1. Forex Market Insight

EUR/USD

With the euro zone facing record inflation – partly driven by war factors, but also by pandemic-related supply constraints – European Central Bank (ECB) officials are increasingly supporting a rate hike in July.

Meanwhile, ECB officials said any changes should be “predictable, gradual and data-dependent” in order to combat high inflation, so that debtors can better cope with higher borrowing costs.

This makes it even more important to act in a timely manner.

“Delaying the monetary policy turn is a risky strategy,” he said. “The more inflationary pressures spread, the more intense and abrupt rate hikes will be needed.”

Technical Analysis:

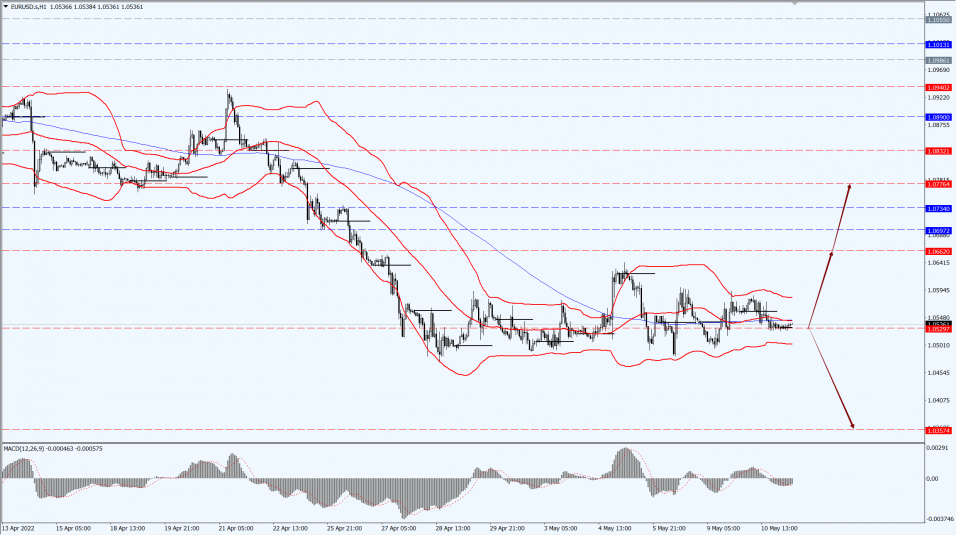

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the position of 1.0357. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0662 and 1.0776.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England raised interest rates by 0.25 percentage points last Thursday, 5th May 2022, raising the benchmark rate to 1%, the highest rate since 2009 and the fourth consecutive rate hike by the Bank of England.

The Bank of England also predicted that inflation will reach 10% this year, with Russia’s unprovoked attack on Ukraine fueling a spike in food and energy prices.

Technical Analysis:

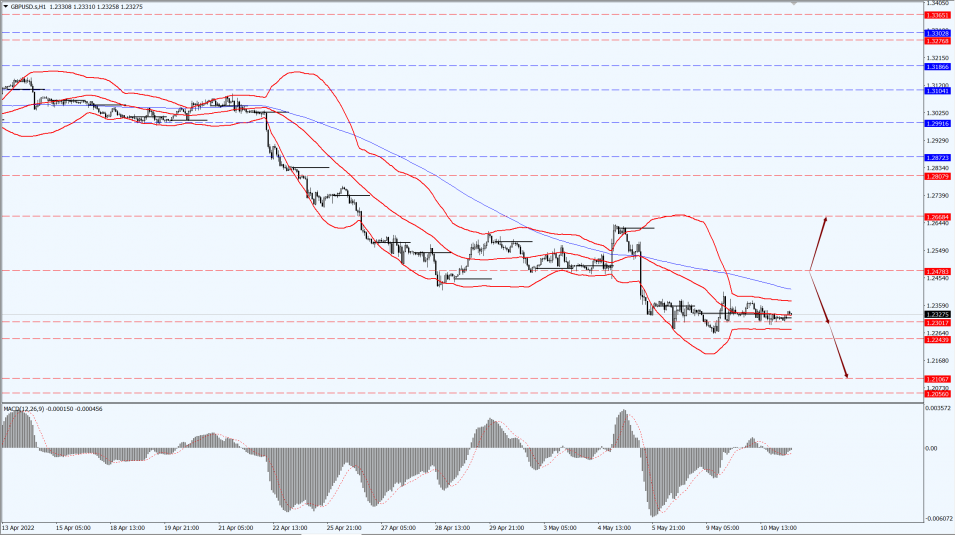

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2478-line today. If GBP runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2301 and 1.2106. If GBP runs above the 1.2478-line, then pay attention to the support strength of the position of 1.2668.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold extended decline, once hitting a near three-month low to $1831.30 an ounce.

As the dollar regains momentum, investors turned their attention to U.S. inflation data for clues on the Federal Reserve’s monetary policy strategy.

Although the geopolitical situation remains volatile, it is being ignored by the market for the time being.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1830-line today. If the gold price runs steadily above the 1830-line, then it will pay attention to the support strength of the 1844 and 1855 positions. If the gold price breaks below the 1830-line, then pay attention to the suppression strength of the two positions of the 1812 and 1804.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell more than 2% yesterday, 10th May 2022, dropping below the 100 mark for a second straight day of losses and the lowest in two weeks.

The demand outlook was pressured by the spread of the pandemic and the growing risk of recession. At the same time, the dollar rose on market concerns about tightening monetary policy.

The strong dollar makes crude oil more expensive for buyers using other currencies.

Technical Analysis:

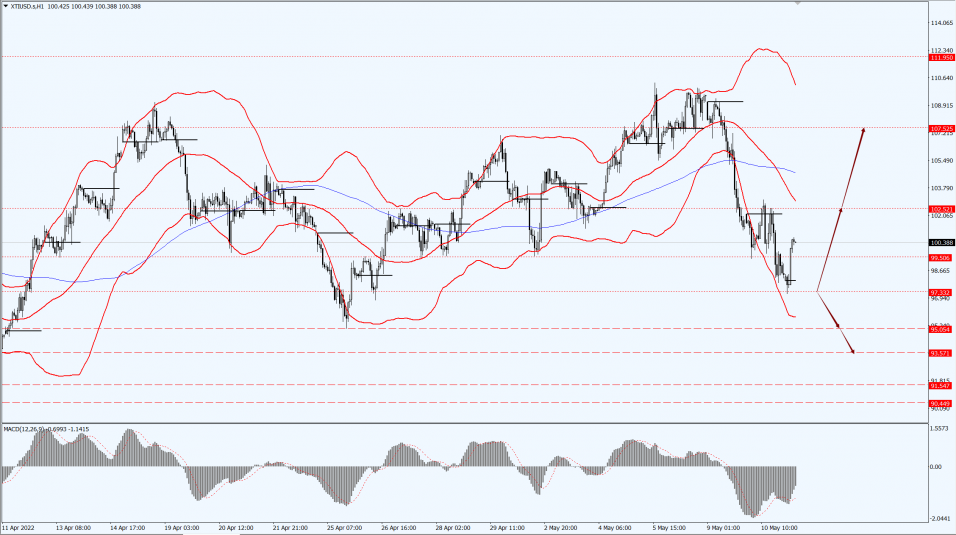

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 97.33-line today. If the oil price runs above the 97.33-line, then focus on the suppression strength of the two positions of 102.52 and 107.52. If the oil price runs below the 97.33-line, then pay attention to the support strength of the two positions of 95.05 and 93.57.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.