1. Forex Market Insight

EUR/USD

The euro fell by 0.6% against the dollar to 1.1263, the lowest level in a month. The euro pared losses against the dollar due to speculative and options demand and a weaker Swiss franc. With this, the euro advanced against the Swiss franc for a second day.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the suppression strength of the 1.1267-line. If the euro runs steadily below the 1.1267-line, we will pay attention to the support strength of 1.1198 and 1.1183 below. If the euro strength breaks above the 1.1267-line, we will pay attention to the suppression strength of the two positions of 1.1315 and 1.1357.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rallied against the dollar, rising by 0.10% to 1.3501 as the euro weakened against the pound and U.S. stocks rebounded.

Prime Minister Boris Johnson’s fate remains up in the air as authorities investigate allegations that he and his men hosted a party in violation of epidemic prevention regulations.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3522-line today. If the pound runs above the 1.3522-line, it will pay attention to the suppression of the 1.3574 and 1.3661 positions. If the pound runs below the 1.3522-line, it will pay attention to the support strength of the 1.3409 and 1.3365 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices plunged to a one-week low yesterday as the dollar and U.S. bond yields rebounded sharply, after Fed Chairman Jerome Powell hinted that the Fed would raise interest rates in March and also shrink its balance sheet after the first rate hike begins.

However, the Ukraine crisis is still expected to limit the decline in gold prices. The focus during the day will be on U.S. GDP data for the fourth quarter, in addition to initial claims, durable goods orders and the core PCE price index for the fourth quarter are worth paying attention to.

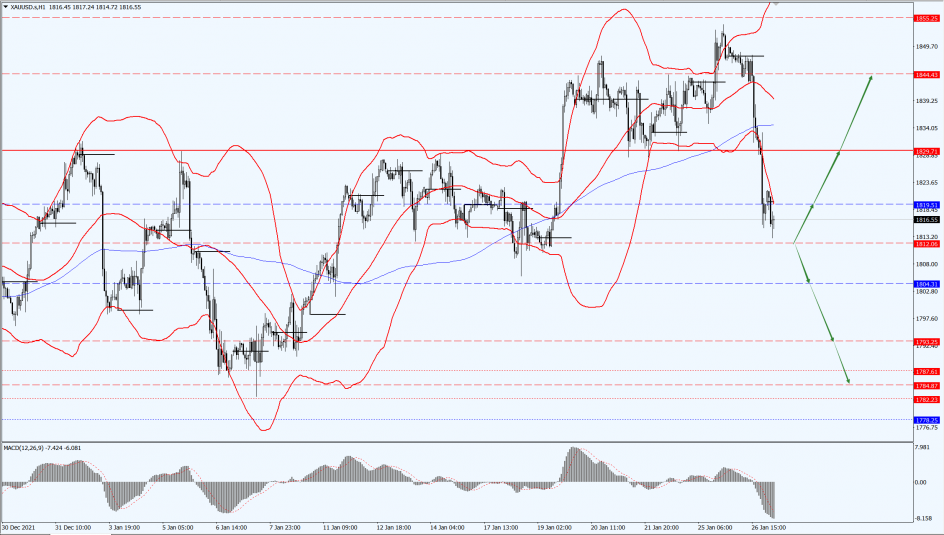

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1812-line today. If the gold price runs steadily above the 1812-line, then it will pay attention to the suppression strength of the 1819 and 1829 positions. If the gold price falls below the 1812-line, it will open up further callback space. At that time, pay attention to the strength of 1804 and 1793.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Brent crude oil prices topped $90 for the first time in seven years yesterday before easing back as markets worried about tensions between Russia and Ukraine.

The potential conflict poses significant risks to financial markets, especially for energy commodities such as natural gas and oil.

The markets are concerned about how the sanctions will affect the entry of Russian oil into the market, where reduced supplies of Russian oil will temporarily push up oil prices amid an undersupplied global oil market;

In addition, the weekly report from the U.S. Energy Information Administration (EIA) showed that Cushing crude oil inventories fell for the third consecutive week to 31.7 million barrels, close to the 30 million barrel level, a level considered by the market as a low inventory alert.

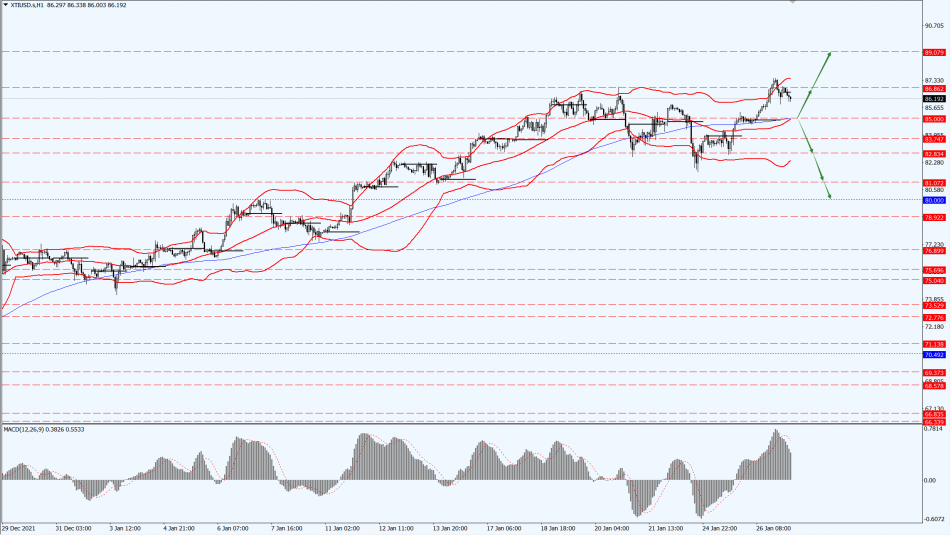

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 85-line today. If the oil price runs below the 85-line, then focus on the support strength of 82.83 and 80 positions. If the oil price runs above the 85-line, then pay attention to the suppression of 87 and 89.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.