1. Forex Market Insight

EUR/USD

The ECB policymakers said that they will not automatically expand their asset purchase program after the end of the 1.85 trillion-euro pandemic emergency stimulus program. Similarly, concerns about the cliff effect will not automatically equate to a requirement to increase conventional programs.

Ultimately, the ECB’s “pandemic emergency asset purchase program” (PEPP) is expected to end in March next year, and investors are expecting the ECB to increase other stimulus measures at that time to make up for the shortfall.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the direction of the breakout from the 1.1554 to 1.1622 volatility range. If it breaks through the 1.1622-line, it will open up further upside potential. At that time, pay attention to the suppression of the 1.1663 and 1.1708 positions. If it falls below the 1.1554-line, it will open a further downward space. At that time, pay attention to 1.1501 first-line support.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound closed down by 0.92% against the dollar, falling for a fourth straight week and hitting a new low of 1.3411, since December 23, 2020, with fears that the U.K. faces a harsh economic winter adding to the decline.

At the same time, investors’ concerns about surging gas prices in the U.K. and gasoline shortages in recent weeks overshadowed the talk of a possible interest rate hike by the Bank of England.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is focused on the breakthrough direction of the 1.3522 and 1.3574 shock ranges. If it breaks above the 1.3574-line, it will open up a further upside potential. At that time, pay attention to the suppression of the 1.3669 and 1.3721 positions. If it falls below the 1.3522-line, it will open up a further downside space. At that time, pay attention to the 1.3409 first-line support.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

On Friday, 1st October 2021, gold prices closed slightly higher as a weaker dollar index overshadowed market bets on interest rate hikes. Meanwhile, high inflation data and concerns about economic growth risks increased gold’s appeal.

During this interval, the focus during the day will be on the final U.S. durable goods orders for August and factory orders data for August.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the direction of the breakthrough in the range of 1751 to 1768. If it breaks above 1768, it will open up further upside potential. At that time, pay attention to the suppression of 1782 and 1801. If it falls below the 1751-line, it will open up further downside space. With that, we will pay attention to the strength of support at 1740 and 1724.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Last Friday, oil prices rose slightly due to tight supply caused by OPEC+ alliance supply constraints. In addition, a slight rise in U.S. consumer confidence and the California oil spill also contributed to the rise in oil prices.

However, the OPEC+ will hold a meeting soon. With this, the market is worried that OPEC+ will increase production significantly, which limits the increase in oil prices.

Until then, look out for the 21st OPEC+ Ministerial Meeting for the day.

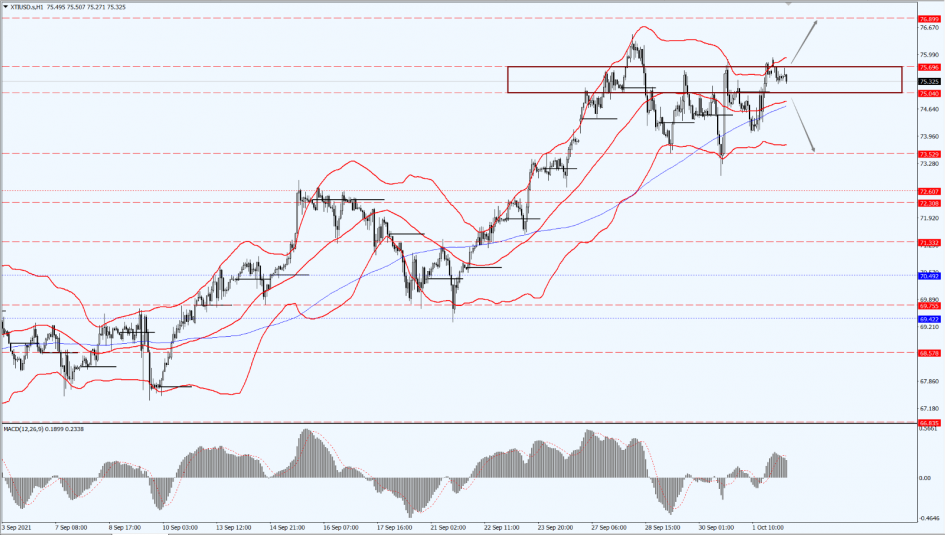

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are focused on the direction of the breakout at the 75.04 to 75.69 range. If it breaks through the 75.69-line, it will open up further upside potential. At that time, focus on the suppression of the 76.89-line. If it falls below the 75.04-line, it will open up a further downside space. At that time, focus on 73.52 first-line of support.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.