1. Forex Market Insight

EUR/USD

EUR/USD briefly touched an intraday high earlier on Friday, 26th August 2022, after Reuters reported that some European Central Bank (ECB) policymakers want to discuss a 75 basis point rate hike at their September policy meeting, even as the risk of recession looms as the inflation outlook is worsening.

In an interview with Dutch national broadcaster NOS on Friday, 26th August 2022, Dutch central bank governor and ECB management board member Knott said he favored a sharp interest rate hike to curb inflation.

Technical Analysis:

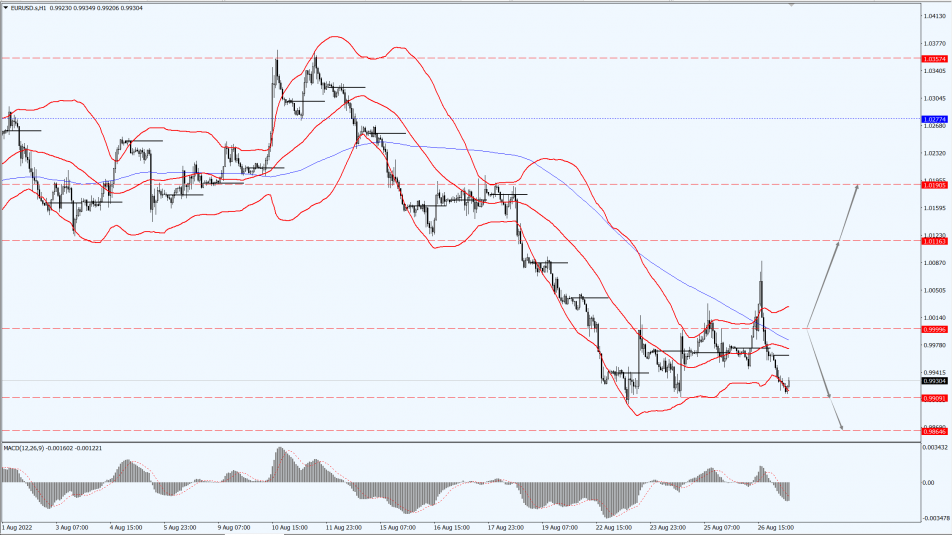

(EUR/USD 1-hour chart)

We focus on the 0.09999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9938 and 09864. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP slipped on Friday, 26th August 2022, after Britain’s energy regulator said energy bills for British households would jump 80 percent to an annual average of 3,549 pounds ($4,188) from October.

Unless the government does something, millions of families will be left without fuel and businesses will face hardship.

Technical Analysis:

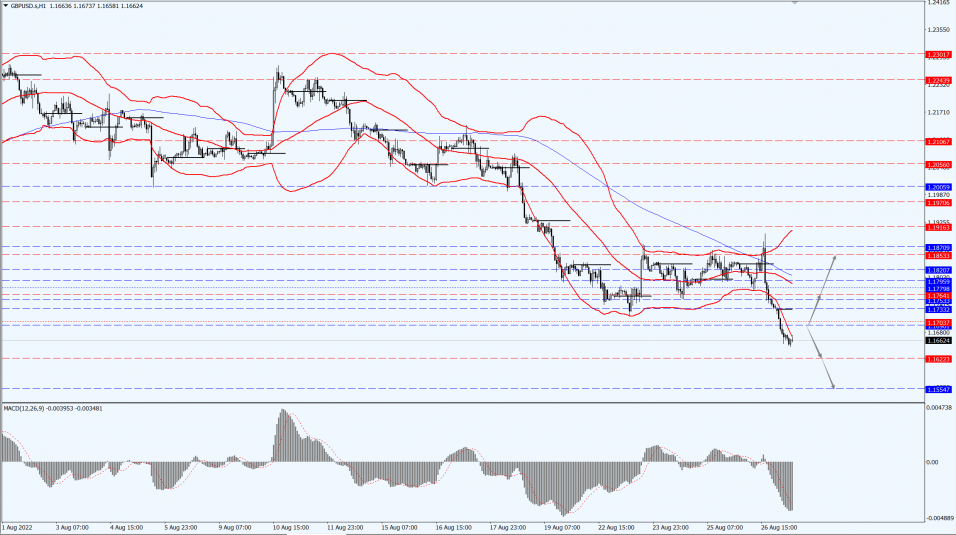

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1696-line today. If GBP runs below the 1.1696-line, it will pay attention to the suppression strength of the two positions of 1.1622 and 1.1554. If GBP runs above the 1.1764-line, then pay attention to the suppression strength of the two positions of 1.1764 and 1.1853.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell more than 1% on Friday, 26th August 2022, after Federal Reserve Chairman Jerome Powell said in a speech at Jackson Hole that the U.S. economy needs tighter monetary policy until inflation is under control.

Powell said that could mean slower growth, but did not hint at what measures the Fed might take at its September policy meeting.

Technical Analysis:

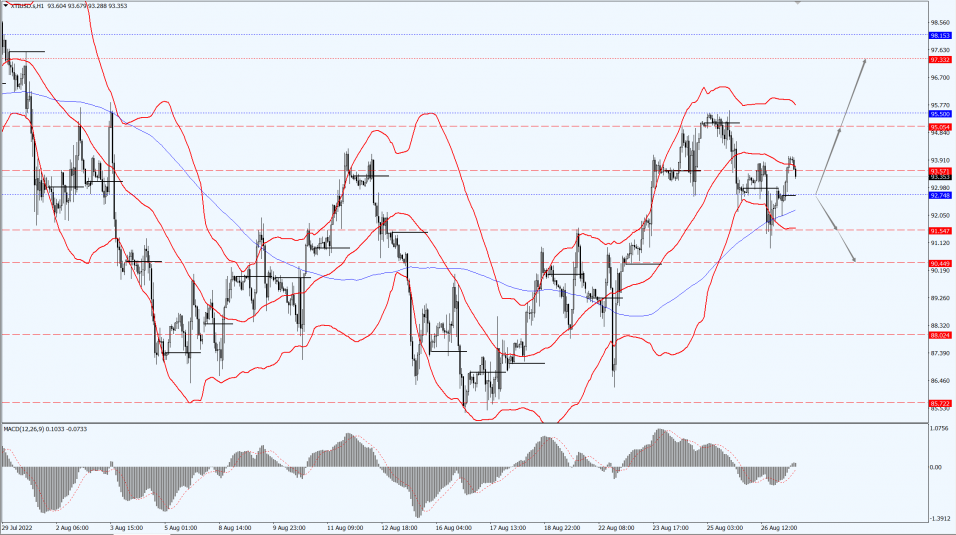

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1720-line today. If the gold price runs steadily below the 1720-line, then it will pay attention to the support strength of the 1713 and 1700 positions. If the gold price breaks above the 1720-line, then pay attention to the suppression strength of the two positions of the 1735 and 1743.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices settled higher on Friday, 26th August 2022, helped by signals from Saudi Arabia that the Organization of the Petroleum Exporting Countries (OPEC) may cut production.

But trading was choppy, with investors digesting and ultimately looking down on Fed Chairman Powell’s warnings about future economic pain.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 92.74-line today. If the oil price runs above the 92.74-line, then focus on the suppression strength of the two positions of 95.05 and 97.33. If the oil price runs below the 92.74-line, then pay attention to the support strength of the two positions of 91.54 and 90.44.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.