1. Forex Market Insight

EUR/USD

A report released by S&P Global on the 23rd showed that the preliminary Eurozone manufacturing purchasing managers’ index for August was 49.7, a 26-month low, affected by high inflation.

In addition, the preliminary Eurozone Services PMI came in at 50.2 in August, a 17-month low.

The report points to continued weakness in the eurozone’s manufacturing sector, which is overlapping with a contraction in the services sector, while high inflation and rising interest rates are putting increasing pressure on the demand side.

Moreover, the prospect of supply disruptions to the Nord Stream 1 pipeline has made investors nervous and anxious, deepening their concerns about the prospects for economic development in Europe.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.09999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9938 and 09864. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP held steady yesterday, 24th August 2022, staying above the two-and-a-half year low it hit a day ago and is currently quoted around 1.1800.

Earlier, S&P Global released its preliminary UK composite purchasing managers’ index (PMI) at 50.9 in August, down from 52.1 in July and the lowest since February 2021, close to the R&B watershed of 50.

These figures add to the signs that the UK economy is set for recession.

Recently, the pound has been battered by concerns around soaring UK inflation and economic downturn, and last week it suffered its biggest one-week fall against the dollar since September 2020.

Technical Analysis:

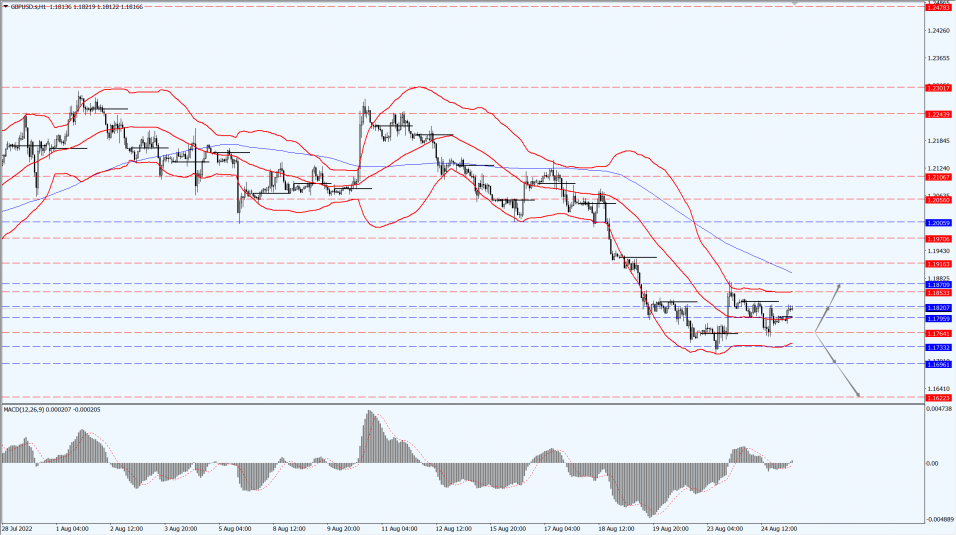

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1764-line today. If GBP runs below the 1.1764-line, it will pay attention to the suppression strength of the two positions of 1.1696 and 1.1622. If GBP runs above the 1.1764-line, then pay attention to the suppression strength of the two positions of 1.1820 and 1.1870.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices held steady on Wednesday, 24th August 2022, as the dollar gave back some of its earlier gains in the session and investors awaited clues on interest rate hikes from the Jackson Hole central bank presidents’ meeting.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1751-line today. If the gold price runs steadily below the 1751-line, then it will pay attention to the support strength of the 1743 and 1735 positions. If the gold price breaks above the 1751-line, then pay attention to the suppression strength of the two positions of the 1760 and 1768.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed higher on Wednesday, 24th August 2022, after a volatile session on concerns that the US would not consider additional concessions to Iran in its response to the draft agreement to revive the Iran nuclear deal.

If the nuclear deal is reinstated, Iran, a member of the Organization of Petroleum Exporting Countries (OPEC), will be able to resume crude oil exports.

Iran said it had received a response from the United States to the EU’s “final” version of the 2015 nuclear deal between Iran and the major powers.

Technical Analysis:

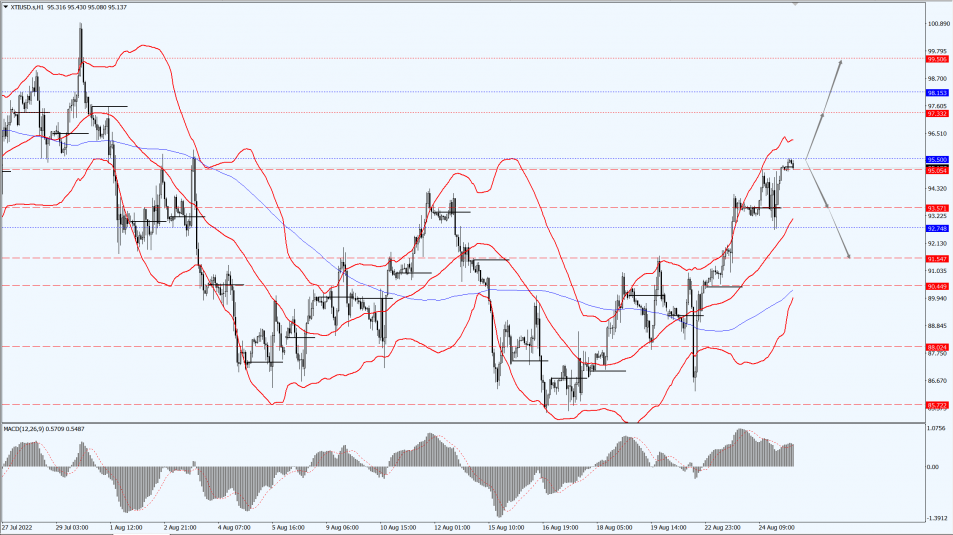

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 95.50-line today. If the oil price runs above the 95.50-line, then focus on the suppression strength of the two positions of 97.33 and 99.50. If the oil price runs below the 95.50-line, then pay attention to the support strength of the two positions of 93.57 and 91.54.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.