1. Forex Market Insight

EUR/USD

Statements from several European Central Bank (ECB) policymakers should be closely watched in recent days.

The central bank met on Wednesday, 15th June 2022, on an ad hoc basis and pledged to control borrowing costs in the second-tier eurozone countries.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the two positions of 1.0357 and 1.0184. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP traded in a shaky.

It first fell after the Bank of England announced a 25-basis-point rate hike, which some had predicted would come at a much deeper rate to combat soaring inflation.

The trend then reversed, rising 1.42% to touch the highest since 10th June 2022 at $1.235.

The Bank of England said it was ready to take “robust” action to address “more persistent signs of inflationary pressures”.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2243-line today. If GBP runs below the 1.2243-line, it will pay attention to the suppression strength of the two positions of 1.2106 and 1.2056. If GBP runs above the 1.2243-line, then pay attention to the suppression strength of the two positions of 1.2301 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose 1% in oscillating trading on Thursday, 17th June 2022, hitting an intraday high of $1857.39 an ounce and closing at $1857.03 an ounce.

The dollar retreated sharply as Fed Chairman Powell downplayed a 75-basis-point rate hike in July, driving safe-haven flows back to gold.

U.S. gold futures settled at $1,849.90, up 1.7%.

The dollar has retreated from the two-decade highs it recently touched.

This has increased the attractiveness of gold to overseas buyers.

Technical Analysis:

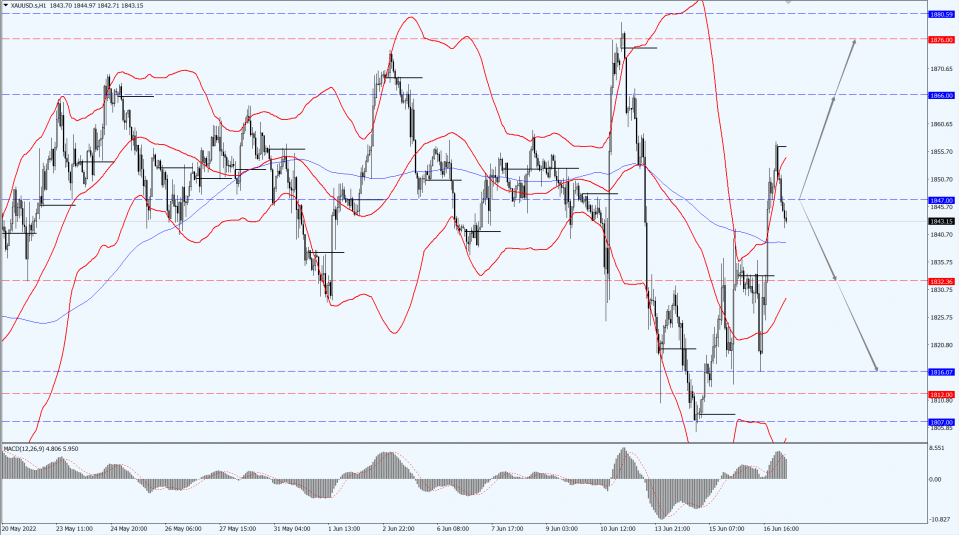

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1847-line today. If the gold price runs steadily below the 1847-line, then it will pay attention to the support strength of the 1832 and 1816 positions. If the gold price breaks above the 1847-line, then pay attention to the suppression strength of the two positions of the 1866 and 1876.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose more than 1% on Thursday.

U.S. imposes new sanctions on Iranian crude oil.

Moreover, the U.S. is considering limiting fuel exports, and the market is concerned about supply shortages.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 116.30-line today. If the oil price runs above the 116.30-line, then focus on the suppression strength of the two positions of 120.06 and 127.10. If the oil price runs below the 116.30-line, then pay attention to the support strength of the two positions of 113.10 and 109.62.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.