1. Forex Market Insight

EUR/USD

The dollar climbed for a second day straight, following the rally in U.S. bond yields. Yesterday, statements from Fed officials may confirm expectations that the tapering of the asset purchase program will begin before the end of the year.

The September jobs report is now a potential trigger for the Fed’s “tapering” action. Adding to this, the U.S. bond yields climbed to the highest since late June, as the market expects the Fed to tighten monetary policy.

Over and above, the Fed announced last week that it may start tapering stimulus as early as November and hinted that rate hikes may come sooner than expected. Against the background of the strong dollar, the euro will remain in a weak finishing pattern.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to whether the 1.1727-line can break through. If it can break through the 1.1727-line, it will open up a further upside potential. At that time, pay attention to the suppression of the 1.1753 and 1.1786 positions.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England kept its target rate unchanged at 0.1% and maintained its £895 billion GBP (USD1.22 trillion) asset purchase target unchanged. The Bank of England said it expects inflation to rise through the target will be temporary, and the bond purchase action plan continues until the end of the year. However, two policymakers called on the central bank to immediately halt its 895 billion GBP (USD1.23 trillion) bond-buying program.

The BoE said a surge in gas prices in recent weeks, has led to the collapse of several smaller British energy suppliers and forced the government to intervene. By this, it means that inflation is also likely to remain above 4% in the first half of 2022.

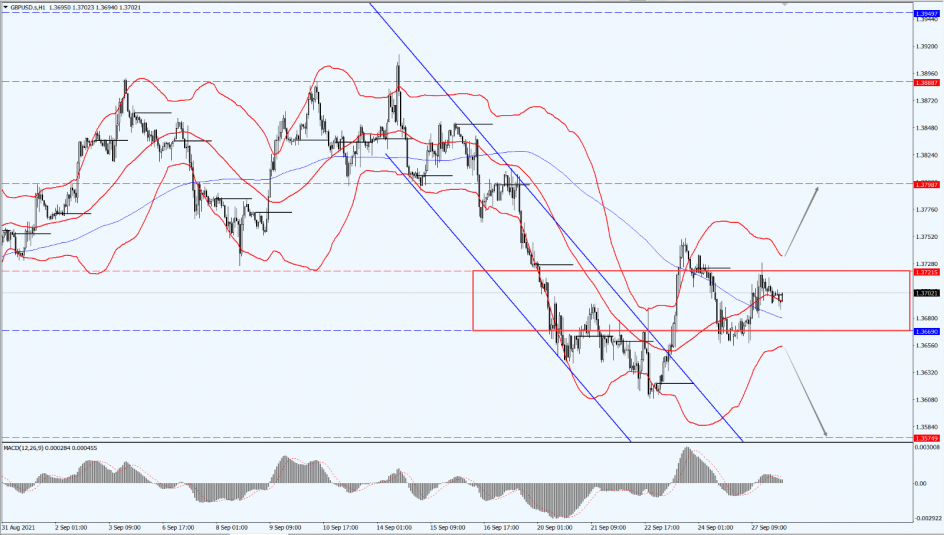

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The British pound is still focused on the direction of the Bollinger Band’s upper and lower rail breakthrough. If it breaks through the Bollinger Band upper rail, it will open up a further upside potential. At that time, focus on the suppression of the 1.3798-line. If it falls to the lower rail of the Bollinger Band, it will open further downside space. At that time, pay attention to the strength of the 1.3574 first-line support.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices stabilized in volatile trading yesterday, with spot gold closing near the 1,750-mark. The stronger dollar and rising U.S. bond yields limited gains as investors await speeches from the Federal Reserve policymakers for more clues on tapering strategies.

During this interval, the dollar rose by 0.15%, making gold more expensive for holders of other currencies, while the yield on the 10-year U.S. Treasury yield rose to its highest in three months.

Apropos to this, the market’s focus will now be on speeches by the Fed officials this week, including Chairman Jerome Powell, who will testify before Congress on the Fed’s policy response to the outbreak.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the breakthrough direction of the shock range from 1741 to 1760. If the price of gold breaks upwards through 1760, it will open up further upside potential. At that time, pay attention to the suppression of the positions of 1768 and 1782. If the price of gold falls below 1741, it will open a further downside potential. At that time, pay attention to the support of 1724 first-line support.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

The Brent oil futures rose by $1.44, or 1.8%, to close at $79.53 per barrel yesterday, following three consecutive weeks of gains. The U.S. oil rose by $1.47, or 2%, to close at $75.45 per barrel, its highest level since July, after five straight weeks of gains.

Oil prices approached the $80 mark as demand for fuel recovered rapidly following the Delta variant virus outbreak, while Hurricane Ida hit U.S. crude oil production hard. Additionally, the global energy crisis is expected to tighten supply in the crude oil market quickly.

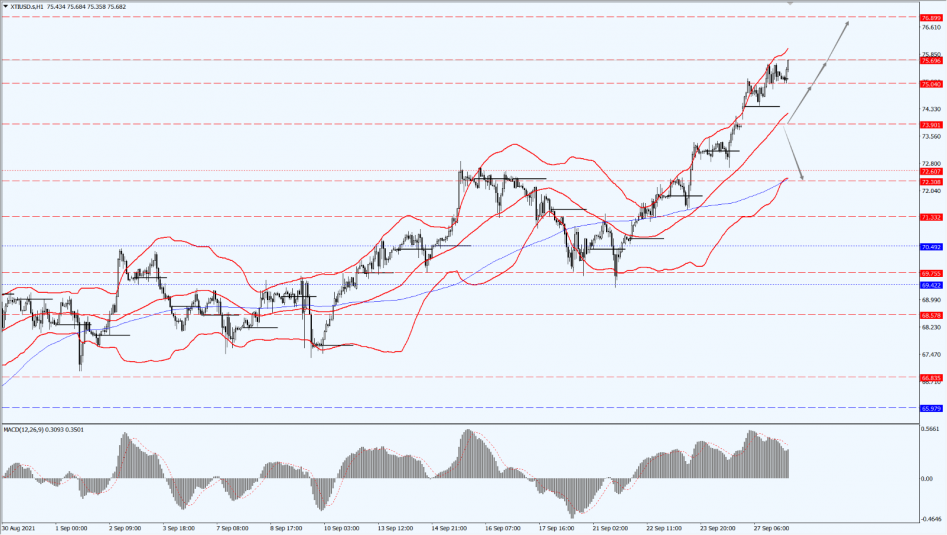

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, the oil prices are paying attention to the 73.90-line. As long as the upward trend is still maintained above the 73.90-line, the upward trend will focus on the suppression of the 76.89-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.