1. Forex Market Insight

EUR/USD

The Germany’s economy ministry is joining a European Central Bank campaign trying to assuage concerns among the population that currently high inflation rates are here to stay.

In a series of tweets published on Monday, 4th October 2021, the ministry labeled recent price spikes in the country as mostly temporary. It said a value-added tax cut last year and new carbon-pricing measures are partly to blame, echoing explanations offered by policy makers including ECB President Christine Lagarde and Bundesbank President Jens Weidmann.

A report last Thursday, 30th September 2021, showed inflation in Germany climbed to 4.1% in September, the strongest in three decades.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1554-line of support. If the euro breaks below the 1.1554-line, it will open up a further downside potential. At that time, pay attention to the 1.150-line of support. On top, pay attention to the suppression of the 1.1622 and 1.1663 positions. Once it breaks through the 1.1663-line, it will open up a further upside potential.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound remains on shaky ground as the U.K. is likely to still face energy and food shortages in the fourth quarter. Coupled with strong U.S. data this week, the pound could retest the $1.34 area and revert to its September losses.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is paying attention to the 1.3574-line today. Once the pound’s strength breaks below the 1.3574-line, it will open up a further downside potential. At that time, focus on the support of the 1.3522 and 1.3409 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose to a more than one-week high yesterday. The demand for gold was boosted by a weaker dollar and the safe-haven sentiment in the stock market. However, the market remains a bit nervous about the central banks pulling back on stimulus policies at a time of such economic uncertainty.

Nevertheless, the market now awaits the U.S. non-farm payrolls report for September, scheduled for Friday, 8th October 2021. The report is expected to show continued improvement in the labor market, which could influence the Fed’s timetable for tapering economic support.

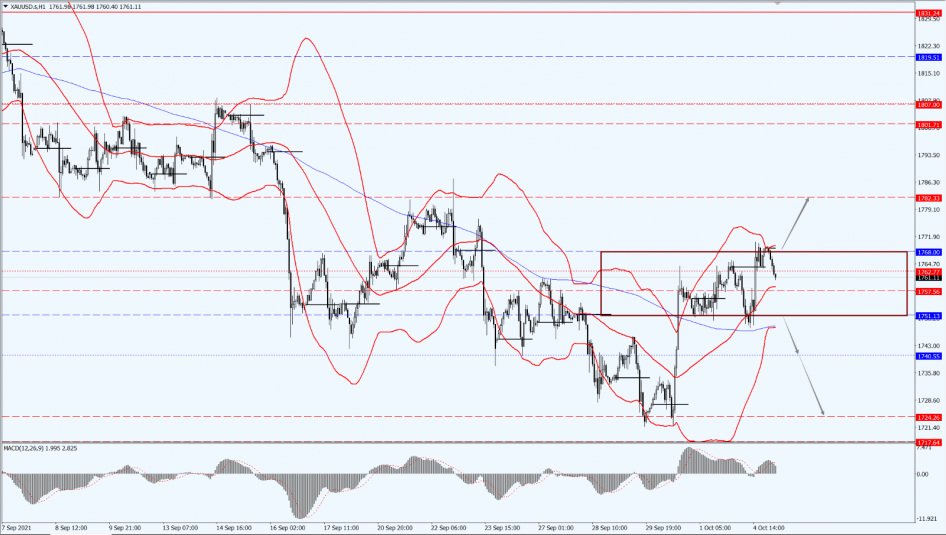

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is still paying attention to the direction of the breakthrough in the 1751 to 1768 range. If it breaks through the 1768-line and upwards, it will open up a further upside potential. At that time, pay attention to the suppression of 1782 and 1801. If it falls below the 1751-line, it will open up a further downside space. At that time, pay attention to the strength of support at 1740 and 1724.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil rose more than 3%, hitting a near seven-year high of $78.38 per barrel. Earlier, the Organization of the Petroleum Exporting Countries (OPEC) and Russia-led oil-producing allies comprising OPEC+ confirmed they would stick to their current production policy as demand rebounded, despite calls from some countries to ramp up output.

While OPEC+’s decision to continue gradually increasing oil production has pushed up oil prices and exacerbated inflationary pressures, consumer countries still fear that it will derail the economic recovery from the pandemic.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, the oil price maintains its bullish trend. The bottom line focuses on the support at 75.69 and 76.89, while the top line focuses on the suppression at 78.30 and 80.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.