1. Forex Market Insight

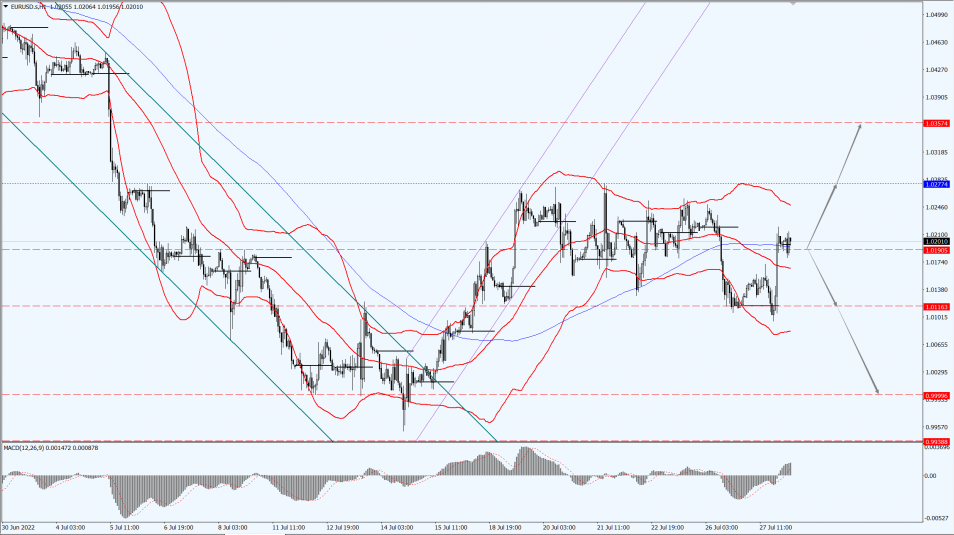

EUR/USD

Last night, the euro recovered almost all of its losses from the previous session, which was the euro’s biggest one-day percentage drop in two weeks.

However, fears of a recession in Europe remain high as Russia further reduces gas supplies to Europe via the Nord Stream 1 pipeline.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0190-line today. If EUR runs steadily below the 1.0190-line, then pay attention to the support strength of the two positions of 1.0116 and 0.9999. If the strength of EUR breaks above the 1.0190-line, then pay attention to the suppression strength of the two positions of 1.0277 and 1.0357.

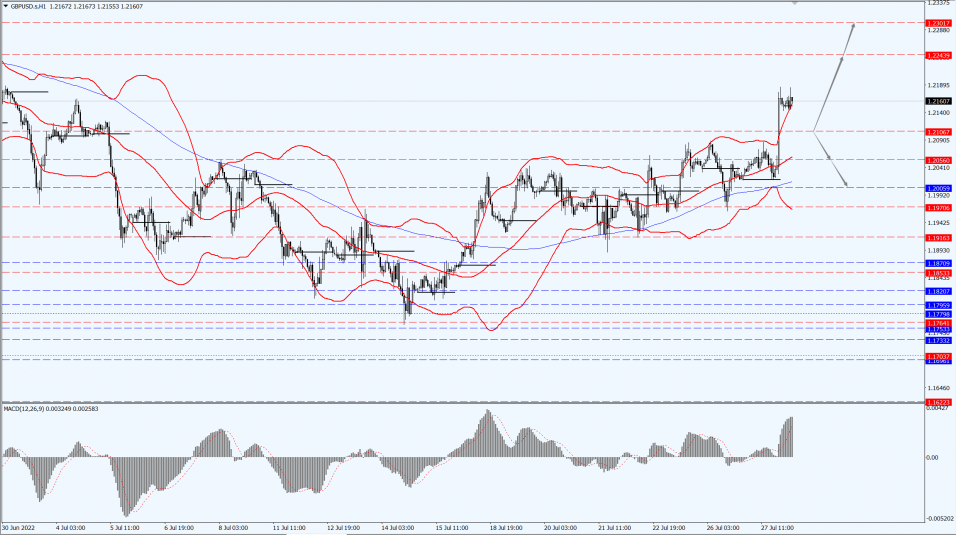

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England is expected to raise interest rates, and GBP closed up 1.25% against the dollar on Wednesday, 27th July 2022, at 1.2152.

The U.K. energy regulator previously said that the U.K. energy price cap continued to rise in October and that U.K. inflation is likely to climb gradually to double digits in the next few months.

This is expected to prompt the Bank of England to change its original cautious attitude towards rate hikes to aggressive, thereby boosting GBP.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2106-line today. If GBP runs below the 1.2106-line, it will pay attention to the suppression strength of the two positions of 1.2056 and 1.2005. If GBP runs above the 1.2106-line, then pay attention to the suppression strength of the two positions of 1.2243 and 1.2301.

2. Precious Metals Market Insight

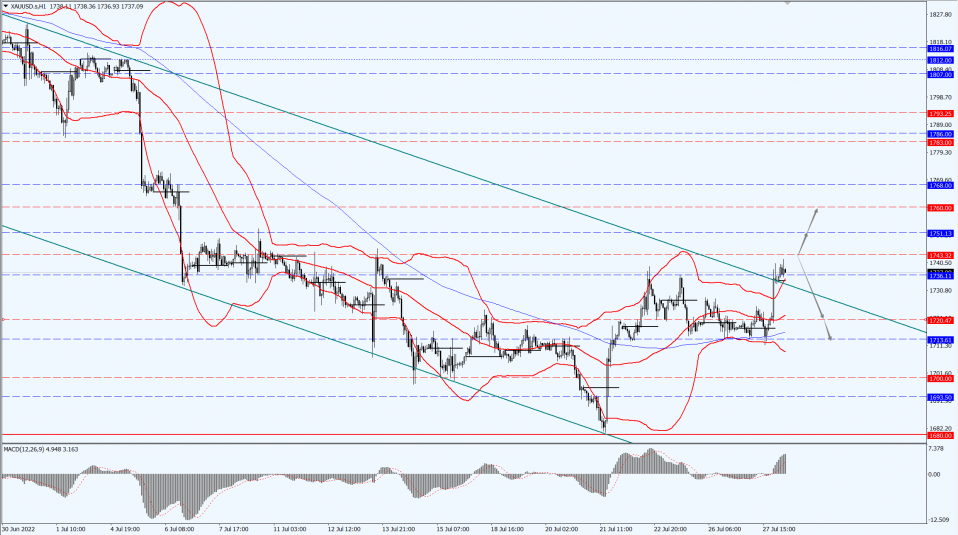

Gold

Fundamental Analysis:

The Federal Reserve announced early Thursday, 27th July 2022, morning that it would raise its target overnight rate by 75 basis points in an effort to drive down inflation, the highest since the 1980s, and hinted that it would “continue to raise” borrowing costs despite evidence that the economy is slowing.

Fed Chairman Powell also said that the lack of clear visibility of the economy’s future trajectory means that the Fed can only provide reliable guidance on its policy direction on a “meeting-by-meeting” basis.

The dollar retreated, enhancing gold’s appeal among overseas buyers, while U.S. Treasury yields also slipped. The Fed’s aggressive rate hike and the dollar’s recent rally have overshadowed gold’s appeal as a safe-haven, despite the recent risk of a recession.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1743-line today. If the gold price runs steadily below the 1743-line, then it will pay attention to the support strength of the 1720 and 1713 positions. If the gold price breaks above the 1743-line, then pay attention to the suppression strength of the two positions of the 1751 and 1760.

3. Commodities Market Insight

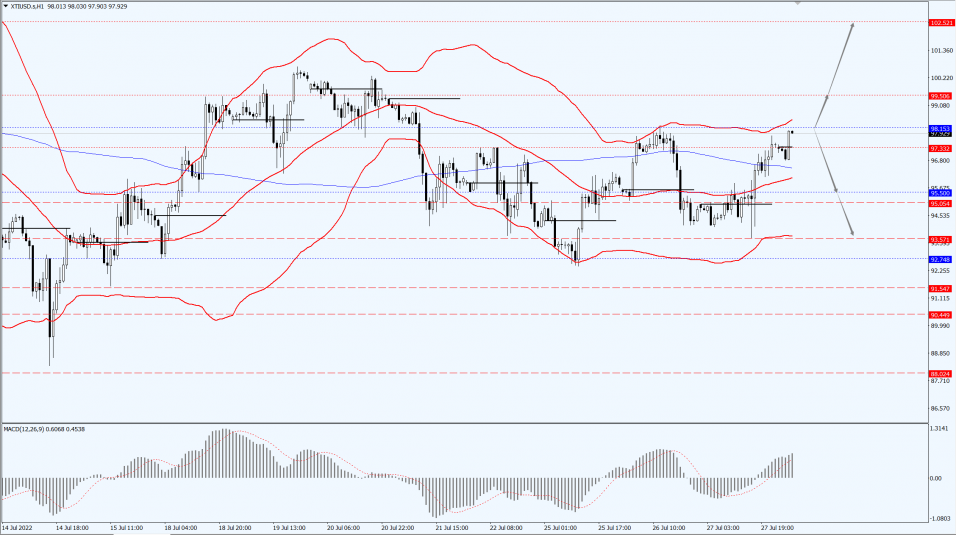

WTI Crude Oil

Fundamental Analysis:

Oil prices closed up more than $2 on Wednesday, 27th July 2022, as reports of lower U.S. inventories and reduced Russian gas deliveries to Europe offset concerns about weaker demand and a U.S. interest rate hike.

The U.S. Energy Information Administration (EIA) said U.S. crude oil inventories fell by 4.5 million barrels last week as exports surged to a record high as U.S. crude prices were well below international indicator Brent crude.

U.S. gasoline demand rebounded 8.5 percent in one week after falling sharply in the past two weeks, the data showed.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 98.15-line today. If the oil price runs above the 98.15-line, then focus on the suppression strength of the two positions of 99.50 and 102.52. If the oil price runs below the 98.15-line, then pay attention to the support strength of the two positions of 95.50 and 93.57.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.