1. Forex Market Insight

EUR/USD

The euro against the U.S. dollar last week maintained a fluctuating downward trend, mainly due to the strong dollar. The European Central Bank’s decision last week was in line with expectations. However, the severe pandemic situation in Europe put pressure on the euro.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the suppression of the 1.1338-line. If the euro runs stably below the 1.1338-line, then pay attention to the support at 1.1226 and 1.1198 below. If the euro breaks through the 1.1338-line, then pay attention to the suppression at 1.1359 and 1.1378.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound continued to fluctuate against the U.S. dollar last week. The Bank of England unexpectedly raised interest rates to support the pound, but the strong U.S. dollar and severe pandemic situation restricted the pound from rising.

Technical Analysis:

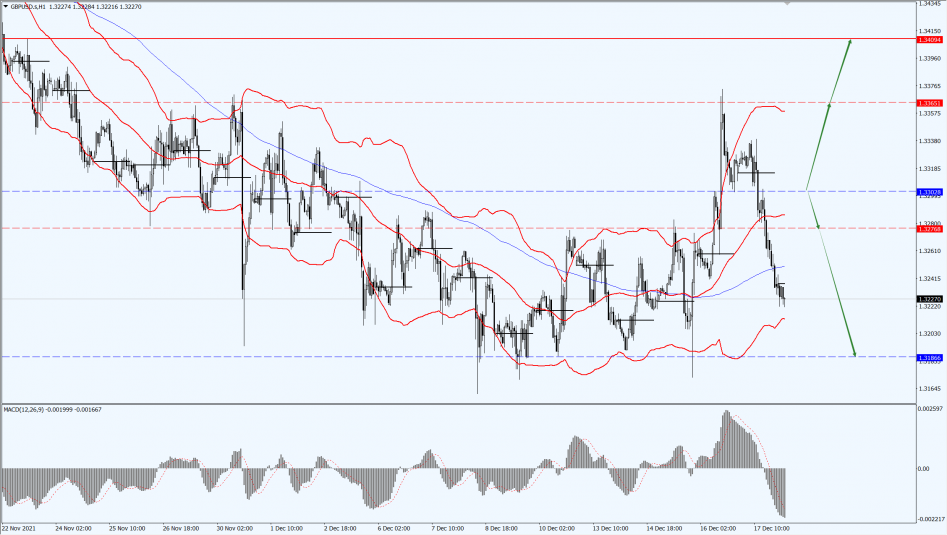

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3302-line. If the pound runs below the 1.3302-line, pay attention to the support of the 1.3186 line. If the pound strength rises above the 1.3302-line, then pay attention to the suppression of the 1.3365 and 1.3409 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Last Friday, 17th December 2021, gold prices rose and fell to close lower. On the other hand, the Omicron virus provided support for gold prices. However, the dollar strength and the Federal Reserve official’s hawkish speech made gold prices give up their gains.

This week, we will focus on the U.S. November PCE price index and the U.S. third quarter real GDP final value. As Friday is Christmas Eve, the New York Stock Exchange will be closed for the day, and the CME Group’s precious metals and foreign exchange transactions will also be suspended.

Technical Analysis:

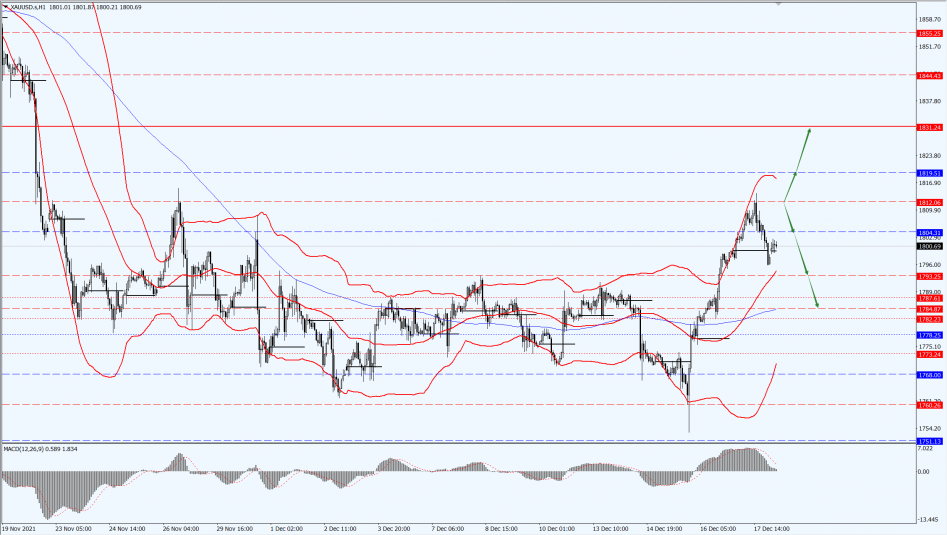

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the first line of 1812. If the price of gold runs below the first line of 1812, then pay attention to the support at the positions of 1793 and 1784. If the price of gold breaks through the line of 1812 once again, it will open up a further upside space. At that time, pay attention to the suppressive strength of each position at 1819 and 1831.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil extended its decline, once hitting a new low of $68.75/barrel since 7th December 2021. with a surge in cases of mutated strains in various countries, the CDC issued an unpromising alert on the U.S. outbreak, and market concerns about the impact of the Omicron strain on demand and increased supply weighing on prices.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices pay attention to the 71.13-line. If oil prices run below the 71.13-line, then pay attention to the support of the 68.57 and 66.33 positions in turn. If the oil price breaks through the 71.13-line, it will open up further upward space. At that time, pay attention to the suppression of the 72.77-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.