1. Forex Market Insight

EUR/USD

Aggressive interest rate hikes by major central banks to curb inflation could lead to a sharp slowdown or recession in the global economy. EUR rose 0.2%, hitting an intraday high of 1.0581 to close at $1.0532.

The rate hike has strengthened the dollar, but the euro has gained in recent days as the European Central Bank (ECB) also plans to raise rates to curb inflation.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the two positions of 1.0357 and 1.0184. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

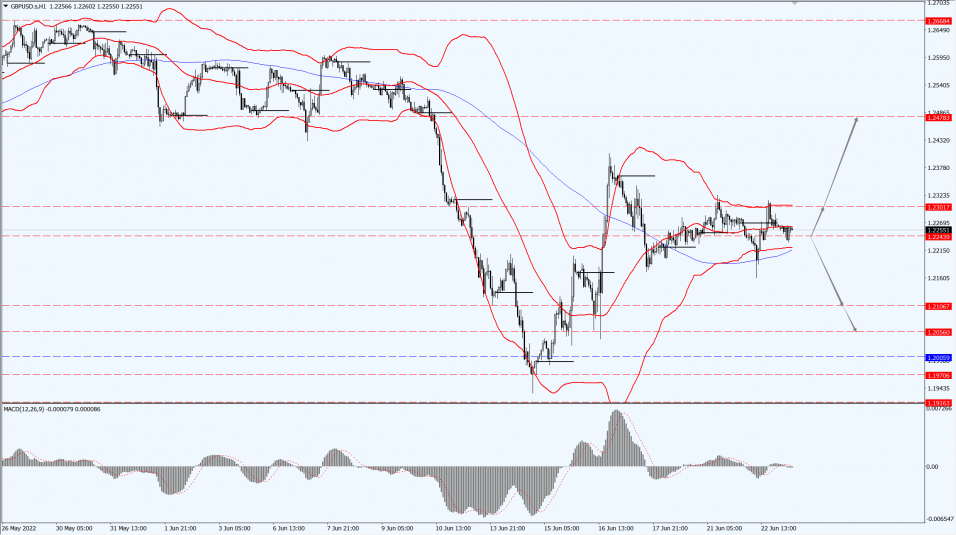

GBP Intraday Trend Analysis

Fundamental Analysis:

The UK’s consumer prices index (CPI) in May hit another 40-year high, reaching 9.1%.

In addition, the Canada’s CPI surged to an annual rate of 7.7% in May, reaching its highest level since January 1983.

The data is the latest to show that consumer prices are hotter than expected.

At one point on Wednesday,22nd June 2022, the pound fell nearly 1 percent to a near one-week low of 1.2160.

It then recovered most of the lost ground and closed down 0.01% at 1.2260.

The U.S. dollar rose against the Canadian dollar on Wednesday, 22nd June 2022, once approaching 1.30, and finally closed up 0.22% at 1.2945.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2243-line today. If GBP runs below the 1.2243-line, it will pay attention to the suppression strength of the two positions of 1.2106 and 1.2056. If GBP runs above the 1.2243-line, then pay attention to the suppression strength of the two positions of 1.2301 and 1.2478.

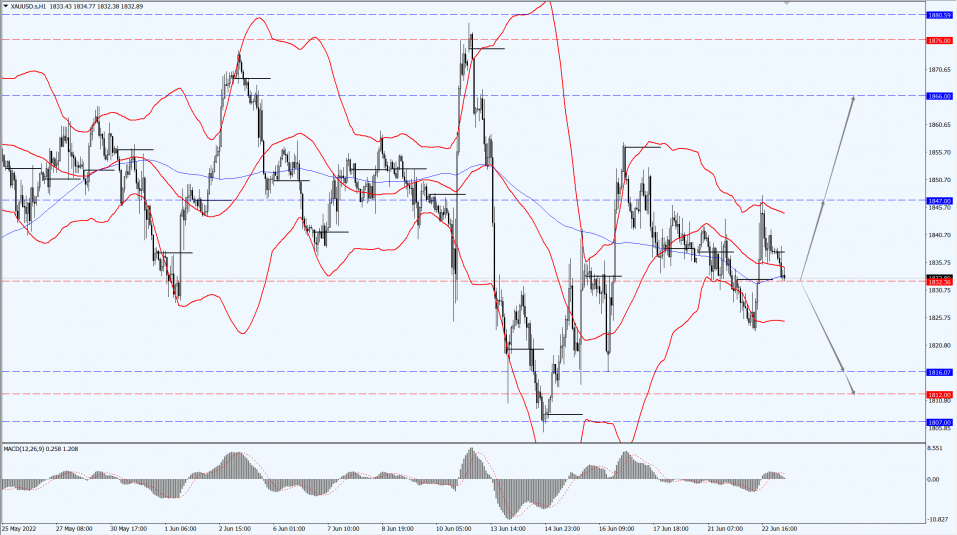

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold fluctuated within a narrow range and is currently trading around $1,836.

Overnight Fed Chairman Jerome Powell acknowledged in his Senate testimony statement that the possibility of a U.S. recession certainly exists and that a soft landing is challenging.

This puts pressure on the dollar and provides support to gold prices.

And because gold is considered to be a hedge against inflation.

Inflation data from both the UK and Canada rose to 40-year highs, also adding to the appeal of gold.

However, expectations for rate hikes by central banks around the world remain high.

Treasury yields are still at high levels and gold bulls are still wary.

This trading day focus on the performance of the PMI data in Europe and the United States in June, focusing on the movement of the initial jobless claims in the United States.

Watch for Fed Chairman Powell’s testimony before the House Financial Services Committee on the semi-annual monetary policy report and news related to the geopolitical situation.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1832-line today. If the gold price runs steadily below the 1832-line, then it will pay attention to the support strength of the 1816 and 1812 positions. If the gold price breaks above the 1832-line, then pay attention to the suppression strength of the two positions of the 1847 and 1866.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil fell slightly and is now trading around $103.80 a barrel.

Morning API data showed that U.S. crude oil and gasoline inventories rose last week, and President Joe Biden called for a moratorium on gasoline taxes.

Coupled with the aggressive attitude of the Federal Reserve to raise interest rates, the fear of economic recession has suppressed oil prices.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 105.01-line today. If the oil price runs above the 105.01-line, then focus on the suppression strength of the two positions of 107.52 and 109.62. If the oil price runs below the 105.01-line, then pay attention to the support strength of the two positions of 102.52 and 99.50.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.