1. Forex Market Insight

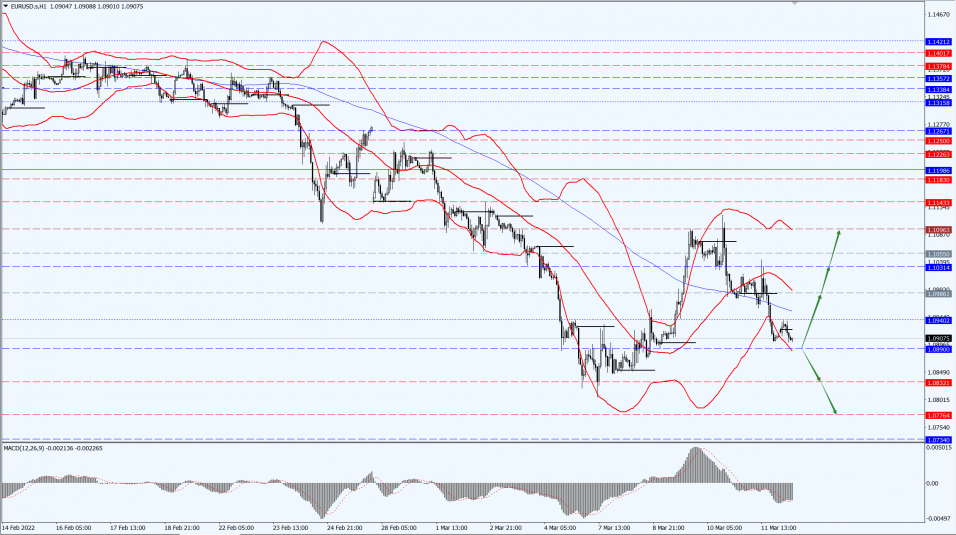

EUR/USD

EUR/USD slipped 0.63% to 1.0913, paring gains in overnight trading, and edged lower this week for a sixth straight weekly loss. Meanwhile, the euro has fallen more than 2.5% against the dollar so far in March.

The euro hit a near two-year low on Monday amid heightened stagflation fears over the Ukraine war. However, it has found some support after the European Central Bank announced it would gradually withdraw stimulus, paving the way for a rate hike by the end of 2022.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we focus on the 1.0890-line. If the euro runs steadily above the 1.0890-line, then pay attention to the suppression strength of the two positions of 1.0986 and 1.1031. If the strength of the euro breaks below the 1.0890-line, then pay attention to the support strength of the two positions of 1.0832 and 1.0776.

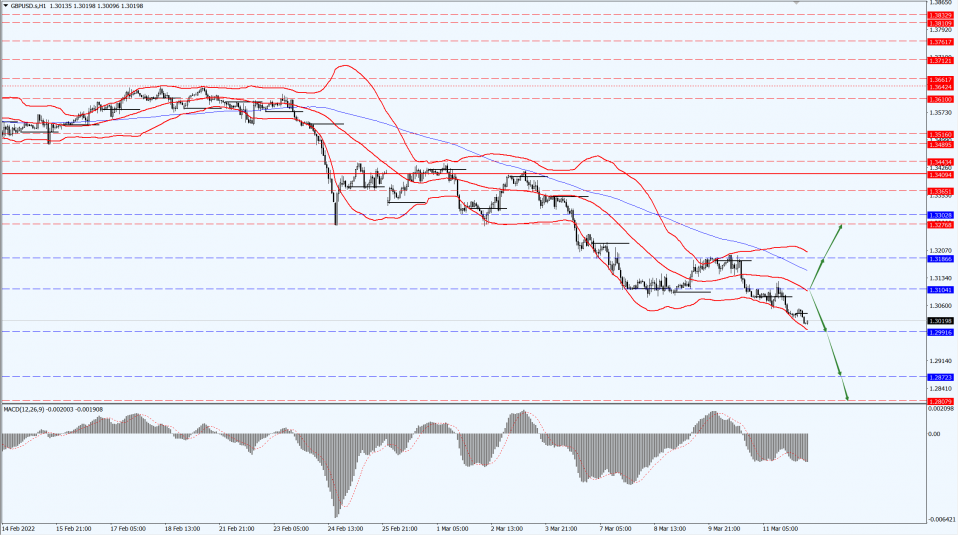

GBP Intraday Trend Analysis

Fundamental Analysis:

Rising U.S. interest rates and rising commodity prices have weighed on the U.K. trade balance, with markets showing little incentive to buy sterling at this stage.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3104-line today. If the pound runs below the 1.3104-line, it will pay attention to the support strength of the two positions of 1.2991 and 1.2872. If the pound runs above the 1.3104-line, it will pay attention to the suppression strength of the two positions of 1.3186 and 1.3276.

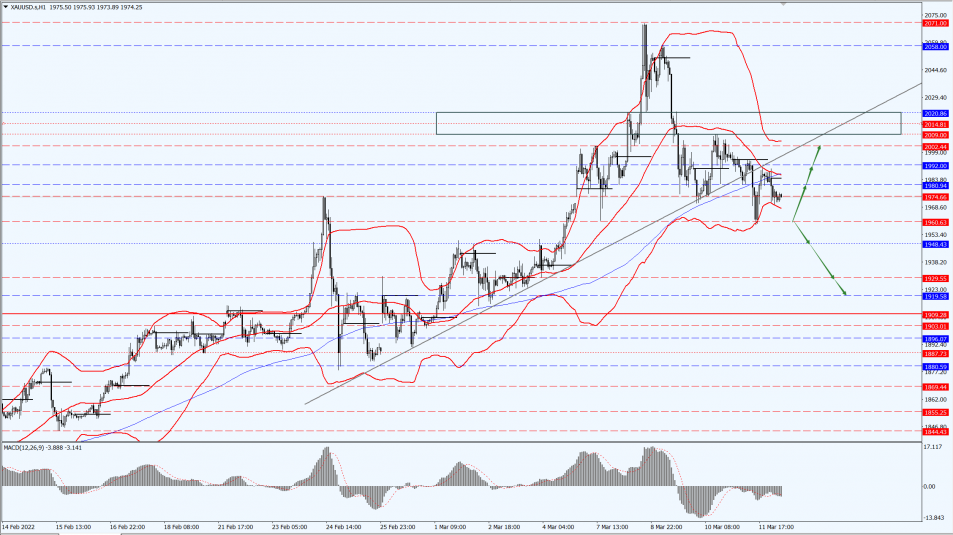

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

On Friday, 11th March 2022, the price of gold fell sharply, and Russian President Vladimir Putin hinted at progress in Russia-Ukraine negotiations, reducing a new round of gold as a safe-haven investment target.

However, before the close, the decline stopped and rebounded, which limited the decline of gold prices. This was affected by the U.S. announcement of the cancellation of Moscow’s special trade status.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is focused on the 1960-line today. If the gold price runs steadily above the 1960-line, then it will pay attention to the suppression of the 1980 and 1992 positions. If the gold price breaks below the 1960-line, it will open up further downside. At that time, we will pay attention to the support strength of the two positions of 1948 and 1929.

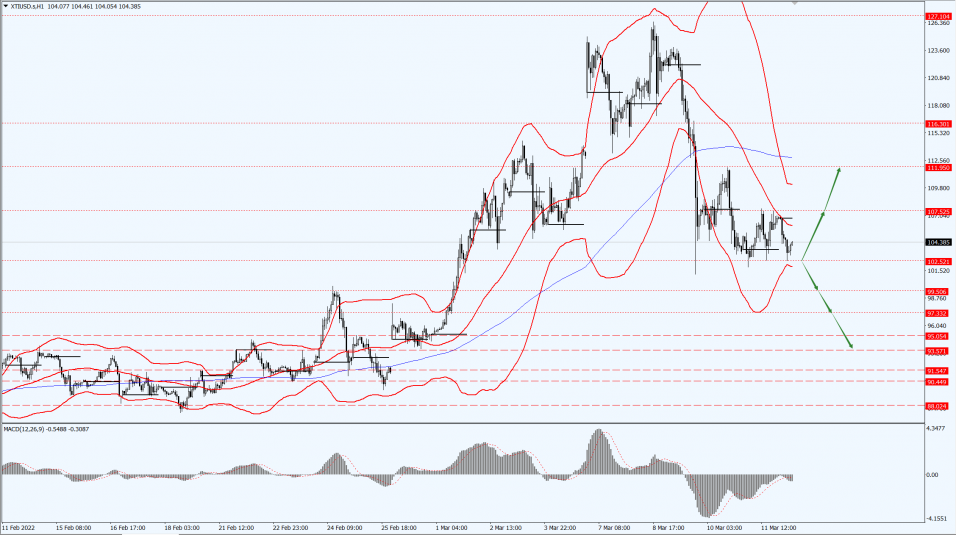

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil rose nearly 3% last week as the market weighed ongoing concerns about global energy supplies and the impact of increased U.S. sanctions on Russia.

WTI April crude oil futures closed up $3.31, or 3.12%, which is $109.33 per barrel. Brent May crude oil futures closed up $3.34, or 3.05%, which is $112.67 per barrel.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 102.52-line today. If the oil price runs below the 102.52-line, then focus on the support at 99.50 and 97.33. If the oil price runs above the 102.52-line, then focus on the suppression at 107.52 and 111.95.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.