1. Forex Market Insight

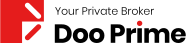

EUR/USD

The euro rose above $1.14 on Wednesday, 12th January 2022, for the first time since mid-November. Once it breaks through the $1.14-mark, momentum trading participants may turn to selling the dollar. The euro rose by 0.11% against the dollar late in the session to $1.1455, after hitting $1.1482 earlier in the session.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the support strength of the 1.1401-line. If the euro runs steadily above the 1.1401-line, we will pay attention to the suppression strength above the 1.1501-line.

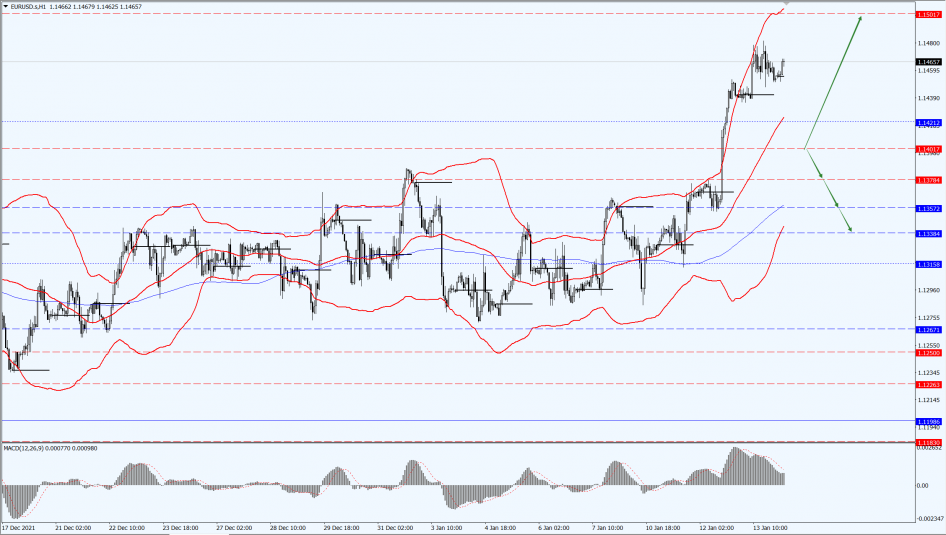

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound rose by 0.04% against the dollar to $1.3706, hitting 1.3749 during the session, its highest level since late October.

The pound has been strengthening recently as traders believe the British economy can withstand a surge in the Covid-19 cases and the Bank of England will raise interest rates again as early as next month.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the support strength of the 1.1401-line. If the euro runs steadily above the 1.1401-line, we will pay attention to the suppression strength above the 1.1501-line.

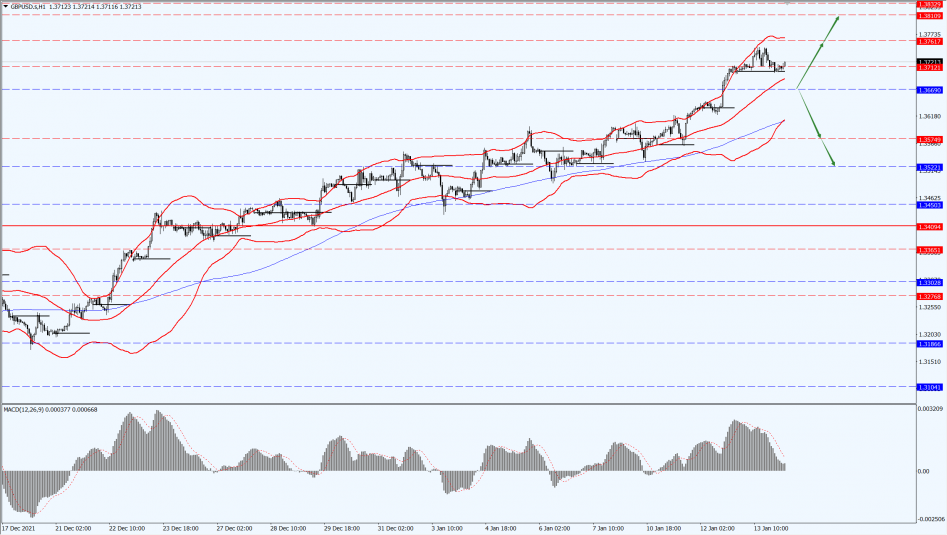

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell slightly yesterday, as investors took profits on gold after the latest economic data tempered inflation expectations.

Meanwhile, Federal Reserve officials generally supported a rate hike in March. However, the lower dollar and U.S. stocks supported a sharp rebound from the lows, and geopolitical concerns also boosted gold’s appeal.

The focus of the day is on the “horror data” retail sales, consumer confidence and Chinese trade account data.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is focused on the 1812-line today. If the price of gold runs steadily below the 1812-line, then it will pay attention to the support strength of the two positions of 1793 and 1804. If the gold price breaks above the 1812-line, it will open up a further upward space. At that time, pay attention to the suppression of 1831-line.

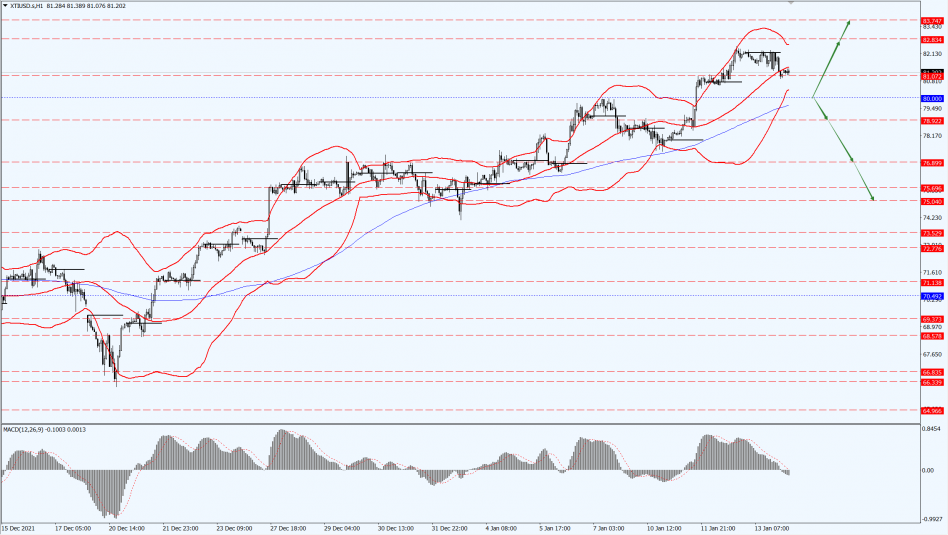

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices edged lower yesterday as investors worried about the big U.S. interest rate hike and took profits after two straight days of gains, but expectations that a strong economic recovery will boost demand at a time of tightening supply limited losses.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 80-line today. If the oil price runs below the 80-line, then focus on the support at 76.89 and 75.69. If the oil price breaks above the 80-line, then pay attention to the suppression of the 81.07-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home