1. Forex Market Insight

EUR/USD

Given the uncertainty about the Fed’s rate hike outlook, the U.S. consumer price index (CPI) and producer price index (PPI) releases later this week could have an impact on the dollar.

In addition, the medium-term outlook for the dollar depends on the Fed’s “reaction mechanism” to inflation developments. The impact of inflation data on the dollar will be “normal” until the Fed makes a “clear” response to inflation.

The PPI and CPI will be released on Tuesday and Wednesday, respectively. Against this background, the Fed’s wandering could cause the euro to fall into a turbulent consolidation pattern.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1535-line. If the euro runs steadily above the 1.1535-line, then pay attention to the suppression of the two positions 1.1583 and 1.1622 in turn. If the strength of the euro drops below the 1.11535-line, it will open up a further downside space. At that time, pay attention to the support of the 1.1501-line.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rose by 0.4% against the dollar on the day, recovering some of its losses after sinking 0.8% last week. The dollar index fell yesterday, after hitting a 15-month high on Friday following the release of strong U.S. jobs data

Investors digested the report, looked ahead to inflation data, and watched comments from Fed officials for clues on interest rate policy. As a result, this led to a slight rebound in the pound yesterday.

Technical Analysis:

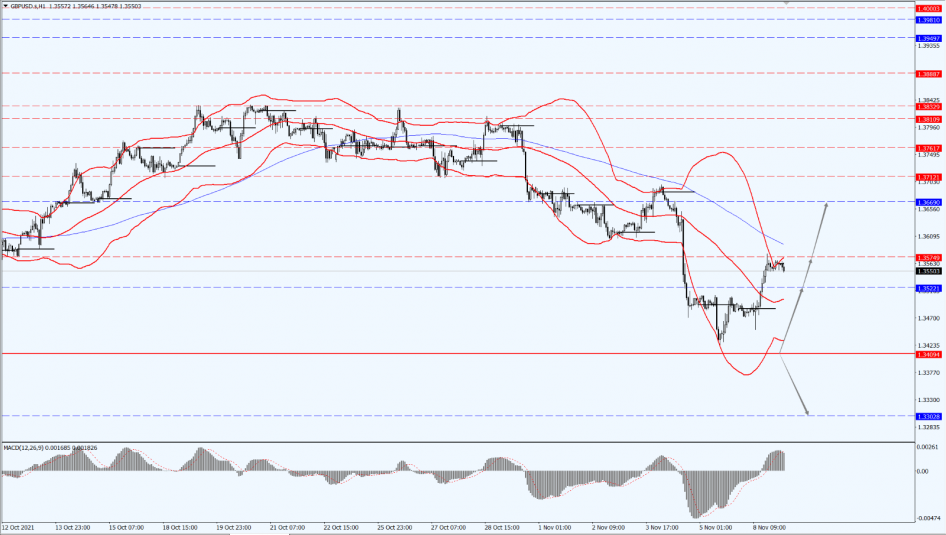

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3409-line. If the pound runs above the 1.3409-line, then pay attention to the suppression of the upper 1.3522 and 1.3574 positions in turn. If the pound strength falls below the 1.3409-line, then pay attention to the support of the 1.3302-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose for the third straight time yesterday to a two-month high, supported mainly by a retreating dollar and high inflation expectations, but strong U.S. stocks limited gains. The debate among Fed officials over interest rate policy also had some impact on gold prices. Intraday focus on the U.S. October PPI data and Fed officials’ speeches.

Technical Analysis:

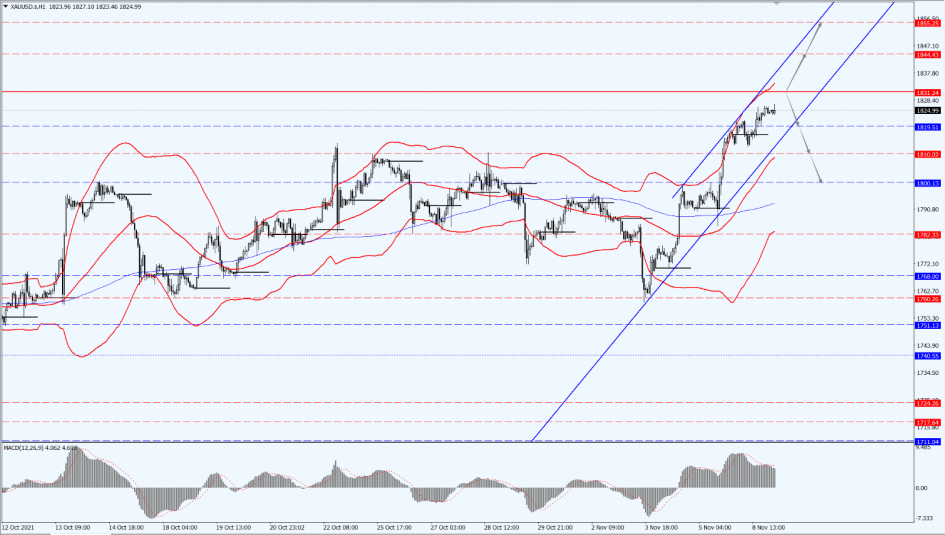

(Gold 1-hour chart)

Trading Strategies:

Gold is paying attention to the 1831-line today. If the price of gold runs stably below the 1831-line, then pay attention to the support at 1810 and 1800. If the price of gold breaks through the 1831-line, it will open up a further upside space. At that time, pay attention to the suppressive strength of each position at 1844 and 1855.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose by nearly 1% yesterday, with positive signs of global economic growth supporting energy demand.

Meanwhile, Saudi Arabia’s state-owned oil producer Saudi Aramco raised its official selling price of crude oil, boosting oil prices. With this, the intraday oil prices focused on the EIA energy report, which may determine whether the Biden administration released crude oil reserves to suppress oil prices.

On the other hand, anticipate on Fed Chairman Powell’s speech, and Fed’s Bullard speech. On Wednesday, 10th November 2021, at 1:00 EIA will release its monthly short-term energy outlook report, and the API crude oil inventory changes will be announced at 5:30.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 78.92-line. If the oil price runs stably above the 78.92-line, then pay attention to the suppression of the 82.83 line. If the oil price falls below the 78.92-line, a further downside space will be opened. At that time, pay attention to the support at the 76.89 and 75.69 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.