1. Forex Market Insight

EUR/USD

EUR/USD closed down 0.75% at 1.0438 on Wednesday, 29th June 2022.

The European Central Bank (ECB) will follow its global counterparts and raise interest rates in July for the first time in a decade, in a bid to cool soaring inflation.

Economists, however, were divided on the magnitude of the rate hike, making investors nervous.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the two positions of 1.0357 and 1.0184. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD closed down 0.52% at 1.2118 on Wednesday, 29th June 2022.

This comes after Bank of England Governor Tony Blair said he did not make a good or bad call on the exchange rate and was not surprised by the fall in the pound over the past few months.

He also said that Brexit would be a drag on the economy.

The UK economy has seen a decline in the level of trend growth and has sought to use policy tools to cool inflation.

Technical Analysis:

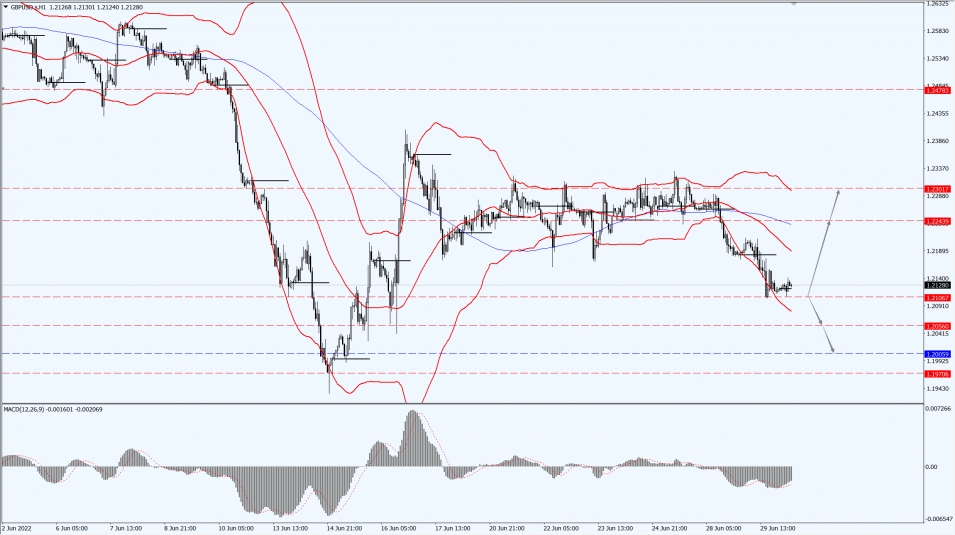

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2106-line today. If GBP runs below the 1.2106-line, it will pay attention to the suppression strength of the two positions of 1.2056 and 1.2005. If GBP runs above the 1.2106-line, then pay attention to the suppression strength of the two positions of 1.2243 and 1.2301.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold fluctuated in a narrow range, slightly below the 1820 mark.

Overnight, the world’s major central bank governors emphasized the need to act quickly to combat inflation, and Fed Chairman Powell’s speech was particularly hawkish, which put pressure on gold prices.

However, the final value of the US GDP in the first quarter was revised down, and the market’s worries about a recession lingered.

In addition, the NATO summit supports military aid to “heroic” Ukraine, as Russia steps up its missile offensive.

Market concerns about the geopolitical situation have also increased, which limited the decline in gold prices.

The focus of this trading day is on the change in U.S. initial jobless claims, the U.S. annual PCE rate for May and the U.S. monthly personal spending rate for May.

At the same time, pay attention to the relevant news of the NATO summit and the situation in Russia and Ukraine.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1832-line today. If the gold price runs steadily below the 1832-line, then it will pay attention to the support strength of the 1812 and 1807 positions. If the gold price breaks above the 1832-line, then pay attention to the suppression strength of the two positions of the 1847 and 1866.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices slid about 2% on Wednesday, 29th June 2022.

That’s because rising U.S. gasoline and distillate inventories and concerns about slowing global economic growth offset ongoing worries about tight crude oil supplies.

Intraday focus on the U.S. initial jobless claims for the week ending 25th June 2022, the U.S. PCE price index annual rate for May, and the OPEC+ meeting.

Technical Analysis:

Trading Strategies:

Oil prices focus on the 109.62-line today. If the oil price runs above the 109.62-line, then focus on the suppression strength of the two positions of 111.95 and 116.30. If the oil price runs below the 109.62-line, then pay attention to the support strength of the two positions of 107.52 and 105.01.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.