1. Forex Market Insight

EUR/USD

Many European Central Bank (ECB) Governing Council members have recently hinted that they would accept a recession in order to bring inflation back to target levels.

Yet, it remains a big question whether ECB members will really stick to their stance in the face of a shrinking economy.

European Commission President von der Leyen could announce details of the initial plan to control energy costs as early as today.

The euro could benefit if they can come up with convincing measures to ease the burden on the economy.

After all, this would increase the likelihood that the ECB would really devote all its efforts to fighting inflation.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9999 and 0.9879. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

The UK economy is showing signs of strain from soaring prices.

Britain’s gross domestic product rose 0.2 percent in July from the previous month, while economists were expecting a 0.4 percent increase.

Currently, the market expects the Bank of England to raise interest rates by another 50 basis points when it decides on the policy rate on 22nd September 2022

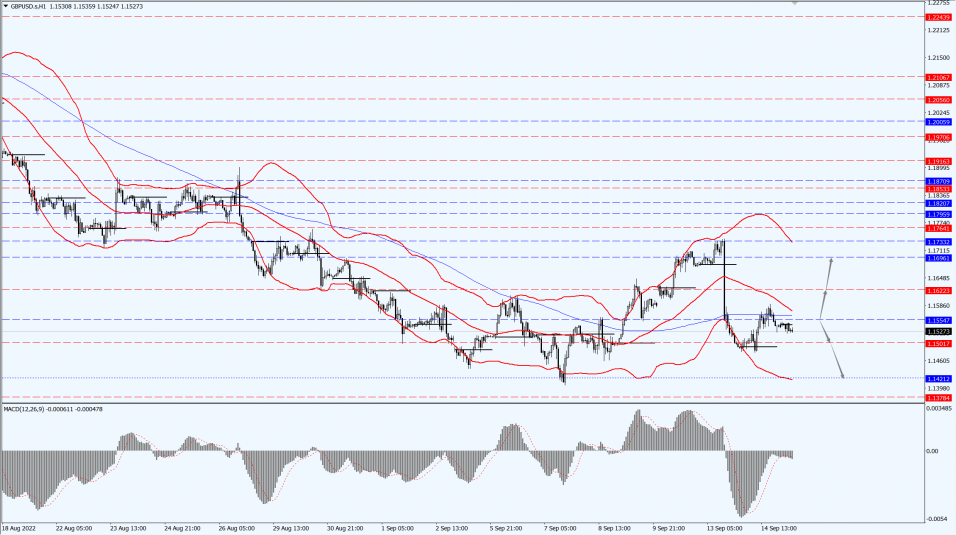

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1554-line today. If GBP runs below the 1.1554-line, it will pay attention to the suppression strength of the two positions of 1.1501 and 1.1421. If GBP runs above the 1.1554-line, then pay attention to the suppression strength of the two positions of 1.1622 and 1.1696.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell through the key $1,700 per ounce level on Wednesday, 14th September 2022, with expectations of a sharp interest rate hike by the Federal Reserve making non-yielding gold somewhat less attractive.

The market now expects the Federal Reserve to raise interest rates by at least 75 basis points at its September 20-21 policy meeting after data showed that the U.S. Consumer Price Index (CPI) unexpectedly rose 0.1% in August.

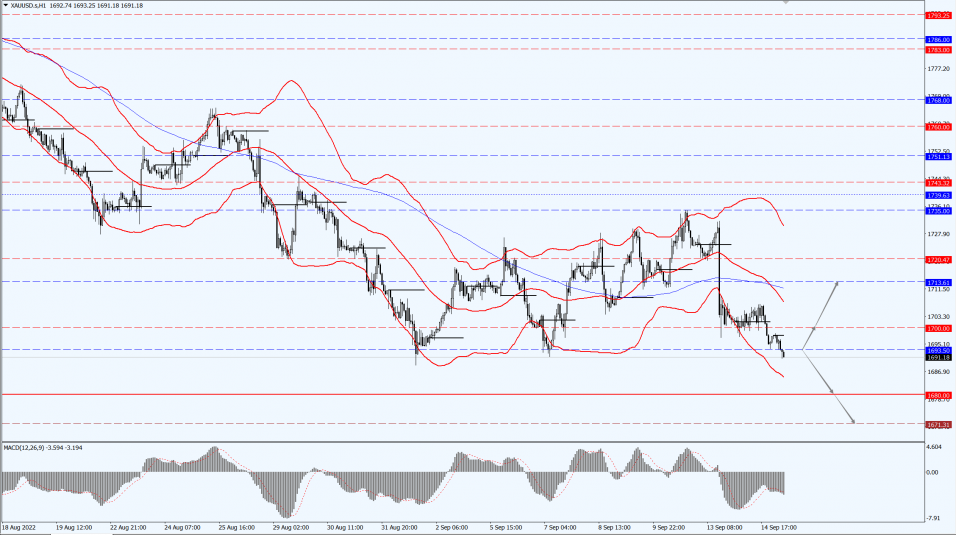

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1693-line today. If the gold price runs steadily below the 1693-line, then it will pay attention to the support strength of the 1680 and 1671 positions. If the gold price breaks above the 1693-line, then pay attention to the suppression strength of the two positions of the 1700 and 1713.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose more than 1.5% on Wednesday, 14th September 2022, as the international energy watchdog predicted an increase in switching from natural gas to oil for heating due to high prices this winter, although the demand outlook remains gloomy.

Data released by the U.S. Department of Energy on Monday, 12th September 2022, showed that the U.S. Strategic Petroleum Reserve stocks fell by 8.4 million in the week ended 9th September 2022. The International Energy Agency (IEA) expects a further economic slowdown to cause global oil demand growth to stall in the fourth quarter of this year.

This has kept oil prices under pressure in the near term and could dampen future gains.

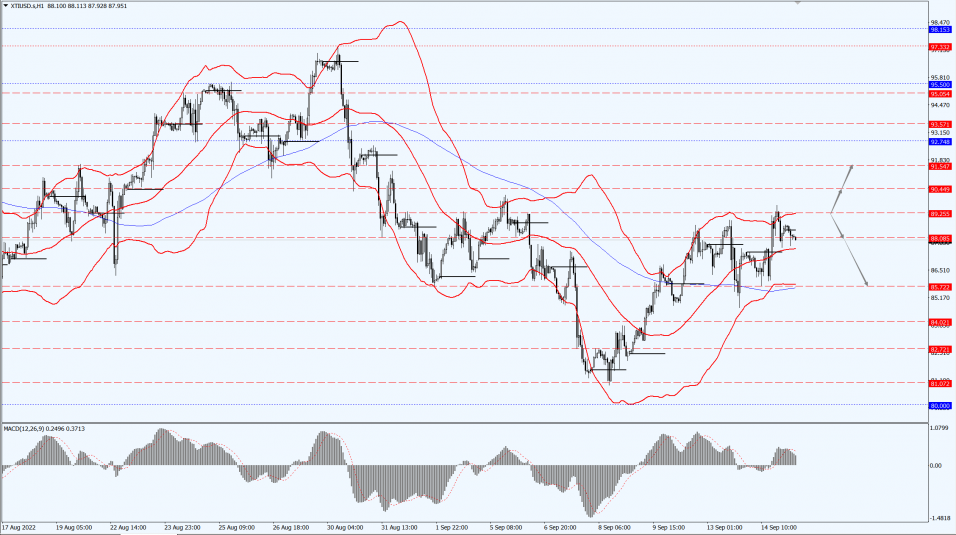

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 89.25-line today. If the oil price runs above the 89.25-line, then focus on the suppression strength of the two positions of 90.44 and 91.54. If the oil price runs below the 89.25-line, then pay attention to the support strength of the two positions of 88.08 and 85.72.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.