1. Forex Market Insight

EUR/USD

European Central Bank President Christine Lagarde said on Monday, 15th November 2021, that the current tightening of monetary policy to curb inflation could stifle the euro zone’s recovery, countering calls for tightening policies and market bets.

The euro’s decline reflects the disappointing performance of the eurozone economy relative to the U.S., which has experienced a greater degree of unexpected upside than the eurozone.

According to him, there has been another surge in the Covid-19 cases in Europe, which has led some countries to consider imposing another lockdown, while the situation in the U.S. seems to have stabilized for now. As a result, markets are increasingly nervous about the euro.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1401-line. If the euro runs stably below the 1.1401-line, maintain the bearish trend. Below, pay attention to the support at 1.1278 and 1.1250, if the strength of the euro breaks through the 1.1401-line, it will open up a further upside. At that time, pay attention to the suppression of the two positions 1.1501 and 1.1535.

GBP Intraday Trend Analysis

Fundamental Analysis:

Among the G-10 currencies, only the pound rose against the dollar; gaining 0.1% to 1.3430.

Positive U.K. employment data boosted the case for a rate hike at the Bank of England’s December meeting. The data, as well as the BoE Governor’s intervention yesterday, should help the pound ahead of the December meeting if global market sentiment does not deteriorate significantly and political negotiations between the EU and the UK do not deliver a major shock to markets.

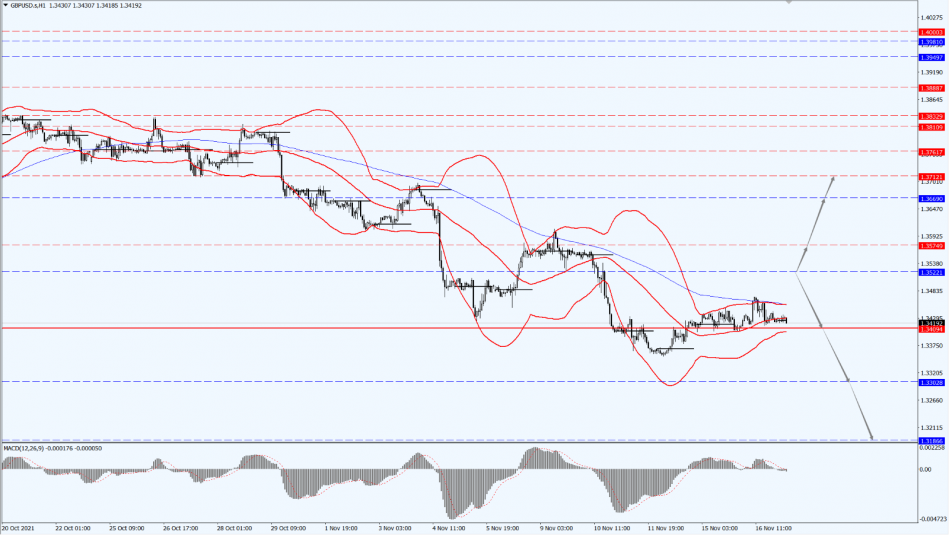

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3522-line today. If the pound runs below the 1.3522-line, then pay attention to the support at the 1.3302 and 1.3186 positions in turn. If the pound breaks through the 1.3522-line, then pay attention to the suppression at the 1.3574 and 1.3669 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Yesterday, gold prices surged higher and retreated due to a better-than-expected U.S. retail sales data. Plus, the rising dollar and U.S. stocks pressured gold prices. However, high inflation continued to support gold prices at higher levels. The main focus during the day will be on the U.S. real estate data and U.K. inflation.

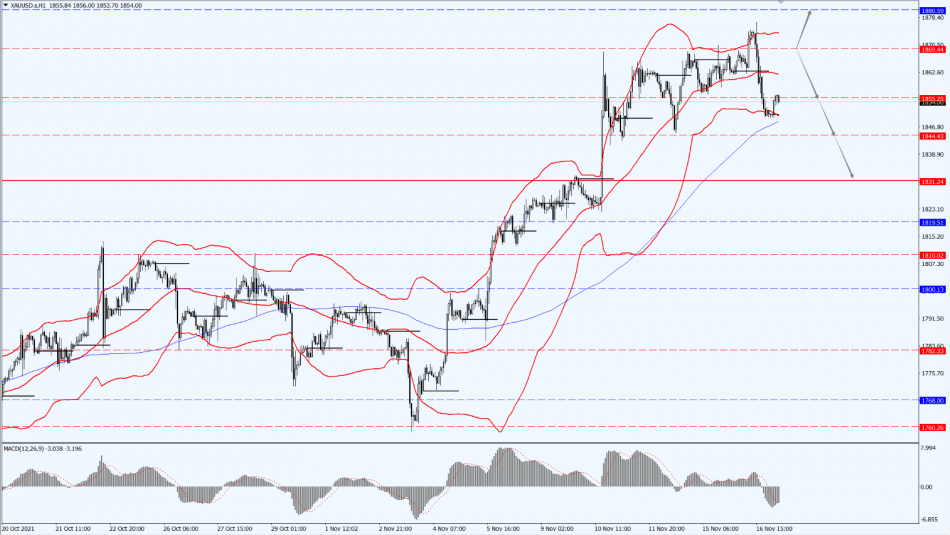

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is still paying attention to the 1869-line today. If the price of gold runs stably below the 1869-line, it will still maintain the bearish trend. At that time, it will pay attention to the support of the 1844 and 1831 positions. If the gold price breaks through the 1869-line, it will open up a further upside space. At that time, pay attention to the suppression of the 1880-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, data from the American Petroleum Institute (API) showed that the U.S. crude oil and distillate inventories increased while gasoline stocks fell last week.

The data showed that crude oil inventories increased by 655,000 barrels for the week ended Nov. 12. Gasoline stocks decreased by 2.8 million barrels while distillate stocks increased by 107,000 barrels.

Oil prices closed lower on Tuesday, 16th November 2021, as the U.S. crude inventories increased last week, having swung between gains and losses during the session, driven by factors such as the possible release of the U.S. strategic oil reserves and concerns about fuel demand shifts.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 78.41-line. If oil prices run above the 78.41-line, they will focus on the suppression of the 81.07 and 82.83 positions in turn. If the oil price drops below 78.41, it will open up a further downward space. At that time pay attention to the 76.89-line of support.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home