1. Forex Market Insight

EUR/USD

There is much to discuss at this week’s ECB meeting. The actual inflation is once again higher than the ECB expects. Additionally, higher energy prices and ongoing supply chain frictions are obviously complicating the ECB’s considerations.

Whether it is short-lived or not, the continued spike in headline inflation will clearly be seen by hawks as a reason to reduce monthly asset purchases (ideally to be announced at the December meeting), while doves may say that higher energy prices will weaken private consumption.

Thus, it will delay the eurozone recovery, and warn against a premature exit from the loose monetary policy. Nevertheless, our bank does not expect Governor Lagarde to reveal any important details. With that said, this week’s meeting is a preparation for the major meeting in December.

Technical Analysis:

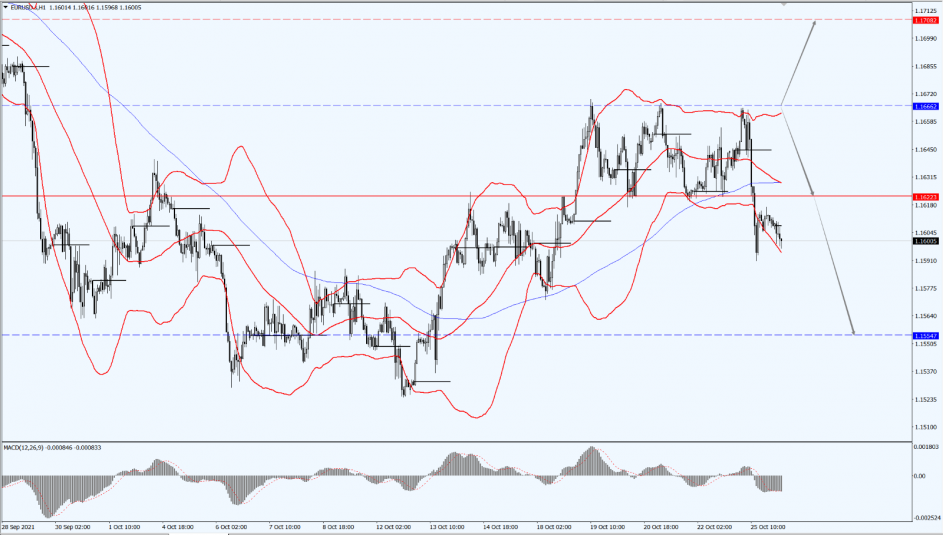

(EUR/USD 1-hour chart)

Execution Insight:

Pay attention to the 1.1666-line today. If the strength of the euro breaks through the 1.1666-line, it will open up a further upside. At that time, pay attention to the suppression of the 1.1708 line. Once the euro falls under the pressure of the 1.1666-line, pay attention to the support at the 1.1622 and 1.1554 positions in turn.

GBP Intraday Trend Analysis

Fundamental Analysis:

The market expects that the Fed may start the rate hike cycle as early as next summer and continue through the end of 2022. Powell and the Fed are open to raising rates and tightening monetary policy faster than expected a few months ago.

This was underscored by Powell’s non-reflexive attitude late last week, and now the time has come to start tapering the asset purchase program. The Fed will likely raise rates at each of its four meetings from July to December 2022, with a rise of perhaps more than 25 basis points.

The market currently expects the Fed to raise rates twice by the end of next year, by about 25 basis points each time. With this, we expect the rate hike cycle to be gradual, but if inflation does stand out this time, then the Fed may need to pick up the pace, which has caused the pound to begin a shocking downward movement.

Technical Analysis:

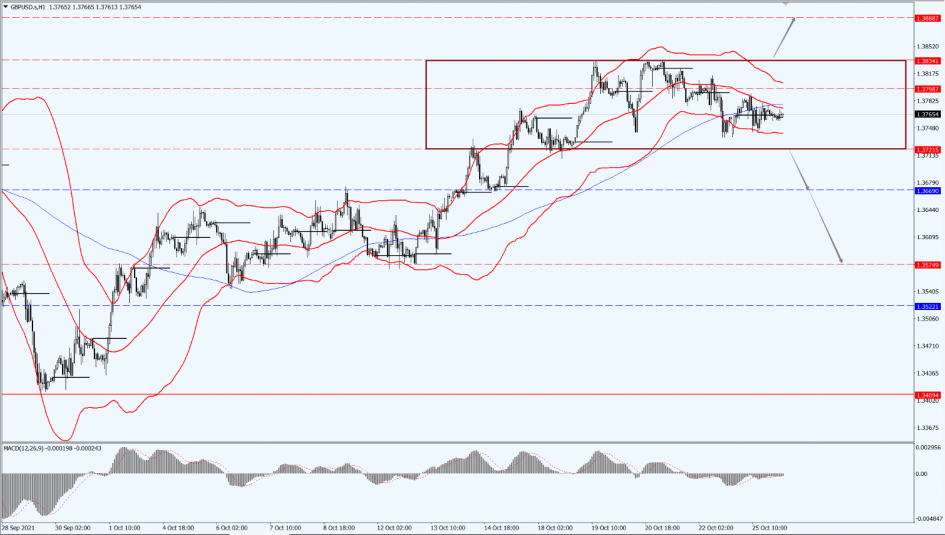

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the direction of the breakout of the 1.3721 to 1.3834 range. If it breaks upwards through the 1.3834-line, it will open up further upside. Then, pay attention to the 1.3888-line; if it drops below the 1.3721-line, it will open up further downside space. At that time, pay attention to the support strength of the two positions of 1.3669 and 1.3574.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose by nearly 1% yesterday. The falling U.S. Treasury yields and ongoing concerns about inflation boosted gold as a safe-haven asset ahead of this week’s major central bank meetings, although the stronger dollar and equity markets limited gold’s gains. The main focus during the day is on the U.S. October Conference Board Consumer Confidence Index.

Technical Analysis:

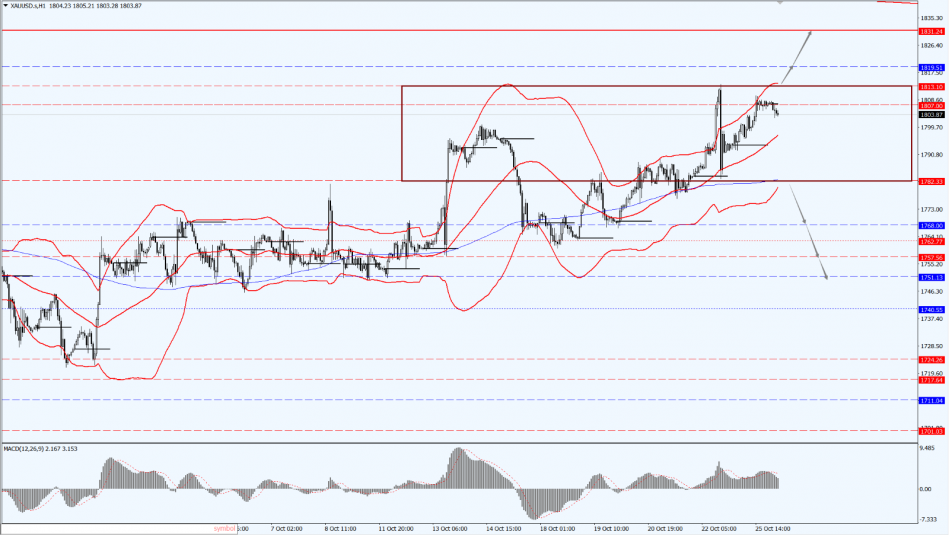

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the direction of the breakthrough of the range from 1782 to 1813. If it breaks upwards through the 1813-line, then pay attention to the suppression of the 1819 and 1831 positions. If it falls below the 1782-line, then pay attention to the support of the 1768 and 1752 positions.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, oil prices touched the 85-mark for the first time since 2014, peaking at $85.41 per barrel before retracing gains.

The market’s attention on the upcoming talks between Iran and the EU could lead to a resumption of the 2015 nuclear deal. Intraday focus on the U.S. consumer confidence index in October, and the U.S. September quarterly new home sales annualized total. Additionally, the EU energy ministers held an emergency summit to talk about how to deal with soaring energy prices.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices today pay attention to the suppression of the 85-line, and the support levels at 83.04 and 81.33. Once the oil price falls below the 81.33-line, oil prices will open up a further downward space.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.