1. Forex Market Insight

EUR/USD

EUR/USD was up 0.08% in late trading at $1.0547 on last Friday, 6th May 2022, having earlier fallen to $1.04830, slightly above the five-year low of $1.0470 hit on 28th April 2022.

EUR/USD weakened as a result of the sanctions imposed following the Russia’s invasion of Ukraine, which has also slowed down the Europe’s economic growth of the Europe and has disrupted energy supplies.

Official data released on last Friday, 6th May 2022, demonstrated that German industrial production fell more than expected in March, as epidemic restrictions and the war in Ukraine disrupted supply chains and made it difficult to fill orders.

Technical Analysis:

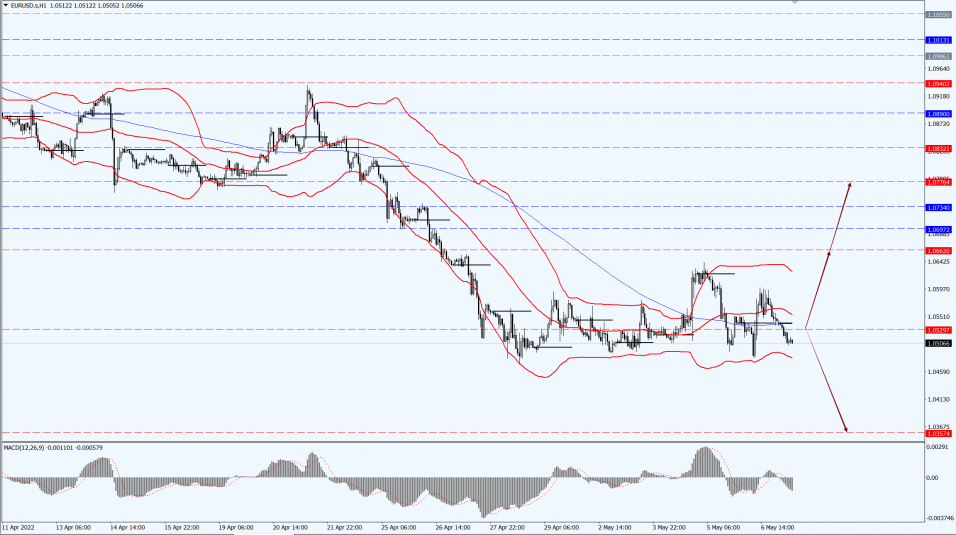

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If the euro runs steadily below the 1.0529-line, then pay attention to the support strength of the position of 1.0357. If the strength of the euro breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0662 and 1.0776.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP fell to its lowest level since June 2020 after the Bank of England raised interest rates on last Thursday, 5th May 2022, to the highest level since 2009. Yet, it warned that the economy was at risk of recession.

GBP/USD was down 0.20% at $1.2331 in late trading on last Friday, 6th May 2022, after dropping to $1.2276 during the day.

Technical Analysis:

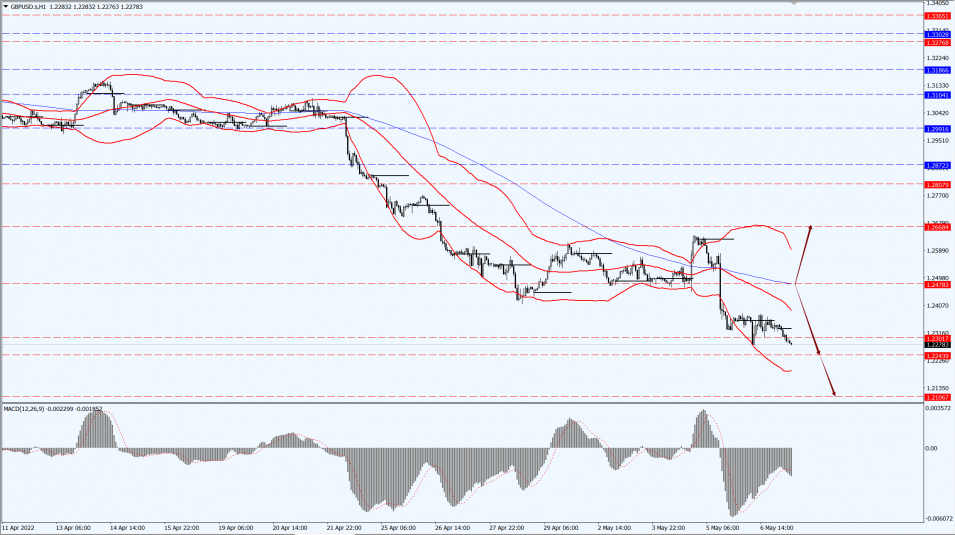

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2478-line today. If GBP runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2243 and 1.2106. If GBP runs above the 1.2478-line, then pay attention to the support strength of the position of 1.2668.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose slightly on last Friday, 6th May 2022, to close at $1,883.38 per ounce. Yet, the weekly trend will fall for the third consecutive week, weighed down by the prospect of a sharp interest rate hike by the Federal Reserve, while demand concerns dragged gold prices down sharply at one point.

The recent climb in U.S. bond yields and stronger-than-expected U.S. employment data is seen as giving justification for a deeper rate hike, which has limited gold prices to the upside.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1869-line today. If the gold price runs steadily above the 1869-line, then it will pay attention to the support strength of the 1880 and 1909 positions. If the gold price breaks below the 1869-line, then pay attention to the suppression strength of the two positions of the 1861 and 1855.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

International oil prices weakened in early trading on Monday, 9th May 2022, as Saudi Arabia cut the selling price of crude oil in Asia. U.S. crude is currently down 0.72%, trading near $108.98 per barrel.

Saudi Arabia cut its oil prices for Asian customers in June for the first time in four months, with state-owned Saudi Aramco lowering its official selling price for Arabian Light crude to Asia to $4.4 per barrel from a $9.35 per barrel premium to the average price in Dubai, Oman.

However, oil prices rose nearly 1.5 percent on last Friday and for the second week in a row, with the EU about to impose sanctions on Russian oil, which could lead to tighter supplies, while traders shrugged off concerns about global economic growth.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 107.52-line today. If the oil price runs above the 107.52-line, then focus on the suppression strength of the two positions of 111.95 and 116.30. If the oil price runs below the 107.52-line, then pay attention to the support strength of the two positions of 102.52 and 99.50.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.