1. Forex Market Insight

EUR/USD

USD is on track for its sixth straight week of gains, the longest-lasting rally of the year, and has risen more than 9% so far in 2022.

EUR fell for a sixth straight week on worries that Russia’s invasion of Ukraine hampered the economy and a rise in the USD.

Although the European Central Bank is widely expected to start raising interest rates in July, it is expected to raise rates at a slower pace than the Federal Reserve.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0357-line today. If EUR runs steadily above the 1.0357-line, then pay attention to the support strength of the two positions of 1.0529 and 1.0662. If the strength of EUR breaks below the 1.0357-line, then pay attention to the suppression strength of the two positions of 1.0184 and 1.0017.

GBP Intraday Trend Analysis

Fundamental Analysis:

Although the Bank of England said it still needs to raise interest rates to curb inflation, it is less confident about controlling inflation in the short term, and concerns about the future economic outlook have intensified.

The subsequent cooling of inflation and economic impact will make the Bank of England cautious.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2301-line today. If GBP runs below the 1.2301-line, it will pay attention to the suppression strength of the two positions of 1.2106 and 1.2005. If GBP runs above the 1.2301-line, then pay attention to the support strength of the position of 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold fell nearly 1.4% yesterday, 16th May 2022, hitting a new low of $1,786.70 an ounce since 31st January. Federal Reserve officials had previously given a time period to consider further accelerating interest rate hikes.

However, gold prices fell off the pace, covering more than half of the day’s losses.

Markets are concerned that more aggressive monetary policy measures by the Federal Reserve to fight inflation could hit economic growth.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1830-line today. If the gold price runs steadily below the 1830-line, then it will pay attention to the support strength of the 1812 and 1793 positions. If the gold price breaks above the 1830-line, then pay attention to the suppression strength of the two positions of the 1844 and 1866.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices settled higher and remained in an overall oscillating range, supported by an improved demand outlook for crude oil.

China’s crude oil demand has rebounded, and the intensified game between Russia and Ukraine continues to push oil prices higher.

However, tight monetary policy by global central banks, high inflation and slow global economic growth have limited crude oil prices to go higher.

Technical Analysis:

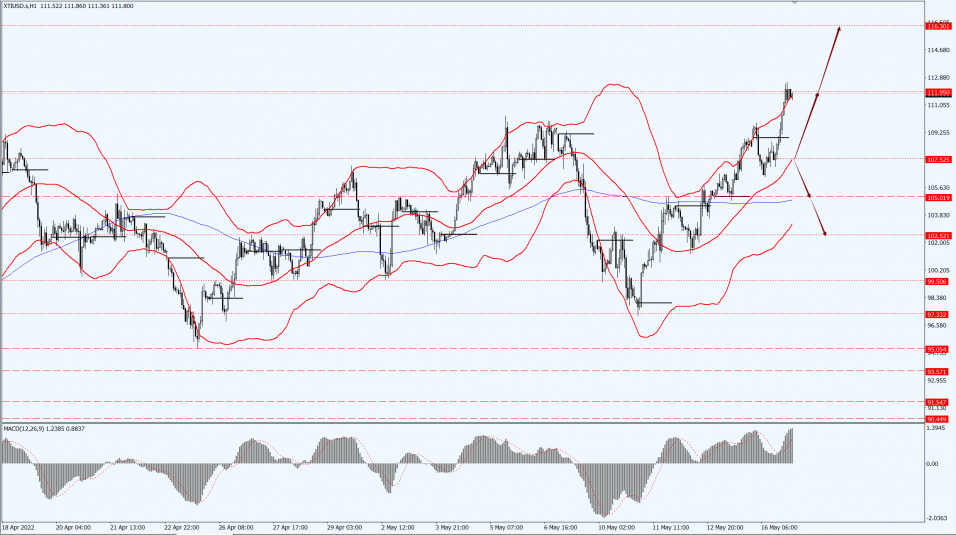

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 107.52-line today. If the oil price runs above the 107.52-line, then focus on the suppression strength of the two positions of 111.95 and 116.30. If the oil price runs below the 107.52-line, then pay attention to the support strength of the two positions of 105.01 and 102.52.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.