1. Forex Market Insight

EUR/USD

The euro rebounded slightly against the dollar, rising by 0.09% to 1.1209. Although the euro still accumulated a decline of about 3% this month.

With the expectations that the ECB may be more dovish than the Fed, and the recent resurgence of a new wave of the Covid-19 outbreaks in Europe, are weighing on the euro.

A survey yesterday showed that a surge in the Covid-19 cases and an unusually high inflation in Germany are weighing on consumer confidence in Europe’s largest economy, dampening business prospects for the upcoming Christmas shopping season.

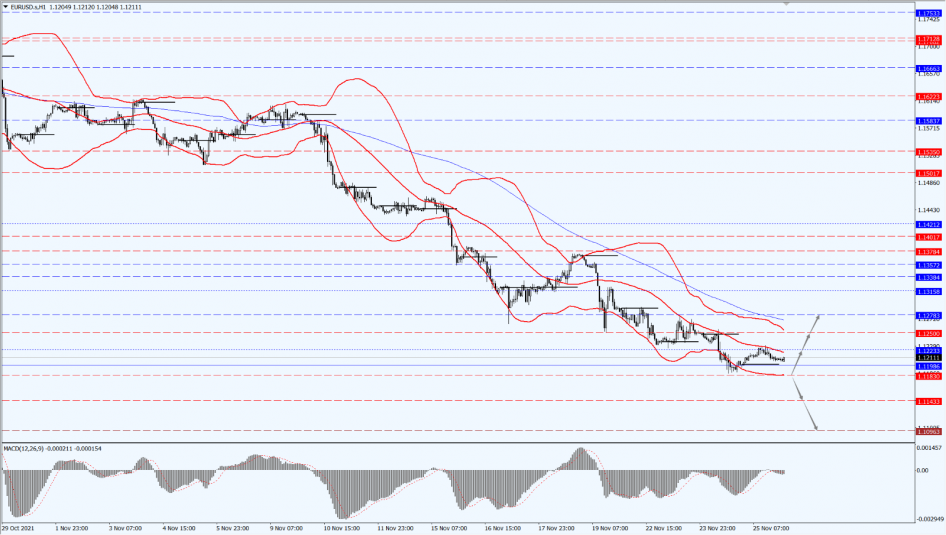

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we still pay attention to the 1.1183-line. If the euro runs stably above the 1.1183-line, we will look at the strength of the euro’s rebound. At that time, we will pay attention to the suppression of the top 1.1223 and 1.125 positions. If the euro’s strength drops below the 1.1183-line, then we will pay attention to the strength of support for each position at 1.1143 and 1.1096.

GBP Intraday Trend Analysis

Fundamental Analysis:

Bank of England Governor Tony Blair said that policymakers will have to act if inflation begins to prompt workers to demand wage increases and prices are expected to continue to rise.

We can’t fix what we usually call first-round effects, and we run the risk that they become embedded. If higher inflation continues for longer, we would start to expect it to continue and then go into wage bargaining – the labor market in this country is very tight, no doubt – and that’s when the central bank would have to step in.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is still mainly focused on the 1.3409-line today. If the pound runs below the 1.3409-line, then pay attention to the 1.3302-line of support. If the pound rebounds above the 1.3409-line, then pay attention to the suppression at the 1.3450 and 1.3522 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

International gold prices strengthened slightly as the dollar index came under pressure. However, the minutes of the Fed’s last meeting suggest that policymakers may accelerate the process of tapering bond purchases, which will continue to exert downward pressure on gold prices.

Against this background, spot gold rose by 0.22% to $1792.50 per once while the COMEX futures gold main contract rose by 0.45% to $1795.0 per ounce as the dollar index sank by 0.05% to 96.761.

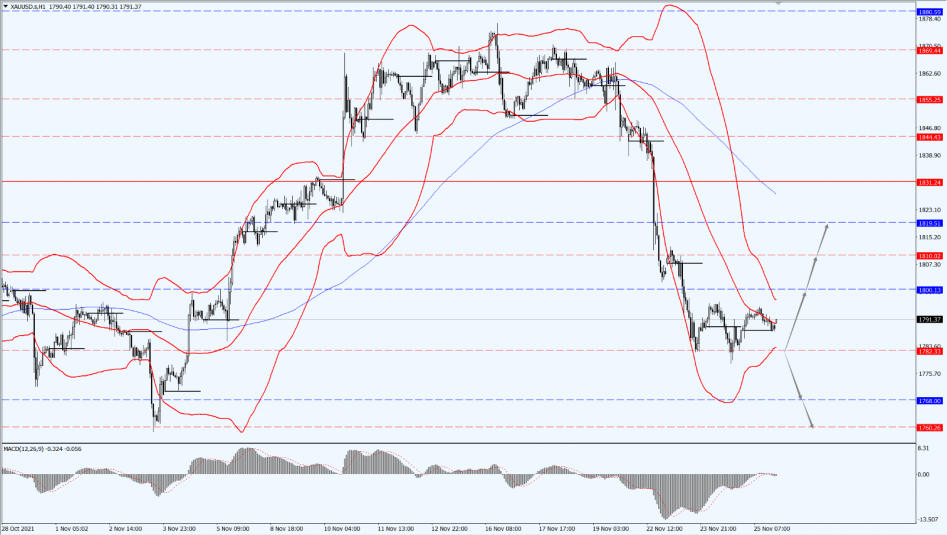

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold may continue to run the restorative market today. Therefore, we still pay attention to 1782-line today. If the price of gold runs stably above 1782, then pay attention to the suppression of the two positions of 1800 and 1810. If the price of gold falls below 1782, it will open up a further downside. At that time, we will pay attention to the support of the two positions of 1768 and 1760.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, Brent oil futures edged down by $0.03 to settle at $82.22/bbl. The OPEC+ alliance of OPEC and its allies, including Russia, will meet on 1st to 2nd December 2021 to set policy.

During this interval, the market is currently focused on the coalition’s reaction to the release of oil reserves by consumer countries, with crude oil prices performing relatively cautiously.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are still paying attention to the 76.89-line. If oil prices run above the 76.89-line, then pay attention to the suppression at 78.92 and 80 in turn. If the oil price drops below 76.89, it will open up a further downside space. At that time, pay attention to the strength of the positions at 75.69 and 75.04.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home