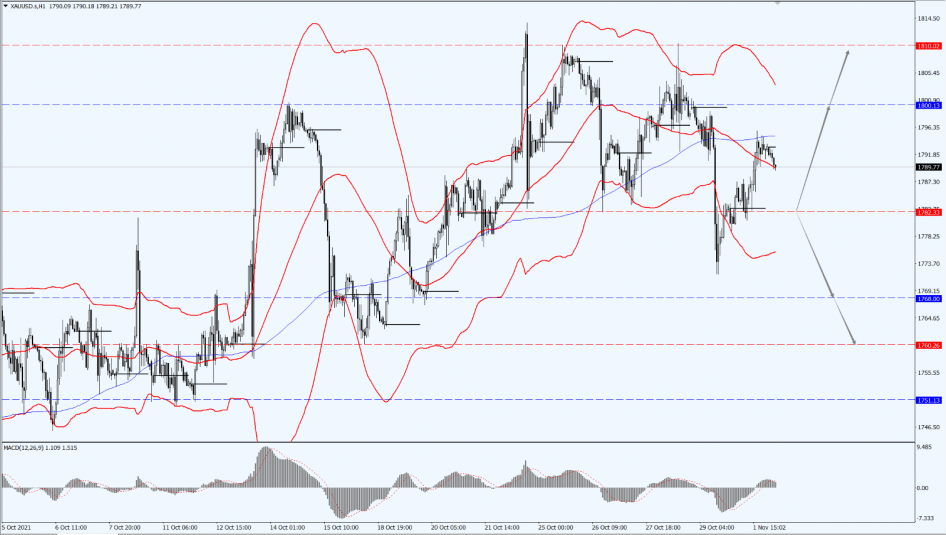

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose slightly yesterday as the dollar weakened and the U.S. manufacturing growth slowed in October.

However, the record highs in U.S. stocks limited gold prices. At the same time, Biden’s $1.75 trillion spending plan suffered a setback in Congress.

So far, there is no U.S. data for the day, and the main focus remains on the Australian Federal Reserve interest rate.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the first line of 1782. If the price of gold runs steadily above the first line of 1782, then pay attention to the suppression of the first line of 1800. If the price of gold falls below the first line of 1782, it will open up further downside space. At that time, pay attention to the support of the two positions of 1768 and 1760.

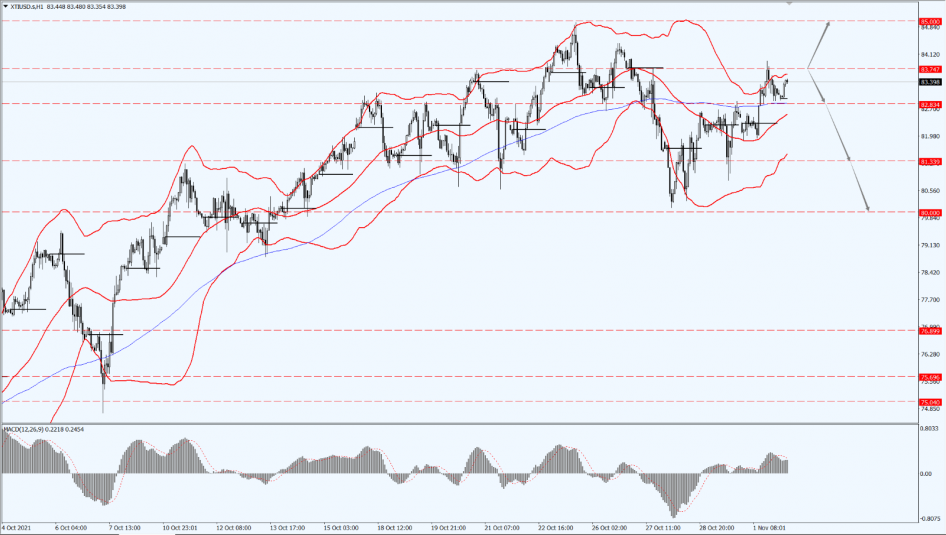

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed higher yesterday, with expectations of strong demand and the belief that the OPEC+ alliance formed by the Organization of Petroleum Exporting Countries (OPEC) and its allies will not increase production too quickly helping to reverse earlier declines caused by the release of fuel reserves by energy-consuming countries.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices pay attention to the 83.74-line. If the oil price runs below the 83.74-line, pay attention to the support at the 82.83 and 81.33 positions in turn. If the oil price breaks above the 83.74-line, then the 85-line will be tested again.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.