1. Forex Market Insight

EUR/USD

Recently, the euro short covering has constituted a certain support for the euro.

The weakening of the dollar index under the pressure of multiple negative factors is also an important factor supporting the rebound of the euro.

However, Germany’s weak economic data performance and investor uncertainty about the European Central Bank’s (ECB) interest rate hike expectations for the year still somewhat limit the rebound space for the currency.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the two positions of 1.0357 and 1.0184. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

GBP Intraday Trend Analysis

Fundamental Analysis:

Given market expectations for a 50bps rate hike in August, the Bank of England (BoE) will have to deliver on that promise to keep the pound at current levels.

This in turn means that the pound will face downside risks if the Bank of England behaves more cautiously in the future.

If the BoE’s rate hike is lower than market expectations, the pound could depreciate more than the market expects.

However, if the BoE does pursue higher interest rates more aggressively, the pound will be better supported.

Technical Analysis:

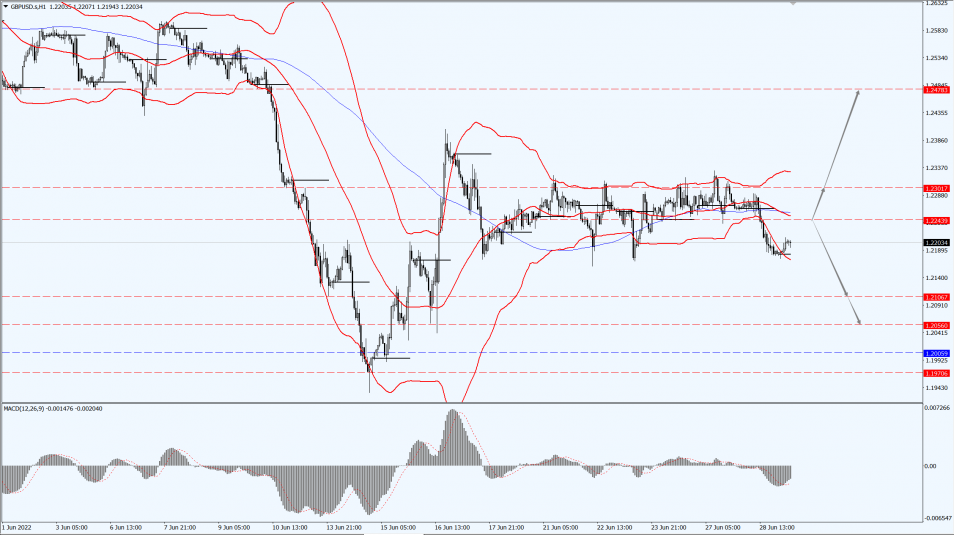

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2243-line today. If GBP runs below the 1.2243-line, it will pay attention to the suppression strength of the two positions of 1.2106 and 1.2056. If GBP runs above the 1.2243-line, then pay attention to the suppression strength of the two positions of 1.2301 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold fluctuated in a narrow range, currently trading around $1820/oz.

Gold prices were under pressure overnight after Fed officials pledged to raise interest rates quickly, rebutting fears of a recession, helping the U.S. dollar index rebound to record its highest close in more than a week.

However, U.S. consumer confidence fared worse and U.S. stocks plunged.

Coupled with market concerns about the geopolitical situation, gold prices were also supported by safe-haven buying.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1832-line today. If the gold price runs steadily below the 1832-line, then it will pay attention to the support strength of the 1816 and 1812 positions. If the gold price breaks above the 1832-line, then pay attention to the suppression strength of the two positions of the 1847 and 1866.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil rose slightly, hitting a one-and-a-half-week high near $112.49 a barrel.

Threats to global output have added fuel to the spot market, while the G7 agreed to study a price cap for Russian oil,

Supply disruptions in Libya and Ecuador have also become more severe, exacerbating the ongoing tension in the market.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 109.62-line today. If the oil price runs above the 109.62-line, then focus on the suppression strength of the two positions of 111.95 and 116.30. If the oil price runs below the 109.62-line, then pay attention to the support strength of the two positions of 107.52 and 105.01.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.