1. Forex Market Insight

EUR/USD

Switzerland’s unexpected rate hike and the European Central Bank’s (ECB) announcement that it is working on a tool to prevent fragmentation of the European bond market.

This will help limit the dollar’s strength around current levels.

In addition, Macron’s centrist coalition Ensemble is expected to win the most seats in Sunday’s, 19th June 2022, general election.

Yet, the near-final results show that this is still far from the absolute majority needed to control the parliament.

The pan-leftist coalition is expected to become the largest opposition group.

The far right, on the other hand, took a record number of seats, and the conservatives are likely to be the one to decide the situation.

Finance Minister Le Maire called the result a shock to democracy, and said that if other factions do not cooperate, “it will hinder our ability to reform and protect the French.”

In the event of a no-majority (hung) parliament, a degree of power-sharing and compromise would have to be reached between the parties, a situation that has not occurred in France for decades.

The last time a newly elected French president failed to secure an absolute majority in parliamentary elections was in 1988.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the two positions of 1.0357 and 1.0184. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD fell more than 1% on Friday, 17th June 2022, to 1.2172, giving back most of the gains recorded after the Bank of England’s decision to raise interest rates again.

Although the Bank of England’s rate hike was lower than many in the market had expected, the central bank has sent hawkish signals of further policy action ahead.

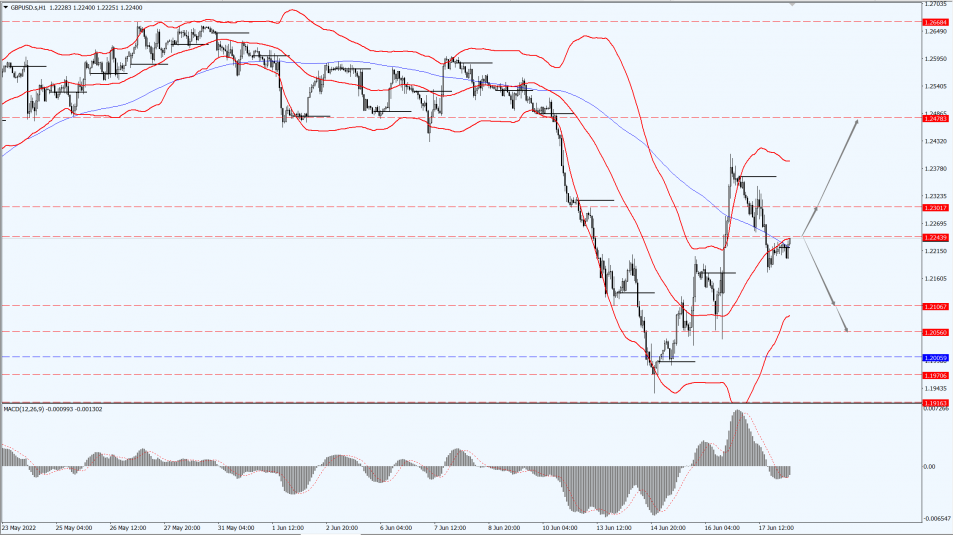

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2243-line today. If GBP runs below the 1.2243-line, it will pay attention to the suppression strength of the two positions of 1.2106 and 1.2056. If GBP runs above the 1.2243-line, then pay attention to the suppression strength of the two positions of 1.2301 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold fluctuated slightly lower, and the current relative strength of the US dollar and interest rate hikes by major central banks have weakened the attractiveness of safe-haven metals.

The Federal Reserve announced the biggest rate hike since 1994 last week, the Swiss National Bank raised rates for the first time in 15 years, and the Bank of England also took action.

However, factors such as inflation at multi-decade highs and geopolitical tensions still provide support to gold prices.

The survey shows that Wall Street analysis is neutral on gold prices this week, while retail investors tend to be bullish on the aftermarket.

The New York Stock Exchange was closed for one day on Monday, 20th June 2022, coinciding with the June Holiday in the United States.

Trading in the CME’s precious metals and U.S. crude oil contracts ends early at 02:30 GMT the following day, which may limit the trading space.

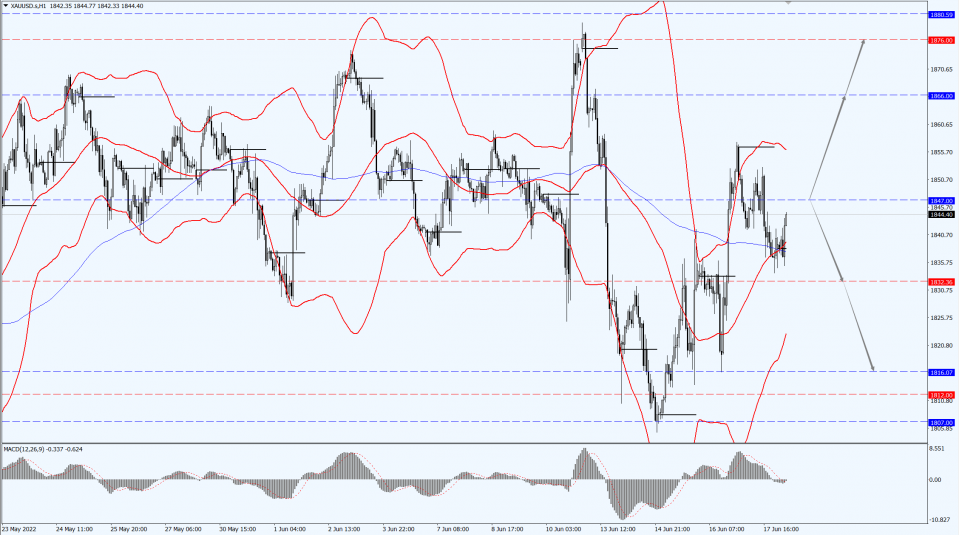

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1847-line today. If the gold price runs steadily below the 1847-line, then it will pay attention to the support strength of the 1832 and 1816 positions. If the gold price breaks above the 1847-line, then pay attention to the suppression strength of the two positions of the 1866 and 1876.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil plunged more than 5.6% on Friday, 17th June 2022, the biggest drop in three months.

Fears that interest rate hikes by major central banks could slow the global economy and cut demand for energy.

In addition, OPEC+ began looking at the next production action, saying that all the production cuts made in 2020 are about to be restored.

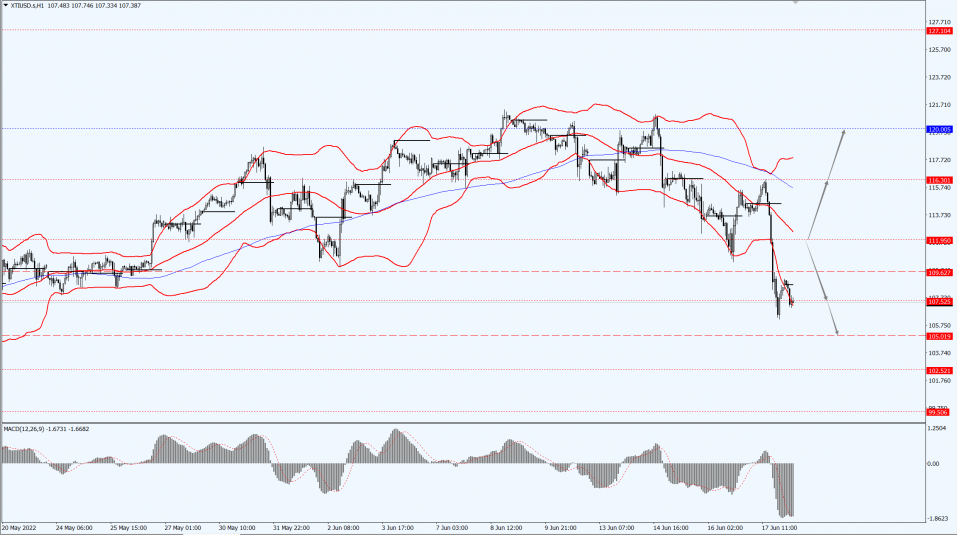

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 111.95-line today. If the oil price runs above the 111.95-line, then focus on the suppression strength of the two positions of 116.30 and 120.00. If the oil price runs below the 111.95-line, then pay attention to the support strength of the two positions of 107.52 and 105.01.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.