1. Forex Market Insight

EUR/USD

The U.S. dollar fell on Monday,23rd August 2021, following last week’s biggest one-week gain in more than two months. This is as risk sentiment in the market has improved.

Meanwhile, poor U.S. data suggested that the Federal Reserve is unlikely to quickly withdraw accommodative monetary policy. The U.S. business activity growth slowed for the third consecutive month in August, as capacity constraints, supply shortages, and the rapid spread of the Delta variant weakened the rebound from the recession triggered by the pandemic last year. As a result, the euro rebounded.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, the euro pays attention to the 1.1705 to 1.1773 range. If the euro breaks above 1.1773, it will open up further upside potential. At that time, pay attention to the suppression of 1.1795. On the lower end, pay attention to the support of 1.1705. As long as it does not fall below 1.1705, it will maintain the bullish trend. Once the strength of the euro drops below 1.1705, it will open up further downside potential. By then, pay attention to the support of 1.1663.

GBP Intraday Trend Analysis

Fundamental Analysis:

The three-month U.S. dollar index (DXY) recently reached a six-year high, implying that the movements of other currencies are highly correlated against the dollar.

“The U.S. dollar correlation has been gradually increasing since March 2020, rising to 64% in July. Coupled with the seasonal factors centered on the U.S. dollar in September, we expect that the focus of the foreign exchange market will continue to be on the trend of the U.S. dollar.

According to the past reports, this indicator was downgraded in 2011 in the U.S. credit rating, while the so-called “taper tantrum” in 2013, and the Fed’s interest rate hike expectations in 2015 also saw highs.

This trend may continue ahead of the Fed’s likely announcement of a tapering plan in September, with the pound rallying strongly on the back of yesterday’s downward trend in the U.S. dollar as a result of this correlation.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

Today, the pound is mainly focused towards the direction of the break from the 1.3669 to 1.3721 range. If it breaks upwards through the 1.3721-line, it will open up further upside potential. At that time, pay attention to the suppression of the 1.3777 and 1.3816 positions. If it falls below the 1.3669-line, it will open up further downside potential.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices broke through the key psychological level of $1,800 on Monday,23rd August 2021. The fall of the U.S. dollar pushed investors to buy gold, while the rising number of the Covid-19 cases drove the market to expect the Fed to postpone the tapering of economic support measures.

In addition to that, the Federal Reserve will hold its annual symposium on 27th August 2021 in Jackson Hole, Wyoming. The market is focused on Fed Chairman Powell’s speech for clues on the timeline for tapering bond purchases.

Technical Analysis:

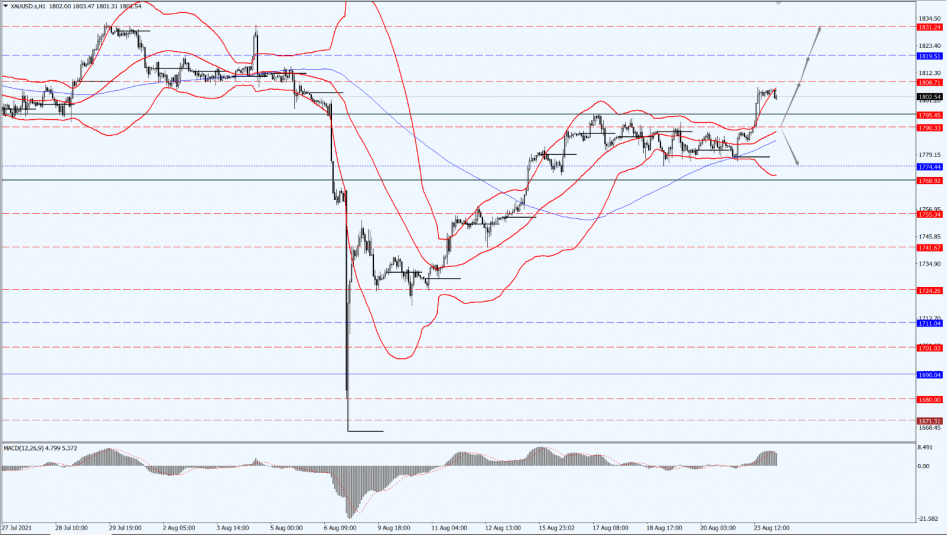

(Gold 1-hour chart)

Trading Strategies:

Yesterday, the price of gold broke through and went up. Today, the price of gold still maintains its bullish trend. At the top, focus on the suppression of the three positions of 1808, 1819 and 1831. On the lower end, focus on the support of 1790. Once the price of gold falls below the 1790-line, there is a possibility that it could open up a greater downside potential.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

The U.S. oil futures rose by $3.50, or 5.6 percent, and settled at $65.64 per barrel, while Brent crude oil rose by $3.57, or 5.5 percent, and settled at $68.75 per barrel.

Both contract indicators posted their biggest gains in more than nine months. Boosted by the rebound in financial markets and signs of progress in the pandemic prevention, oil prices ended its previous seven-day losing streak, while the weaker dollar provided support for oil prices.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices rebounded strongly after bottoming out yesterday. Today, we pay attention to the momentum of the inertial rise in oil prices. At the top, we will pay attention to the suppression at 66.35 and 67.5. At the bottom, we will pay attention to the 65.16-line. Once it falls below the 65.16-line, will it could possibility create room for further correction. At that time, we will pay attention to 64 first-line support.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.