1. Forex Market Insight

EUR/USD

The U.S. dollar index retreated this week due to a rebound in risk sentiment.

However, as the Fed is still discussing when to taper its bond purchases, and the European Central Bank (ECB) still shows no signs of stopping its bond purchases in the near term. With this, the overall trend in the euro has been weak.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

In the past two days, the euro has competed for long and short positions at a high level, creating a wide range at 1.1727 to 1.1779. Today, we will pay attention to the direction of the breakthrough at the wide range. If it breaks through the 1.1779-line, it will open up the euro’s upside potential. At that time, we will pay attention to the suppression of the two positions, 1.1795 and 1.1820. If it falls below the 1.1727-line, it will open up the further downside potential for the euro. At that time, pay attention to the support of the 1.1705-line.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Fed may start to slow down asset purchases in the next few months, and the FOMC meetings in November and December seem to be a good time to announce the tapering of bond purchases.

This would keep the dollar’s overall uptrend intact in the fourth quarter, and this expectation will further suppress the trend of the pound.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

Yesterday, the pound went down unilaterally and destroyed the rising structure on the left. Today, we are focusing on the process of reconfirmation. Therefore, we will pay attention to the 1.3721-line today. If the pound rebounds to the 1.3721-line and falls under pressure again, we will pay attention to the two positions,1.3669 and 1.3601. If the pound rebounds above the 1.3721-line and stabilizes above the middle track of the Bollinger Bands, there will possibly be a retesting at the 1.3771-line. Once the strength breaks through 1.3771, it will open up further upside potential.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Yesterday, gold stabilized after a sharp retreat.

The market is looking forward to the annual Jackson Hole Symposium, and will be closely watching Fed Chairman Powell’s keynote speech today for any latest signals on when and how the U.S. central bank intends to taper its asset purchases.

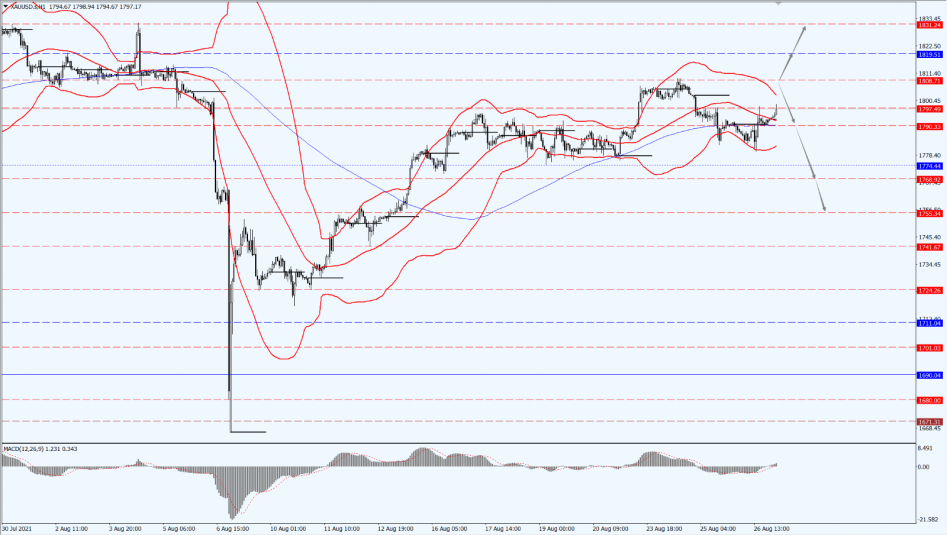

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold price rebounded on Thursday, 26th August 2021. The long and short sides are now competing again on the 1797-line. Today, we are mainly focusing on the 1808-line. From the current strength of the gold price rebound, the bullish trend is relatively strong. Therefore, the market outlook needs to be aware of the gold price backtesting the 1808-line again. The downward pressure on the 1808-line will form a negative line of strength. At that time, the downward process will likely be opened again. At that time, we will pay attention to the support of the 1790 and 1768 positions. If the price of gold rises above the 1808-line, it will open up a greater upside potential. At that time, focus on the suppression strength at 1819 and 1831.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell yesterday, halting a three-day rally. The WTI crude oil futures fell by 1.4% on Thursday, 26th August 2021 after accumulating nearly 10% gains in the previous three trading days.

Investors are anticipating the Fed’s Jackson Hole symposium to provide clues on the stimulus policy cuts. If the Fed reduces stimulus, it will be seen by the market as bearish for commodities such as oil. Thus, this concern is prompting investment to shift to the U.S. dollar.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Yesterday’s high oil price sideways volatility indicates that both parties are cautious and unwilling to attack in advance. Today, we pay attention to the direction of the breakthrough of the 66.83 to 68.57 range of the high volatility formed yesterday. If it breaks above the 68.57-line, it will open up a greater upside potential. At that time, pay attention to the suppression of the positions at 69.75 and 70.49. If it falls below the 66.83-line, it will open up a greater downside potential. At that time, pay attention to the support of the positions at 65.07 and 65.16.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.