1. Forex Market Insight

EUR/USD

The euro fell by 0.19% against the dollar to 1.1530, the lowest since July 2020. The rise in energy prices raised concerns that inflation may weaken economic growth. At the same time, European coal prices have hit record highs and natural gas prices are four times higher than they were in early 2021.

The ZEW Indicator of Economic Sentiment for Germany fell for the fifth consecutive month in October, dropping by 4.2 points. The performance was much lower than expected. Meanwhile, the supply bottlenecks had a serious impact on Europe’s largest economy.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we pay attention to the 1.1554-line of support. If the euro breaks below the 1.1554-line, it will open up a further downside space. At that time, pay attention to the 1.1501-line of support as it could possibly open up a further upside potential.

GBP Intraday Trend Analysis

Fundamental Analysis:

The reduction in quantitative easing (QE) is not an implied signal about the timing of the FOM’s subsequent interest rate hikes. The situation may soon guarantee that the Fed will adjust the pace of bond purchases. At one point, FOMC members generally believed that the taper would end in mid-2020.

The U.S. inflation risks are on the upside, and the spike in inflation is “largely temporary. Meanwhile, the underlying inflation is close to the Fed’s 2% inflation target. The economy is expected to continue to strengthen, but the Coronavirus delta variant has affected the economic activity in the third quarter.

Sterling fell by 0.05% to 1.3588 against the U.S. dollar. Due to market speculation that the Bank of England’s efforts to curb inflation will drag down economic growth and the outlook for consumer confidence, the pound shorts increased their short-selling efforts.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today pays attention to the 1.3574-line. If the pound moves above the 1.3574-line, then pay attention to the suppression of the 1.3669 and 1.3721 positions in turn. Once the pound strength drops below the 1.3574-line, it will open up a further downside space. At that time, pay attention to the strength of the positions at 1.3522 and 1.3409.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

With the decline in U.S. Treasury yields and the rise in gold prices yesterday, investors are assessing the inflationary pressures brought about by rising energy prices and the outlook for monetary policy.

The poor performance of the U.S. stock market and the decline in the yield of the U.S. 10-year Treasury bonds boosted the demand for gold.

The market will look to Wednesday’s release of the U.S. consumer price index for clues on the Fed’s tapering schedule. The data is expected to show that price pressures have remained high last month; gold ETF positions have fallen over the past three weeks and are near their lowest level since May 2020.

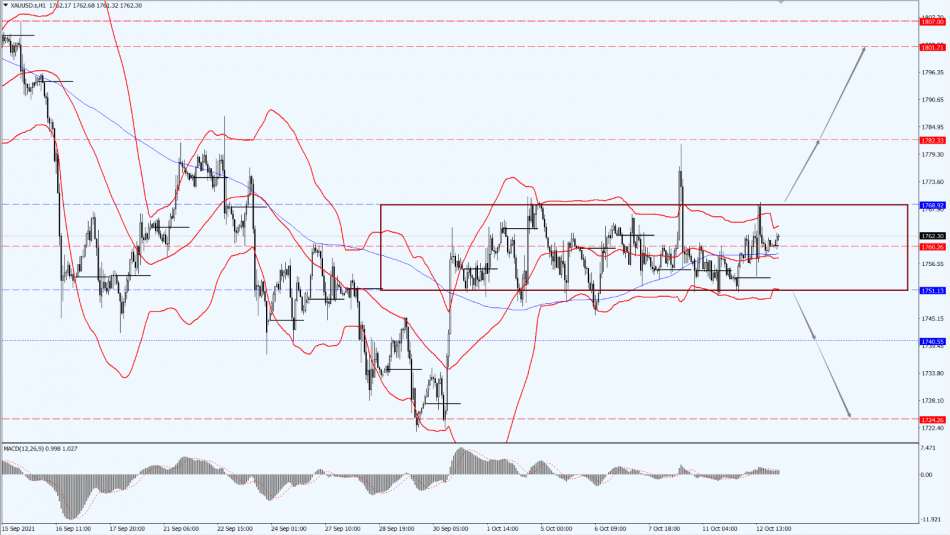

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold is still paying attention to the direction of the breakthrough in the 1745 to 1768 range. If it breaks through 1768 upwards, it will open up a further upside potential. At that time, it will pay attention to the suppression of the two positions at 1782 and 1801. If it falls below the 1745 line, it will open up a further downside space. With that, we will pay attention to the strength of support at 1740 and 1724.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

New York crude oil futures rose for the fourth consecutive day as the market is volatile. The market is evaluating how the global power crisis will affect oil demand this winter.

New York crude futures rose by 0.2% on Tuesday, 12th October 2021. The shortages of natural gas and coal at the onset of winter in the northern hemisphere have prompted some in the power industry to turn to fuels such as diesel and fuel oil.

Meanwhile, the International Monetary Fund (IMF) has expressed concern that the global economic recovery is losing momentum, with higher food and fuel prices among the reasons it cited. West Texas Intermediate futures for November delivery rose by 12 cents to settle at $80.64 per barrel, while Brent crude futures for December delivery fell by 23 cents to settle at $83.42 per barrel.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 78.25-line. If oil prices run above the 78.25-line, we will continue to follow the trend of bullish thinking and focus on the suppression of the 80 and 81.33 positions in turn. If the oil price falls below the 78.25-line, it will open a further downside space. At that time, pay attention to the strength of support at 76.89 and 75.04.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home