1. Forex Market Insight

EUR/USD

This week, the Federal Reserve will announce its latest interest rate resolution. However, the economic expectations and dot plot will not be announced.

Nevertheless, Fed Chairman Jerome Powell will hold a press conference, as the market is widely expecting the Fed to announce the decision to taper its bond purchases at its November meeting. Bearing this, the euro will trigger dramatic fluctuations.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1622-line. If the euro runs steadily below the 1.1622-line, maintain the bearish trend. With this, pay attention to the support at 1.1535 and 1.1501 in turn. If the strength of the euro breaks through the 1.1622-line, then pay attention to the repressive strength at 1.1663 and 1.1708.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England rate hike is expected to heat up to support the pound. Many recent analyses have pointed out that the U.K. interest rate hike is inevitable and predict that the Monetary Policy Committee (MPC) will raise rates by 15 basis points in December this year, which is the best compromise outcome.

Barclays Bank stated in its recent forward-looking report that if the structural problems in the U.K. are to be solved, the Bank of England Monetary Policy Committee (MPC) will raise interest rates by 15 basis points in December, followed by 25 basis points each in February and May next year.

Bank of England Governor Andrew Bailey has also hinted more than this rate hike, recently he also released a clearer “turn hawk” signal. In addition, he said that the current U.K. inflation rate is higher than the central bank set 2% target, and must be managed to slow inflation.

Against the backdrop of an unexpected rise in inflation but weakening growth momentum, the hawkish members of the MPC made a more convincing case than the doves. The money market prices will remain close to 100 basis points between now and mid-2022, compared to just 15 basis points before the MPC meeting in August.

While supply chain disruptions and rising energy prices are a global phenomenon, the MPC highlighted the risk of continued inflationary pressures, the risk of excessive expectations, and the risk of wage disruptions.

Technical Analysis:

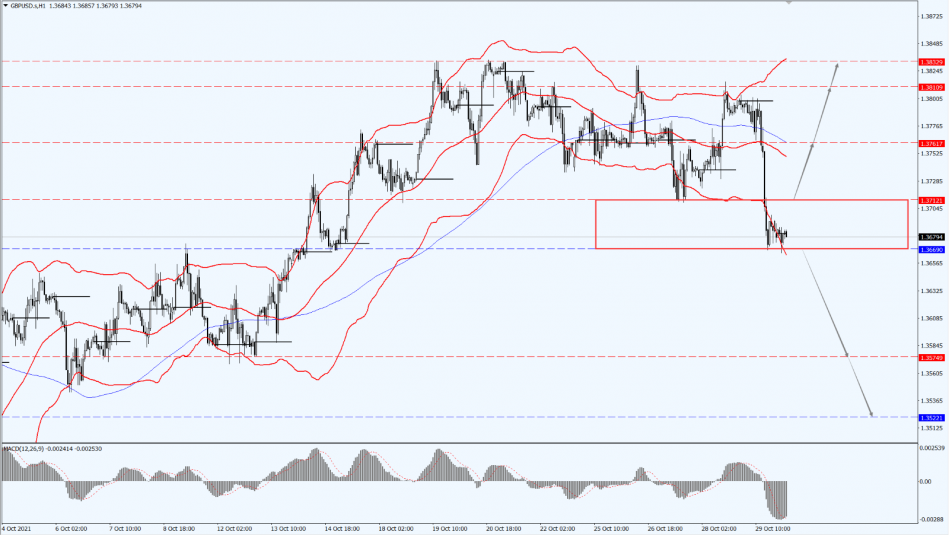

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the direction of the breakout of the 1.3669 to 1.3712 range. If it falls below the 1.3669-line, it will open up further downside. At that time, pay attention to the support at the 1.3574 and 1.3522 positions. If it breaks through the 1.3712-line, it will open up a further upside potential. At that time, pay attention to the suppression of 1.3761 and 1.3801 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices are currently trading near $1780, as the market’s expectation for the Fed’s resolution this week to taper debt and rising interest rates next year continue to increase, which put heavy pressure on gold prices.

However, due to the slow growth of the U.S. economy, the labor market is still facing serious problems. This led to the rise of stagflation concerns, which limited the decline in gold prices before the Fed’s resolution.

This week’s focus on the Fed’s November interest rate resolution. The Fed’s meeting will not announce economic expectations and dot plot, but Powell will be holding a press conference.

With this, global commodity trends are likely to be affected by the resolution, but investors must remain highly vigilant.

Technical Analysis:

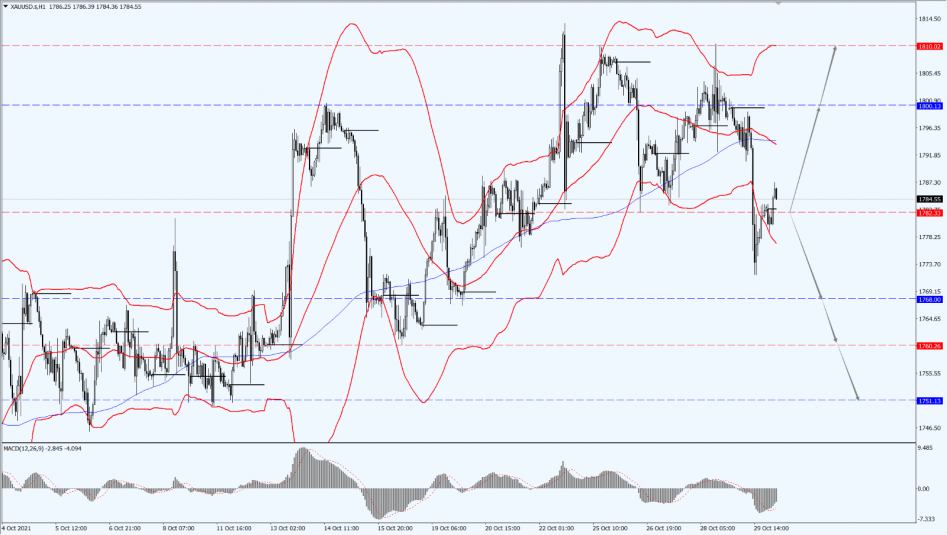

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the first line of 1782. If the price of gold runs steadily above the first line of 1782, then pay attention to the suppression on the first line of 1800. If the price of gold falls below the first line of 1782, it will open up a further downside space. At that time, pay attention to the support of the two positions at 1768 and 1760.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose by 11% in October on signs that consumption outpaced supply and led to a decline in inventories. The continued shortage of natural gas boosted demand for oil products, which also helped push oil prices higher in October. Adding to this, the OPEC+ meeting this week may shape the direction of oil prices.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are focused on the direction of the 80 to 82.83 range. If it breaks above the 82.83-line and upwards, it will open up a further upside potential. At that time, it will possibly test the suppression of the 85-line again. If it falls below the 80-line, it will open a further downward space. At that time, pay attention to the strength of support at 76.89 and 75.04.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home