1. Forex Market Insight

EUR/USD

EUR/USD fell below the psychological level of $1.05 as investors remained nervous about Russia cutting off gas supplies to parts of Europe for failing to meet Russian ruble settlement requirements.

EUR/USD fell to $1.0497. Earlier, it fell to $1.0470, the lowest since January 2017.

The European Commission warned Russian gas buyers on Thursday, 28th April 2022, that a switch to ruble settlement could violate sanctions.

Currently, there is confusion over member states’ responses to Moscow’s payment requests. Officials are seeking clarification from the EU on its position.

Technical Analysis:

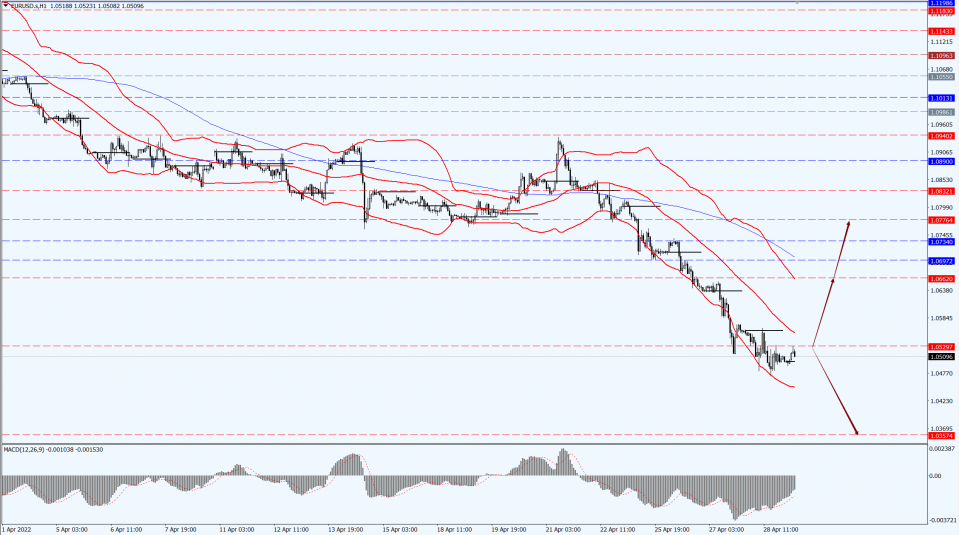

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If the euro runs steadily below the 1.0529-line, then pay attention to the support strength of the position of 1.0357. If the strength of the euro breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0662 and 1.0776.

GBP Intraday Trend Analysis

Fundamental Analysis:

The dark clouds of recession are starting to hang over many advanced countries right now, but it seems that the U.K. is at greater risk than most.

Earlier, the International Monetary Fund warned that the UK’s inflation shock could be “the worst of both worlds” as it not only faces a tight labor market like the US, but also an energy crisis like Europe.

A range of data, from the Purchasing Managers’ Index (PMI) to consumer confidence, suggests a faltering economic recovery. Brexit makes the UK particularly vulnerable to global inflationary shocks. Poor trade performance appears to have “greater persistence” in the UK, while falling labor supply from EU countries is exacerbating wage pressures.

The British government may tighten fiscal policy too quickly, or repeat the mistakes made after the global financial crisis. The governor of the Bank of England has acknowledged that interest rate policymakers must walk a difficult path between tackling inflation and potentially triggering a recession.

Technical Analysis:

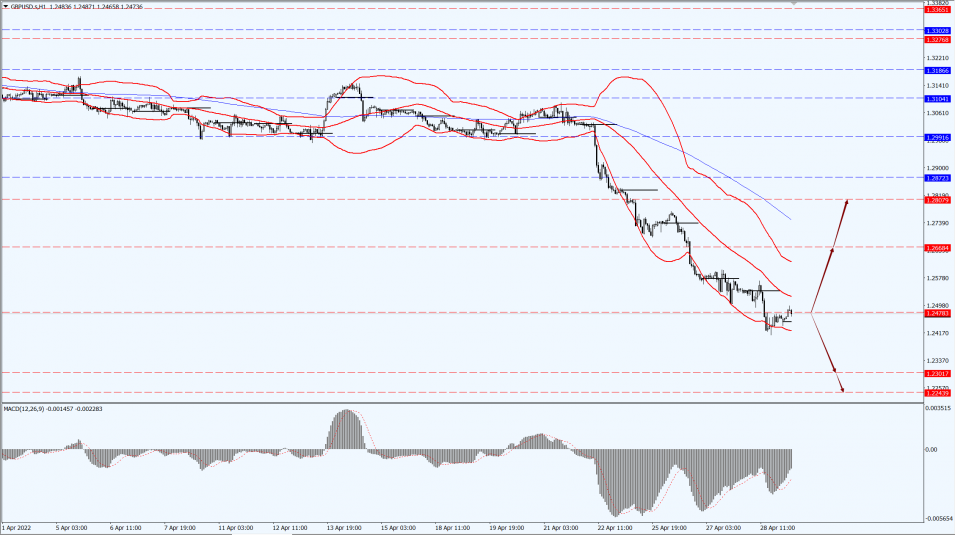

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.2478-line today. If the pound runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2301 and 1.2243. If the pound runs above the 1.2478-line, then pay attention to the support strength of the two positions of 1.2668 and 1.2807.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold rebounded sharply from a 10-week low and rose to around $1,894 in late trading, weighed down by a strong dollar and expectations of a faster pace of U.S. interest rate hikes. It hit $1,871.99 earlier in the session, the lowest since 17th February 2017.

Prices have fallen about 2.2% this month and are poised to post their biggest monthly decline since last September as the market expects the Federal Reserve to sharply tighten monetary policy and the dollar to strengthen.

Technical Analysis:

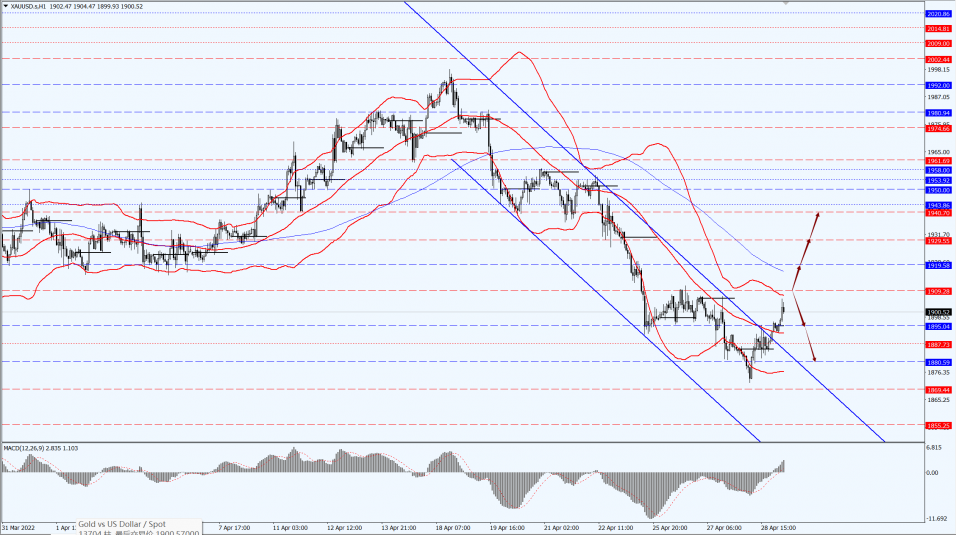

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1909-line today. If the gold price runs steadily below the 1909-line, then it will pay attention to the support strength of the 1895 and 1880 positions. If the gold price breaks above the 1909-line, then pay attention to the suppression strength of the two positions of the 1919 and 1929.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil rose more than 3% in late trading to $105.20 per barrel, as the possibility of an EU ban on oil imports from Russia appears to be on the rise, supported by a tightening global diesel supply.

Oil prices fluctuated earlier. Germany is preparing to stop buying Russian oil in stages, clearing the way for the EU to ban Russian oil imports.

The latest report on Thursday, 29th April 2022, drove prices higher.

Technical Analysis:

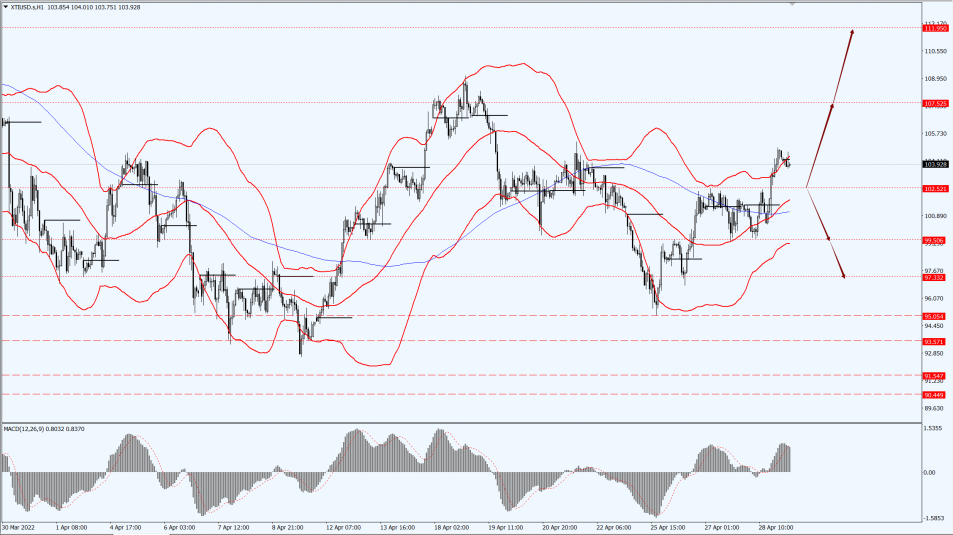

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 102.52-line today. If the oil price runs above the 102.52-line, then focus on the suppression strength of the two positions of 107.52 and 111.95. If the oil price runs below the 102.52-line, then pay attention to the support strength of the two positions of 99.50 and 97.33.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.