1. Forex Market Insight

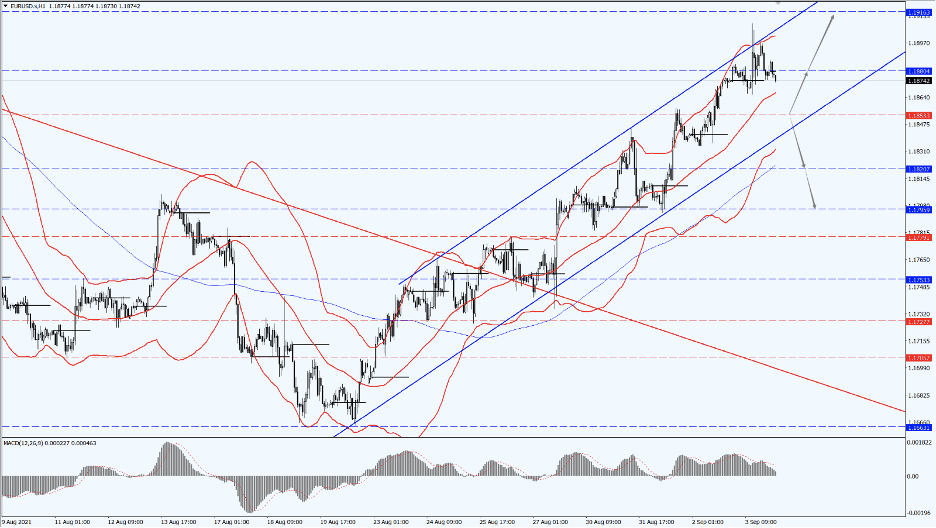

EUR/USD

Eurozone inflation is at a ten-year high. Meanwhile, hawkish statements made by ECB officials ahead of the policy meeting on September 9, 2021, as well as a much weaker-than-expected increase in Non-Farm Payrolls previously reported in the U.S., may have kept the Fed from rushing to scale back its massive stimulus measures, supporting the euro in the near term.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, the euro pays attention to the 1.1853-line. If the euro is inside the ascending channel, pay attention to the 1.1853-line of support. If the euro’s strength drops below the 1.1853-line it could possibly form a greater downside potential for the euro. At that time, pay attention to the support at 1.1820 and 1.1795.

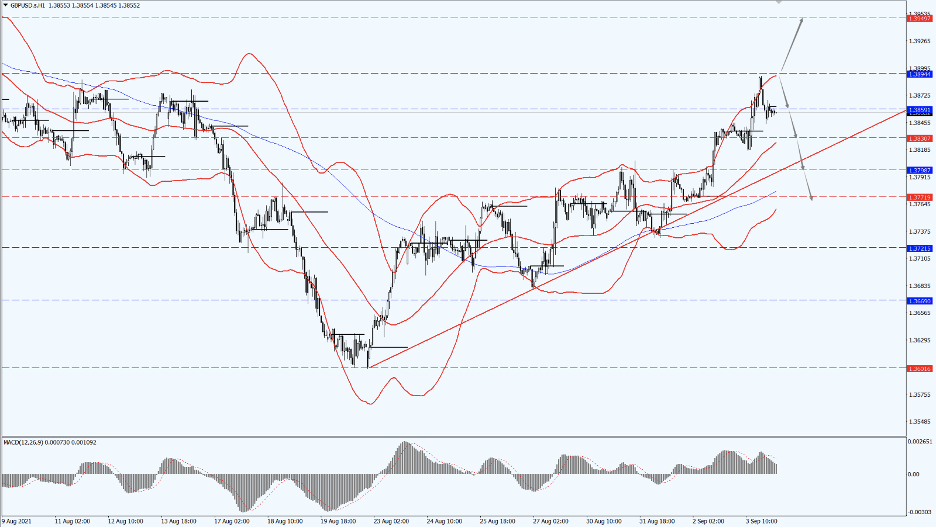

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound is facing an accumulation of unfavorable factors. In addition, supply chain problems and worker shortages are weighing on the progress of the post-pandemic recovery for manufacturers.Adding on to that is the fact that the last week of August saw the highest number of Covid-19 cases in the UK in more than a month.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

Today, the pound pays attention to the 1.3894-line. As long as it runs below the 1.3894-line, the pound is in an adjustment to the rising wave on the left. At that time, the lower support will be 1.3859, 1.3830 and 1.3798. If the strength of the pound breaks above the 1.3894-line, it could possibly open up a greater upside potential.

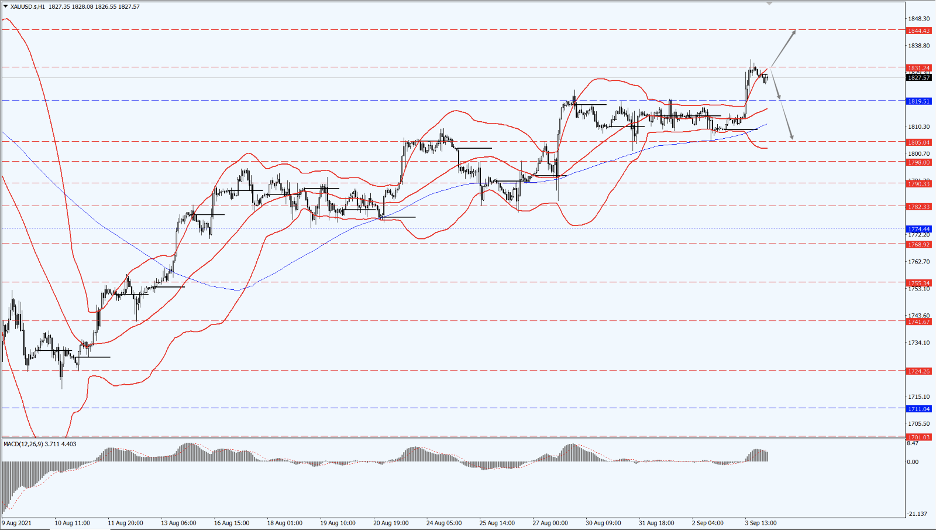

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

The market is now generally neutral on gold’s recent price trend. The latest U.S. jobs data has hit the Fed’s plans to reduce bond purchases, but tapering is not entirely out of the question. With U.S. stocks at record highs, gold still has a place in the portfolios of institutional investors.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold is paying attention to the 1831-line. If the price of gold pierces the 1831 or runs below the 1831-line, then pay attention to the support at 1819 and 1805. If the price of gold breaks above 1831, it will open up a greater upside potential. At that time, pay attention to the 1844-line.

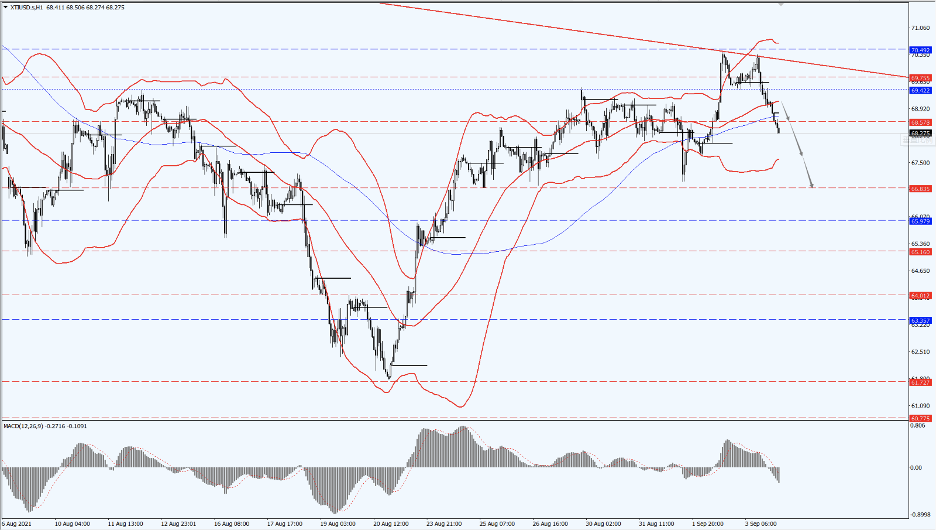

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

OPEC+ agreed to adhere to the existing schedule of gradual monthly production increases. Meanwhile, the delegates stated that the ministers are agreeable in continuing the 400,000 bpd monthly increase.

This was discussed via a video conference, which lasted less than an hour. The discussion was one of the shortest in recent memory – a stark contrast to the difficult negotiations in July. Given that crude prices have largely recovered the ground lost in mid-August, and the relatively tight supply outlook for the year, there is little reason for OPEC+ to change its schedule for gradual increase in monthly production.

Ultimately, about 45% of idle capacity has now been restored, and in July, OPEC+ planned to gradually restore the remaining capacity until September 2022.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices are focused on the suppression of the Bollinger Band Middle Rail. As long as oil prices run steadily below the Bollinger Band Middle Rail, they will still maintain a bearish trend, followed by 68.57, Bollinger Band Lower Rail and 66.83 first-line support. Once the oil price stands on the middle track of the Bollinger Band again, it will test the suppression of the 69.75 line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.