1. Forex Market Insight

EUR/USD

Today’s market was a fairly typical dull one ahead of the non-farm payrolls data release.

The euro will most likely remain stuck in a range like this until the jobs report comes out, but even then, any weakness in the dollar should subside given that a tapering of quantitative easing in November looks near certain.

As the shift from pandemic crisis policy gains momentum, the Fed has signaled that it may begin reducing monthly bond purchases as early as November, followed by a rate hike.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we pay attention to the 1.1554-line of support. If the euro breaks below the 1.1554-line, it will open up a further downside potential. At that time, pay attention to the 1.1501-line of support as it may open up a further upside potential.

GBP Intraday Trend Analysis

Fundamental Analysis:

As global risk sentiment improves slightly, the prospect of a rate hike by the Bank of England reduces some of the downside potential of the pound.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is focused on the suppression of 1.3669, and the support below 1.3522 and 1.3409.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell slightly yesterday as initial jobless claims fell more than expected last week, which boosted U.S. Treasury yields and raised bets that the Federal Reserve may soon start tapering economic support. At the same time, rising stocks dampened risk aversion, also formed a bearish trend for gold prices.

Intraday, focus on the U.S. September non-farm payrolls data, which may be negative for gold prices.

Technical Analysis:

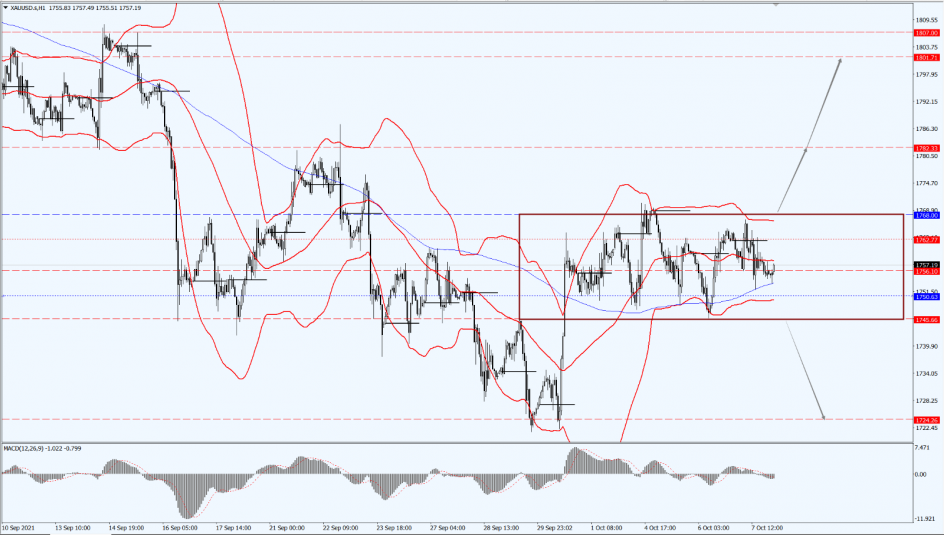

(Gold 1-hour chart)

Trading Strategies:

Today, gold is still paying attention to the direction of the breakthrough in the 1745 – 1768 range. If it breaks through 1768 upwards, it will open up a further upside potential. At that time, it will pay attention to the suppression of 1782 and 1801. If it falls below the 1745-line, it will open up a further downside space. With this, we will pay attention to the support of 1740 and 1724.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices stopped falling and rebounded, with WTI crude futures closing up 1.1% as the U.S. Energy Department said on Thursday, 7th October 2021, that there are no plans to release the Strategic Petroleum Reserve to curb rising gasoline prices.

Crude oil prices fell by 2.7% at one point after the U.S. Energy Secretary raised the possibility of releasing the Strategic Petroleum Reserve, according to a report in the Financial Times on Wednesday, 6th October 2021.

A U.S. Energy Department spokesman said, no ban on crude oil exports was being sought. With this, the market focus now returns to the global shortage of natural gas supplies, which is bound to raise demand for crude oil for power generation this winter.

Meanwhile, the Biden administration has been increasingly vocal about its concerns towards high energy prices. The West Texas Intermediate futures for November delivery rose by 87 cents to settle at $78.30 a barrel, while Brent futures for December delivery rose by 87 cents to settle at $81.95 a barrel.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are focused on the suppression of the 80-line. Once the price rises and falls, the bottom line will focus on the support at 78.30 and 76.89.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home