1. Forex Market Insight

EUR/USD

Russia’s further supply cuts are fueling fears of a recession in Europe.

The euro suffered a full-scale sell-off as more bad news came out on the energy supply front.

Considering the risk of recession in the Eurozone, the collapse of the Italian government and the very strong dollar.

Even if the European Central Bank embarks on a hike in interest rates, it may not help the euro out of a downtrend in the short term.

Technical Analysis:

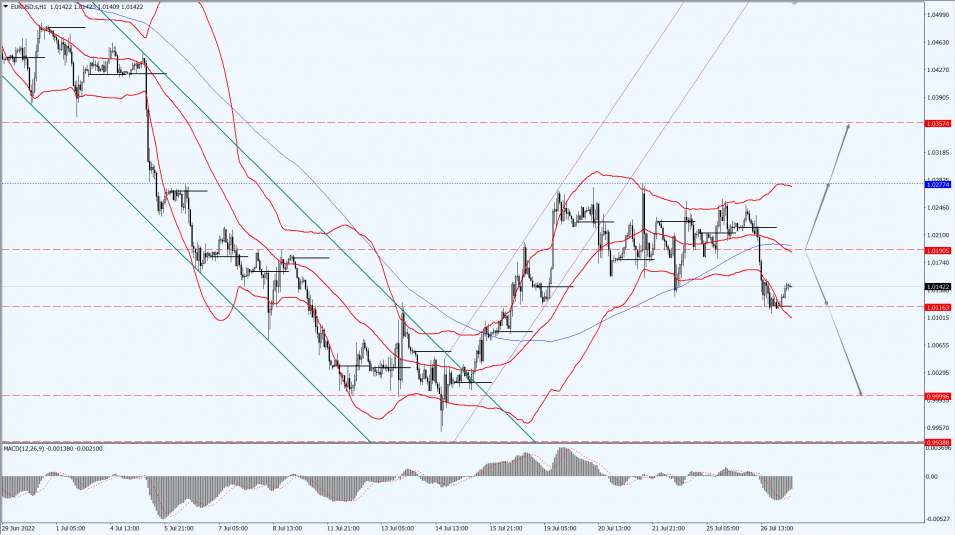

(EUR/USD 1-hour chart)

We focus on the 1.0190-line today. If EUR runs steadily below the 1.0190-line, then pay attention to the support strength of the two positions of 1.0116 and 0.9999. If the strength of EUR breaks above the 1.0190-line, then pay attention to the suppression strength of the two positions of 1.0277 and 1.0357.

GBP Intraday Trend Analysis

Fundamental Analysis:

The GBP/USD retraced from the three-week high of 1.2090 touched in the Asian session after it was still largely a prudent move ahead of the Fed rate meeting.

4 August 2022 will also usher in the Bank of England interest rate meeting, according to a Reuters survey, the Bank of England in August may avoid a more substantial rate hike, but hold fast to a moderate pace of 25 basis points of interest rate increases.

However, in the surveys of economists and bond market makers, many proportions believe that the rate hike will go to 50 basis points to control the historically high inflation rate.

Technical Analysis:

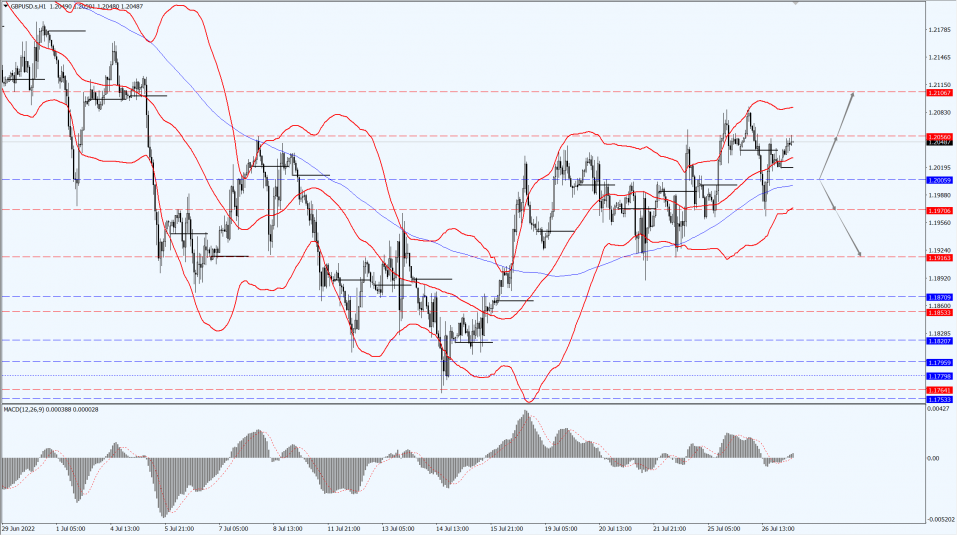

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2005-line today. If GBP runs below the 1.2005-line, it will pay attention to the suppression strength of the two positions of 1.1970 and 1.1916. If GBP runs above the 1.2005-line, then pay attention to the suppression strength of the two positions of 1.2056 and 1.2106.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices were stuck in a narrow range on Tuesday, 26th July 2022, as recession woes lingered.

U.S. bond yields fell, offsetting the impact of a stronger dollar, while markets turned their attention to the Federal Reserve’s two-day meeting.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1713-line today. If the gold price runs steadily below the 1713-line, then it will pay attention to the support strength of the 1700 and 1680 positions. If the gold price breaks above the 1713-line, then pay attention to the suppression strength of the two positions of the 1736 and 1751.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices reversed early gains and closed lower on Tuesday, 26th July 2022, as investors worried about falling consumer confidence and braced for another 20 million barrels of crude to be released from the U.S. Strategic Petroleum Reserve.

The U.S. government said on Tuesday, 26th July 2022, it would sell an additional 20 million barrels of oil from the Strategic Petroleum Reserve (SPR), part of an earlier plan to free up oil reserves to push prices back down.

Oil prices have recently surged on Russia’s invasion of Ukraine and demand recovery from the pandemic.

The U.S. government said in late March that it would release a record 1 million barrels of oil a day from its strategic reserves over a six-month period.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 95.50-line today. If the oil price runs above the 95.50-line, then focus on the suppression strength of the two positions of 98.15 and 99.50. If the oil price runs below the 95.50-line, then pay attention to the support strength of the two positions of 93.75 and 91.54.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.