1. Forex Market Insight

EUR/USD

The euro has accumulated about 2% gains over the past three trading days on expectations that the European Central Bank may raise interest rates by a significant 50 basis points and a Reuters report that a key Russian gas pipeline will restart on time after repairs.

The European Union told member states on Wednesday, 20th July 2022, to reduce gas use by 15 percent between August this year and March next year, as an emergency measure.

This comes after Russian President Vladimir Putin warned that supplies of Russian gas to Europe via the largest pipeline could be further reduced and possibly even halted.

Italian Prime Minister Mario Draghi won a vote of confidence in the Senate on Wednesday, 20th July 2022, but the three main coalition parties refused to participate in the vote, effectively dealing a blow to his government, and the selling pressure on the euro was not eased.

Technical Analysis:

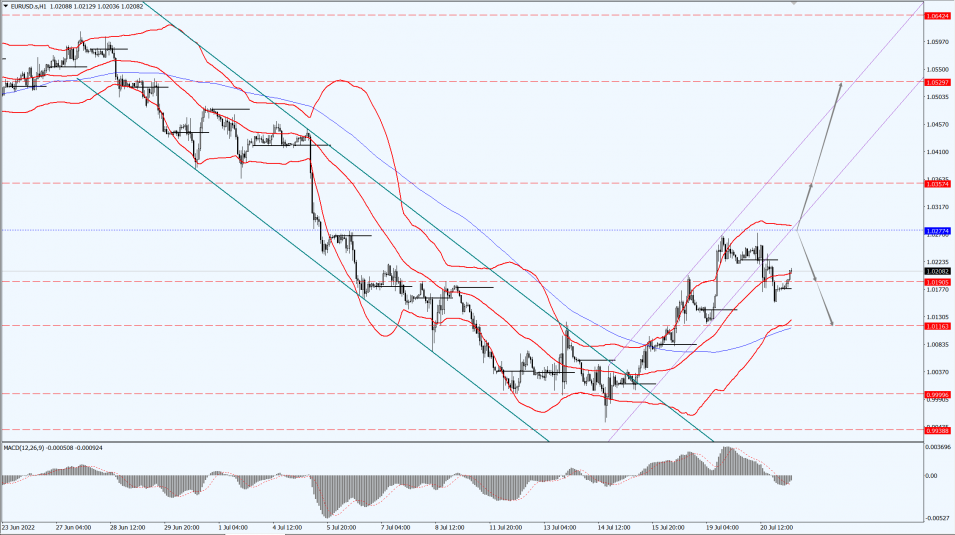

(EUR/USD 1-hour chart)

We focus on the 1.0277-line today. If EUR runs steadily below the 1.0277-line, then pay attention to the support strength of the two positions of 1.0190 and 1.0116. If the strength of EUR breaks above the 1.0277-line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound weakened against the dollar as data showed U.K. inflation climbed to its highest level in 40 years, but was only slightly above expectations.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2056-line today. If GBP runs below the 1.2056-line, it will pay attention to the suppression strength of the two positions of 1.1970 and 1.1916. If GBP runs above the 1.2056-line, then pay attention to the suppression strength of the two positions of 1.2106 and 1.2243.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices are stuck in a tight range, but trading volume is high.

Fed officials have downplayed the idea of a 100 basis point rate hike, but gold prices still haven’t managed to rally as demand for gold remains slightly weak.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1701-line today. If the gold price runs steadily below the 1701-line, then it will pay attention to the support strength of the 1690 and 1680 positions. If the gold price breaks above the 1701-line, then pay attention to the suppression strength of the two positions of the 1712 and 1723.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices slipped Wednesday, 20th July 2022, after U.S. government data showed a drop in gasoline demand during the peak summer driving season.

In addition, concerns of a possible economic slowdown as central banks raise interest rates to fight inflation, leading to lower energy demand.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 99.50-line today. If the oil price runs above the 99.50-line, then focus on the suppression strength of the two positions of 102.52 and 105.01. If the oil price runs below the 99.50-line, then pay attention to the support strength of the two positions of 97.33 and 95.05.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.