1. Forex Market Insight

EUR/USD

Weak economic data was released in Europe last week.

Lower-than-expected German and French PMIs showed the euro zone The lower-than-expected German and French purchasing managers’ indices (PMIs) show that the eurozone economy is struggling to get on track.

This has prompted the market to reduce bets on a significant interest rate hike move by the European Central Bank (ECB).

The eurozone economy is struggling to get on track, which has prompted traders to reduce their bets on the ECB’s move to raise interest rates sharply.

Higher prices in the eurozone meant that demand for manufactured goods fell in June at the fastest pace since the worst of the epidemic in May 2020.

The S&P Global Eurozone Manufacturing PMI fell to a near two-year low of 52.0 from 54.6.

Data released by S&P Global showed that the Eurozone manufacturing and services composite sentiment index was 51.9 in June.

Significantly lower than the 54.6 data released in May, the market ECB rate hike is expected to be reduced.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the two positions of 1.0357 and 1.0184. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

GBP Intraday Trend Analysis

Fundamental Analysis:

The UK Consumer Price Index (CPI) rose to 9.1% in May from 9% in the previous month, the highest since March 1982, data from the Office for National Statistics showed on 22nd June 2022.

In addition, the UK CPI rose 0.7% month-on-month in May, slightly higher than the previous expectation of 0.6%.

The inflation data released this time was in line with expectations of economists and analysts.

Data rose further in May.

This indicates that the current UK inflation situation is severe and the outlook for future inflation could deteriorate further.

As soaring food and energy prices continue to push up the cost of living, inflation levels in the UK have been climbing recently.

The Bank of England previously predicted that UK CPI would exceed 11% in October.

The sub-inflation data will increase the pressure on the Bank of England to subsequently set monetary policy.

The Bank of England is now under pressure to take stronger measures in the form of successive interest rate hikes in the coming months to reduce the price level.

Technical Analysis:

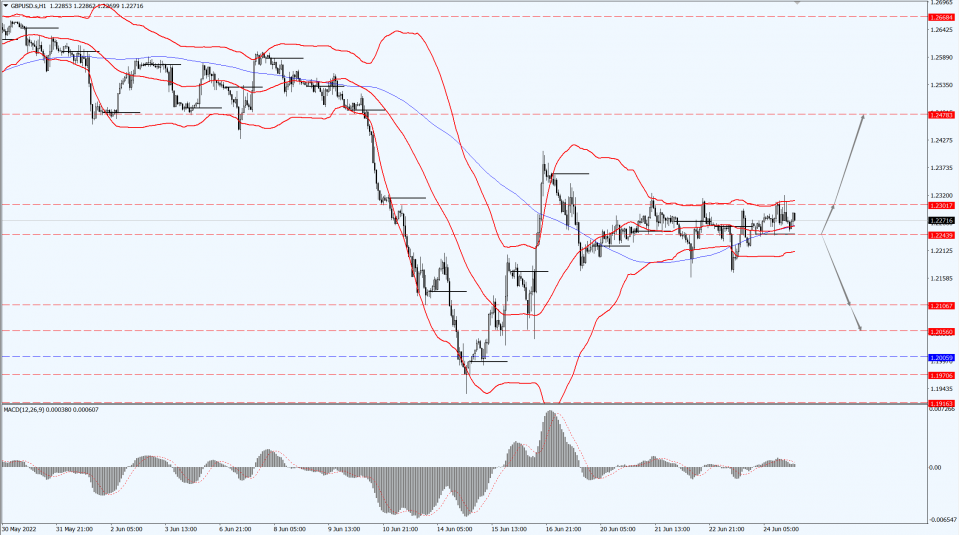

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2243-line today. If GBP runs below the 1.2243-line, it will pay attention to the suppression strength of the two positions of 1.2106 and 1.2056. If GBP runs above the 1.2243-line, then pay attention to the suppression strength of the two positions of 1.2301 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold fell by about 0.8% last week, dipping around $15 per ounce, with an amplitude of about 1.45%.

The difference between the highest and lowest was about $26 per ounce, a narrower decline than last week.

The U.S. Federal Reserve chairman held two hearings in Congress this week and failed to stoke the gold market, with the market reaction relatively muted compared to last week when the U.S. central bank raised interest rates by 75 basis points.

Gold prices are running in the $1820-1850 range this week, still above the important $1800 mark.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1832-line today. If the gold price runs steadily below the 1832-line, then it will pay attention to the support strength of the 1816 and 1812 positions. If the gold price breaks above the 1832-line, then pay attention to the suppression strength of the two positions of the 1847 and 1866.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

International oil prices fell for the second week in a row and refreshed the lows since mid-May.

The Biden administration is considering suspending the federal gasoline tax due to Federal Reserve Chairman Powell’s statement that he will fight inflation at all costs.

PMI data in Europe and the United States performed poorly, and OPEC+ is expected to continue to accelerate production increases.

NYMEX crude oil futures down 4.02% to $106.02/barrel at press time.

ICE Brent crude futures fell 1.67% to $111.72 per barrel.

The two markets hit lows of $101.53/barrel since 11th May 2022 and $104.35/barrel since 19th May 2022, respectively.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 105.01-line today. If the oil price runs above the 105.01-line, then focus on the suppression strength of the two positions of 107.52 and 109.62. If the oil price runs below the 105.01-line, then pay attention to the support strength of the two positions of 102.52 and 99.50.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.