1. Forex Market Insight

EUR/USD

The U.S. dollar index fell to a near one-month low yesterday while the greenback fell against all other G-10 currencies. The dollar index fell by 0.18% to 93.60 after the Federal Reserve said in its latest Beige Book that the U.S. economy grew at a “modest to moderate” rate in September and early October, as the latest surge of COVID-19 cases crested and began to recede.

Fed Governor Randal Quarles said that while it is time for the Fed to begin dialing down its bond-buying program, it would be premature to start raising interest rates in the face of high inflation that is likely to recede next year.

Against this background, the continued weakening of the dollar has led to a strong rebound in the euro.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we still pay attention to the 1.1622-line. If the euro is suppressed by the 1.1622-line, it will test the 1.1554 support line once again. If the euro breaks through 1.1622 and stabilizes above the 1.1622-line, it will open up a further upside space. At that time, pay attention to the suppression strength of the two positions of 1.1708 and 1.1663 in turn.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rose by 0.20% against the dollar to 1.3824 yesterday after data showed an unexpected slowdown in UK inflation last month. The data have hardly changed the people’s expectations that the Bank of England would be the first major central bank in the world to raise interest rates.

After the release of inflation data, the pound recovered its earlier losses, rising by 0.20% to 1.3824 against the dollar, after falling by 0.4% before.

Data from the Office for National Statistics on Wednesday showed that the U.K. consumer prices rose by 3.1 % last month, slightly below economists’ expectations of 3.2%. The market is already actively pricing the near-term path of the Bank of England’s policy rate.

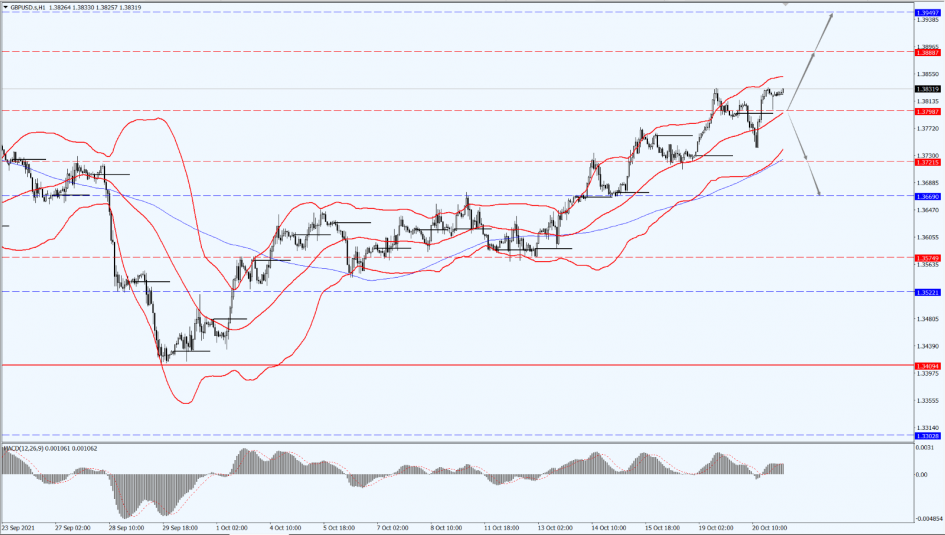

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3798-line today. If the pound runs stably above the 1.3798-line, it will still maintain the bullish trend. At that time, pay attention to the suppression of the 1.3888-line. If the pound strength drops below 1.3798, it will open up further room for correction. At that time, pay attention to the support strength of the two positions at 1.3721 and 1.3669.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices jumped yesterday, with spot gold setting a new high for the week at $1,788.47 per ounce. Prior to the weakening of the dollar, concerns about rising inflation and supply chain issues boosted gold’s appeal.

Gold prices have recently fluctuated as the market is trying to assess the pace of the Federal Reserve’s contraction of epidemic-era stimulus policies. Additionally, continued inflation amid high energy prices and supply chain disruptions has raised concerns that interest rate hikes could come sooner than expected, which is not good for gold.

However, the recent U.S. economic data has been mixed, making the market doubt the possibility of an early rate hike.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1788-line today. If it is under pressure on the 1788-line, it will pay attention to the support at the two positions of 1782 and 1768. If it breaks through 1788 and stands above the 1788-line, it will test the suppression of the 1801 line again.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

WTI oil rose by more than 1% in late trading and continued to hit a nearly seven-year high to $83.65 per barrel.

The EIA report showed an unexpected drop in crude inventories, easing concerns that higher oil prices could undermine demand. Additionally, the U.S. Energy Information Administration (EIA) reported that the U.S. crude oil inventories fell by 431,000 barrels last week as gasoline stocks fell by 5.368 million barrels and refined oil stocks fell by 3.913 million barrels.

This is a sign of continued economic recovery and reflects the importance of crude oil-related products and their role in the current economic recovery, where concerns about demand are really not obvious.

Through this, oil prices are rising at a time when energy supplies are tight due to coal and natural gas shortages. At the same time, the economic recovery has brought about a rebound in oil demand.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices are still paying attention to the 80-line today. If the oil price is above the 80-line, it will maintain the bullish trend. Then, pay attention to the suppression of the 84.23-line in turn. If the oil price falls below the 80-line, it will open up a further downside space. At that time, pay attention to the support strength of 78.25 and 76.89.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.