1. Forex Market Insight

EUR/USD

Policymakers at the European Central Bank on Monday. 29th November 2021 tried to reassure investors frighten by the latest variant of the Covid-19 virus, arguing that the eurozone economy has learned to cope with waves of the outbreak.

According to the WHO, the risk of global transmission of the Omicron variant is “very high” and is threatening economic recovery and could jeopardize plans by the ECB and other global central banks to withdraw emergency support that has been in place for nearly two years.

Speaking to Italian broadcaster RAI on Sunday evening, Lagarde said, “People are obviously worried about the economic recovery in 2022, but I think we have learned a lot, we now know our enemy and we know what to do. We are all better equipped to deal with the risk of a fifth wave of the epidemic or a variant of Omicron.”

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1250-line. If the euro runs steadily above the 1.1250-line, we will see the continuity of the euro’s rebound strength. At that time, we will pay attention to the suppression of the top 1.1315 and 1.1357 positions. If the euro strength drops below the 1.1250-line, then we will pay attention to the support strength in two positions of 1.1223 and 1.1183.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound retraced earlier gains, falling by 0.16% against the dollar to 1.3315. During this interval, the market may take a few weeks to further understand omicron, so it may be difficult for the pound to quickly recover recent losses.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is still mainly focused on the 1.3409-line today. If the pound runs below the 1.3409-line, then pay attention to the 1.3302-line of support. If the pound rebounds above the 1.3409-line, then pay attention to the suppression at the 1.3450 and 1.3522 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell slightly yesterday. As the dollar and U.S. stocks strengthened and risk sentiment rebounded, the market is weighing how severe the impact of the Omicron variant of the virus would be on the economy.

However, the Omicron strain could lead to a longer duration of high inflation, which is expected to give support to gold prices. The focus during the day will be on the Consumer Confidence Index of the Conference Board, in addition to the Chicago PMI and speeches by Federal Reserve officials.

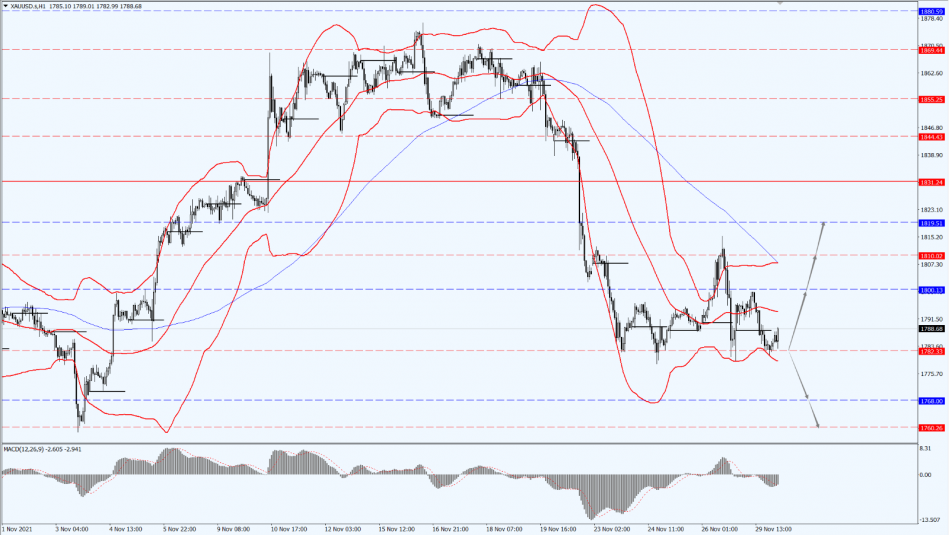

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold may continue to run the restorative market today. Therefore, we still pay attention to 1782 today. If the price of gold runs stably above 1782, then pay attention to the suppression of the two positions of 1800 and 1810. If the price of gold falls below 1782, it will open up a further downside space. At that time, we will pay attention to the support of the two positions of 1768 and 1760.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose by more than 2% on Monday, 29th November 2021, as the U.S. said it had no plans to reconsider releasing strategic oil reserves, and as there was no more data on the Omicron variant of the virus, investors felt that the market had overreacted to concerns on Friday, 26th November 2021.

In addition, investors are focused on the Iranian nuclear talks and the OPEC+ meeting. Intraday focus on the U.S. November Conference Board Consumer Confidence Index, U.S. November Chicago PMI, Fed Chairman Powell and U.S. Treasury Secretary Yellen attend the U.S. Senate Finance Committee meeting, Wednesday 2:00 Fed Vice Chairman Clarida speech, as well as Wednesday 5:30 release of API crude oil inventory data.

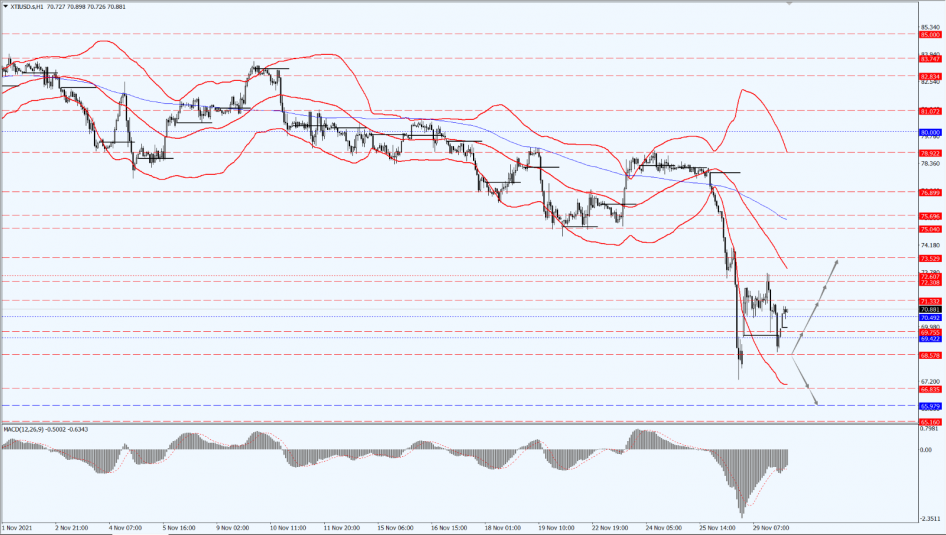

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 68.57-line. If the oil price runs above the 68.57-line, the pressure at 72.60 and 73.52 will be followed in turn. If the oil price drops below 68.57, it will open up further downward space. At that time, pay attention to the strength of support of 66.83 and 65.97 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.