1. Forex Market Insight

EUR/USD

Benchmark U.S. Treasury yields rose on expectations that the Federal Reserve would tighten monetary policy faster than previously expected. The Federal funds rate futures have fully digested the possibility of a March rate hike, as well as four more rate hikes in 2022.

During this interval, the euro ended the day at 1.1312 against the dollar, down by 0.27%.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the suppression strength of the 1.1357-line. If the euro runs steadily below the 1.1357-line, we will pay attention to the support strength of 1.1315 and 1.1267.

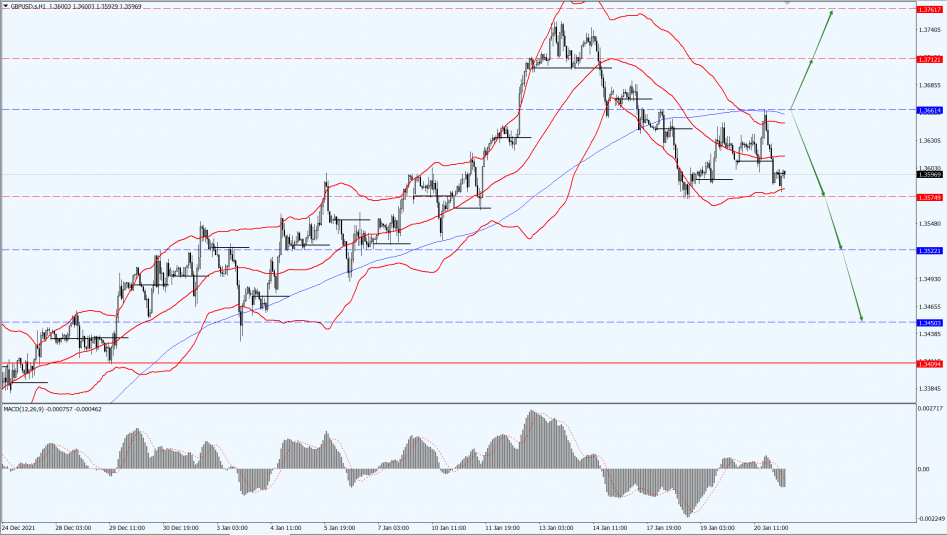

GBP Intraday Trend Analysis

Fundamental Analysis:

The Fed’s Federal Open Market Committee (FOMC) will hold a two-day monetary policy meeting starting next Tuesday, 25th January 2022, after which market participants will carefully analyze the committee’s statement on the tightening policy schedule. Therefore, the pound, which has been out of favor, has been adjusted to a certain extent.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3661-line today. If the pound runs above the 1.3661-line, it will pay attention to the suppression strength of the 1.3712 and 1.3761 positions. If the pound runs below the 1.3661-line, it will pay attention to the supporting strength of the 1.3574 and 1.3522 positions.

2. Precious Metals Market Insight

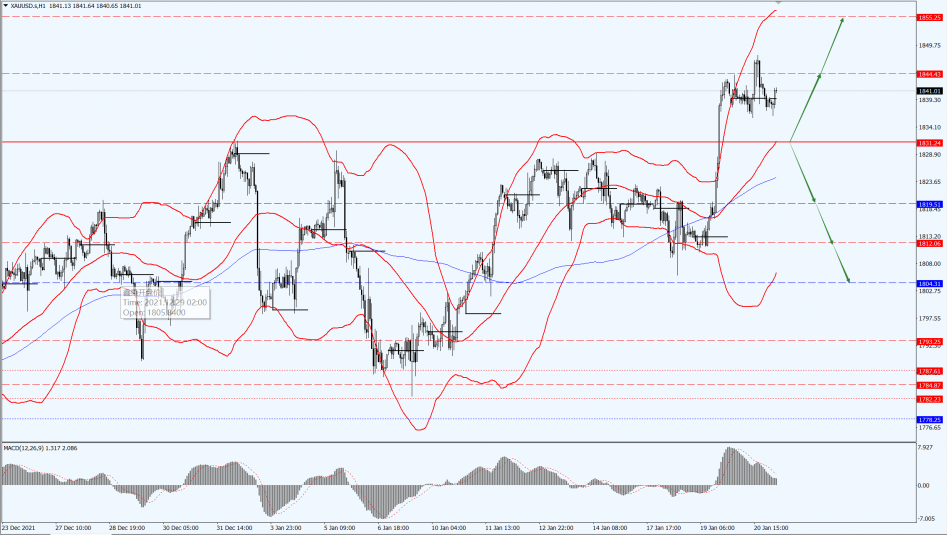

Gold

Fundamental Analysis:

Yesterday, gold prices surged higher and fell as inflation concerns once supported gold prices rose to a two-month high. At the same time, the weak initial claims data and geopolitical crisis continue to attract buying into. However, a stronger dollar caused gold prices to give back gains in late trading.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1831-line today. If the gold price runs steadily above the 1831-line, then pay attention to the suppression strength of the 1844 and 1855 positions. If the gold price falls below the 1831-line, it will open up further callback space. At that time, pay attention to the strength of the 1819 and 1804 positions.

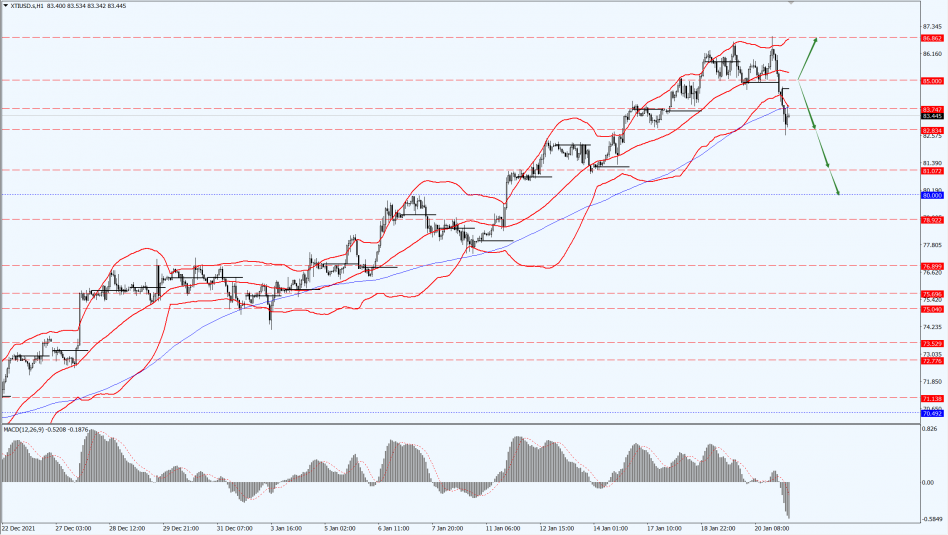

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices extended losses as U.S. crude inventories rose moderately. Saudi exports and production were the highest since April 2020 while U.S. President Joe Biden pledged to try to curb higher oil prices as oil prices retreated from a seven-year high of $87.10 per barrel.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

The oil price is focused on the 85-line today. If the oil price runs below the 85-line, then it will pay attention to the support strength of the 82.83 and 80 positions. If the oil price runs above the 85-line, then pay attention to the suppression of the 87-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home