1. Forex Market Insight

EUR/USD

USD hit a three-week low in choppy trading Friday, 29th July 2022, with investors’ recession concerns temporarily outweighing inflation worries after a batch of mixed economic data.

Among them, the Chicago manufacturing index fell to a new 23-month low of 52.1, refreshing the previous record of 56.0, which also caused some drag on the dollar, which hit a three-week low of 105.57 on Friday, 29th July 2022.

Following Friday’s data, the interest rate futures market expects a 72% chance of a 50 basis point rate hike and a 28% chance of a 75 basis point rate hike at the Federal Reserve’s September policy meeting. The interest rate market also predicts that the federal funds rate will peak in February 2023.

Prior to the release of the U.S. data, the market also expected interest rates to top out in December of this year.

Although EUR/USD rose slightly with USD retreat, it was the most far-fetched of the non-U.S. currencies.

The euro zone’s recession and political risks have weighed on the euro’s performance as Russia suspends energy supplies.

However, the European Central Bank (ECB) has opened the door to tighten monetary policy and is expected to give some consolidation support to the euro in this regard.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0190-line today. If EUR runs steadily below the 1.0190-line, then pay attention to the support strength of the two positions of 1.0116 and 0.9999. If the strength of EUR breaks above the 1.0190-line, then pay attention to the suppression strength of the two positions of 1.0277 and 1.0357.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP fell nearly 1% in afternoon trading in Europe on Friday, 29th July 2022, mainly due to key U.S. inflation data (the personal consumption expenditures (PCE) price index rose 1.0% in June, the largest increase since September 2005, compared with a 0.6% increase in May .

In the 12 months to June, the PCE price index rose 6.8%, the largest increase since January 1982), the dollar rallied after the data was released, but later in the afternoon the pound regained almost all of its losses to close unchanged from the previous day at 1.2163.

The current market for the dollar’s future interest rate hike is expected to begin to be uncertain, and this week will also usher in the Bank of England (BoE) interest rate meeting. If the Bank of England to continue to raise interest rates and raise the rate to 50 basis points, it is expected to give a greater stimulus with GBP.

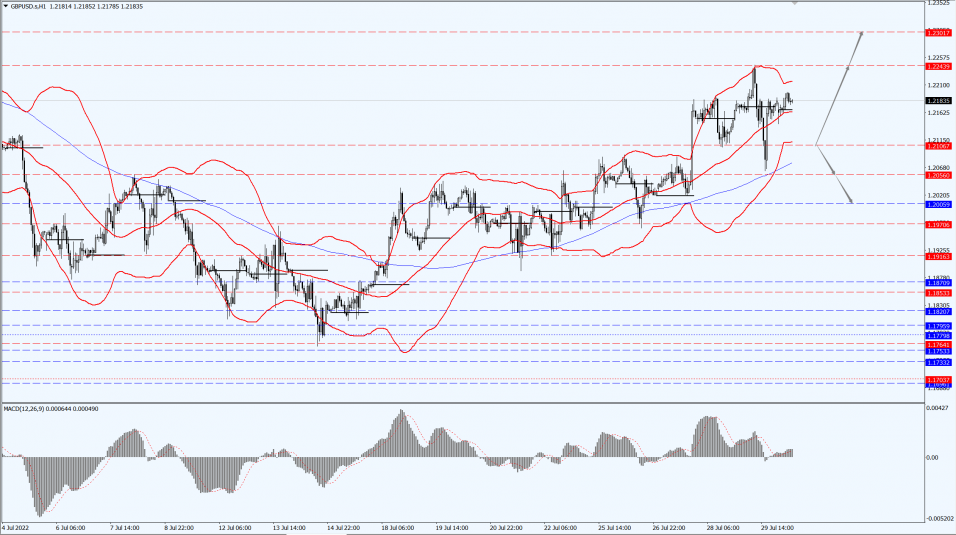

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2106-line today. If GBP runs below the 1.2106-line, it will pay attention to the suppression strength of the two positions of 1.2056 and 1.2005. If GBP runs above the 1.2106-line, then pay attention to the suppression strength of the two positions of 1.2243 and 1.2301.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold hit a fresh multi-week high on Friday, 29th July 2022, with USD paring initial gains after data showed U.S. inflation jumped again, adding to the metal’s safe-haven appeal and the current price range that appears to be attracting buying.

U.S. consumer spending rose more than expected in June. The year-over-year price increase was the largest since 2005.

After the data was released, the dollar quickly gave back its small gains and ended the day down 0.3%, pushing gold to extend its gains.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1760-line today. If the gold price runs steadily below the 1760-line, then it will pay attention to the support strength of the 1751 and 1743 positions. If the gold price breaks above the 1760-line, then pay attention to the suppression strength of the two positions of the 1768 and 1783.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

A Reuters poll showed on Friday, 29th July 2022, that the rally in oil prices would be likely to stall.

Supply risks from sanctions on Russia and OPEC+ output curbs were offset by a slowdown in demand due to recession fears and a renewed global pandemic.

A survey of 35 economists and analysts shows Brent crude oil is expected to average $105.75 a barrel in 2022, down from June’s forecast of $106.82, the first downward revision in monthly oil price estimates since April.

Brent has averaged around $105 a barrel so far this year.

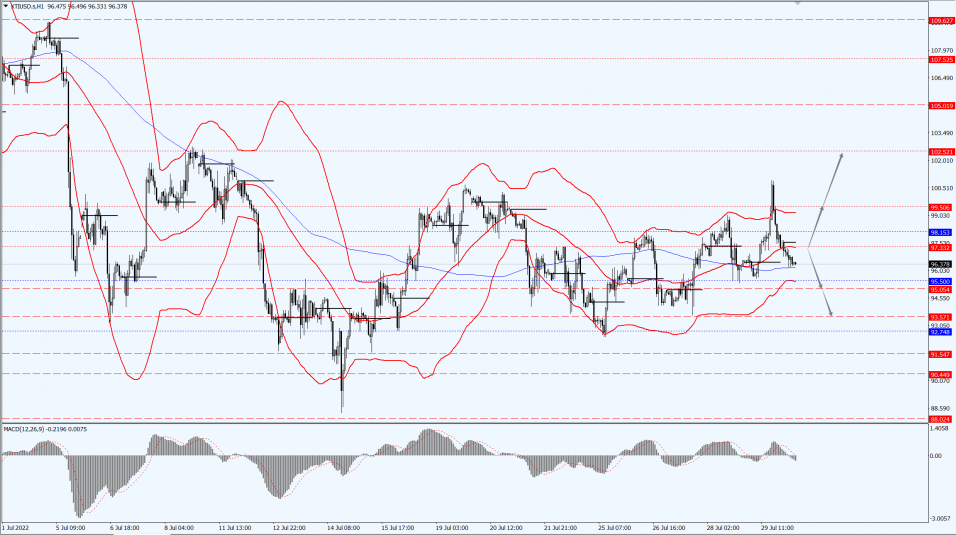

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 97.33-line today. If the oil price runs above the 97.33-line, then focus on the suppression strength of the two positions of 99.50 and 102.52. If the oil price runs below the 97.33-line, then pay attention to the support strength of the two positions of 95.50 and 93.57.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.