1. Forex Market Insight

EUR/USD

The EU leaders are set to approve the emergency measures for member states to ease the unprecedented energy crisis at hand this week. According to the draft statement that was made available to the media, EU heads of government may allow EU member states and the European Commission to “make full use” of the toolbox released last Wednesday, 13th October 2021, to provide short-term relief to households and businesses.

The energy crisis will be an important topic at the EU summit on 21st-22nd October 2021. According to the draft statement, leaders will also call for studying medium- and long-term measures to “mitigate excessive price volatility”, improve the EU’s energy resilience and ensure a successful transition to a green economy.

The communiqué was discussed by EU member state representatives on Friday, 15th October 2021, and is still subject to change before being approved by the head of government. The toolbox proposed by the European Commission earlier last week includes tax cuts and state support for businesses.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we still pay attention to the 1.1622-line. If the euro is suppressed by the 1.1622-line, the support at 1.1554 and 1.1501 will be tested again. If the euro breaks through 1.1622 and stabilizes above the 1.1622-line, it will open up a further upside potential. At that time, focus on the suppression of the two positions at 1.1663 and 1.1708 in turn.

GBP Intraday Trend Analysis

Fundamental Analysis:

The U.S. dollar index edged lower on Friday, 15th October 2021, as a surprise increase in the U.S. retail sales last month and strong corporate earnings boosted market risk appetite.

The pound performed best among the G-10 currencies. Meanwhile, global stocks rallied this week as concerns about economic stagflation eased as the U.S. corporate earnings beat expectations. Market popularity was also boosted by unexpectedly strong U.S. retail sales data for September. With this, retail sales rose by 0.7% last month from the previous month, partly due to rising prices, which were expected to fall by 0.2%.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is focused on the middle of the Bollinger band track today. Once the strength falls below the middle of the Bollinger band track, it will open up a further downside potential. At that time, we will pay attention to the support at 1.3669 and 1.3574 in turn.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold is currently trading slightly higher near $1,770 per ounce after experiencing a sharp drop last Friday. Gold broke through the $1,800 barrier at one-point last week but fell by nearly $30 last Friday.

This decline was a combination of two factors, the failure to effectively break through key technical levels and the rise in the 10-year Treasury yield following the steepening of the U.S. bond yield curve after the release of strong retail data in the United States.

Additionally, the dollar also rallied. However, with market concerns about inflation and economic growth heating up, the Fed is not in a hurry to raise interest rates.

In this regard, gold prices are still hopeful of breaking the $1,800 barrier this week.

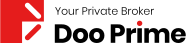

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the first line of 1782. The price of gold will run below the first line of 1782, but still maintains the bearish trend. With this, pay attention to the support of the two positions of 1757 and 1751 in turn.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

The U.S. crude hovered at $82.38/barrel while oil prices extended gains last week. The U.S. oil rose for an eight consecutive week and hit its highest in nearly seven years at $82.66/barrel.

The Brent oil broke the 85 mark for the first time in three years, buoyed by forecasts of supply shortages in the coming months, while an easing of outbreak-related travel restrictions is expected to stimulate demand.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices pay attention to the 80-line. If oil prices are above the 80-line, keep the trend of bullish thinking. Additionally, pay attention to the suppression of the 84.23 line. If the oil price falls below the 80-line, it will open up a further downside space. At that time, pay attention to the support strength in two positions of 78.25 and 76.89.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home