1. Forex Market Insight

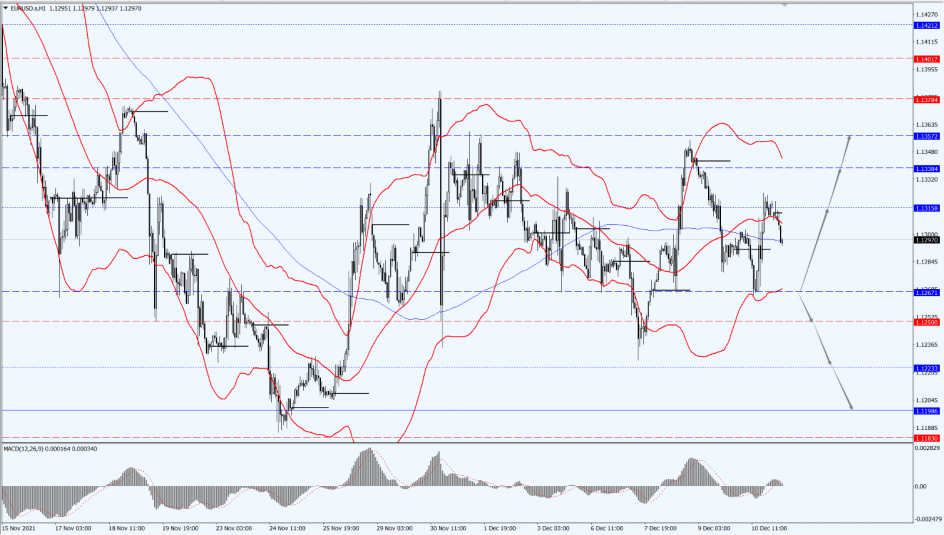

EUR/USD

The euro failed to recover 1.13 against the dollar and is expected to remain weak ahead of the European Central Bank (ECB) meeting.

It is expected that the ECB meeting next week will announce the plan for the pandemic emergency purchase programme (PEPP) when it expires in March next year. However, the ECB is already preparing for an expansion of its asset purchase program.

Overall, the ECB will maintain a highly accommodative stance that will put pressure on the euro in the coming quarters as the Fed begins its rate hike cycle. Looking at today’s U.S. CPI release, as well as next week’s Fed and ECB meetings, a lot of upward pressure will be put on the euro.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1267-line of support. If the euro runs stably above the 1.1267-line, focus on the strength of the euro’s rebound. At that time, pay attention to the suppression at the top 1.1315 and 1.1357 positions. If the euro’s strength drops below the 1.1267-line, then pay attention to the support strength in two positions of 1.1250 and 1.1198.

GBP Intraday Trend Analysis

Fundamental Analysis:

If the Bank of England keeps interest rates unchanged at its next meeting, the pound could easily experience fresh selling pressure due to the increased market uncertainty and volatility from the Omicron variant. In light of the UK’s announcement this week to strengthen restrictions on the Covid-19 pandemic, the Bank expects the BoE to keep interest rates unchanged at 0.10%.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focusing on the 1.3302-line. If the pound runs below the 1.3302-line, pay attention to the support at the 1.3186 and 1.3104 positions. If the pound strength rises above the 1.3302-line, then pay attention to the 1.3409-line of suppression.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose slightly on Friday, 10th December 2021 as U.S. inflation soared to its highest in nearly 40 years. However, the U.S. consumer confidence index rebounded from a 10-year low in December while the U.S. stocks rose sharply on the same day, which limited the rise of gold prices.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1793-line today. If the price of gold runs below the 1793-line, then pay attention to the support of the 1778 and 1768 positions. If the gold price rebounds above the 1793-line again, it will open up further room for rebound. At that time, pay attention to the suppressive strength in two positions of 1804 and 1812.

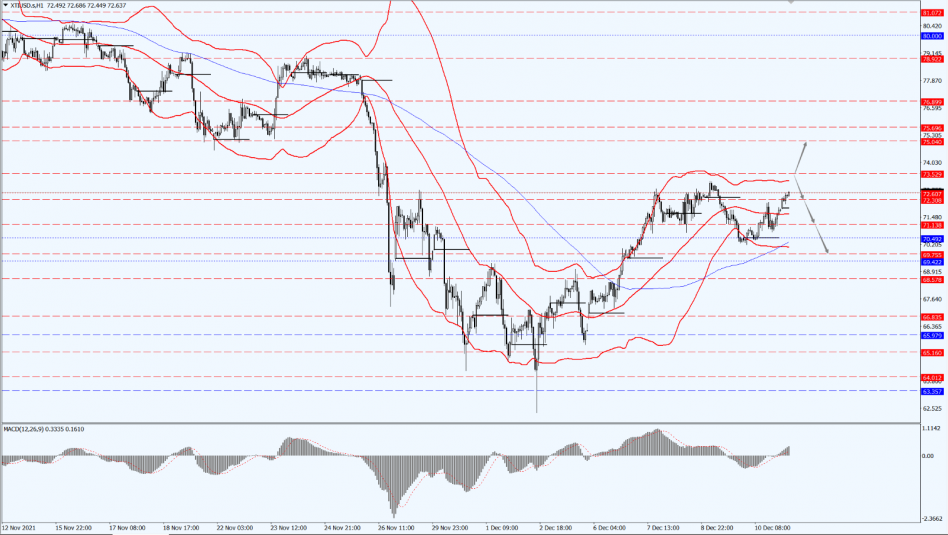

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose last week, posting their biggest weekly gain since late August. Fuel consumption has not suffered any major shocks from the Covid-19 variant strain. Market sentiment has been boosted and concerns about the impact of the Omicron variant on global economic growth and fuel demand have also eased. Intraday focus on the OPEC’s monthly crude oil market report.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are still paying attention to the 73.52-line. If oil prices run below the 73.52-line, maintain the bearish trend. Then, pay attention to the support at 71.13 and 69.75 in turn. If the oil price breaks above 73.52, it will open up a further upside. At that time, focus on the suppression of 75.04.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.